In 2026, the activity to set up an enterprise is receiving much attention, especially regarding tax incentive policies, including the business license fee (license tax). License tax is simply understood as the tax level that businesses must pay annually based on the charter capital recorded on the business license. Viet An Law has received many questions: Set up business in 2026: Is business license fee exempted? Below, Viet An Law will advise and answer questions for customers.

Table of contents

Business license fee is a fee that organizations and individuals producing and trading goods and services must pay annually, based mainly on the charter capital or investment capital recorded on the Enterprise Registration Certificate.

Previously, the license fee was regulated in Decree No. 139/2016/ND-CP, amended and supplemented by Decree No. 22/2020/ND-CP. At the same time, it was guided in Circular 302/2016/TT-BTC, amended by Circular 65/2020/TT-BTC.

Set up business in 2026: Is business license fee exempted?

On May 4, 2025, in Resolution 68-NQ/TW on developing the private economy – one of the four Resolutions considered the “four pillars” in the era of advancement, the Politburo proposed one of the solutions and requirements for developing the private economy, including the requirement:

“Have special mechanisms and policies to support small and medium-sized enterprises, ensuring market principles and compliance with international commitments; abolish business license fees; exempt corporate income tax for small and medium-sized enterprises for the first 3 years of establishment;…”

Institutionalizing this policy, the National Assembly issued Resolution No. 198/2025/QH15, in which Clause 7 Article 10 clearly states: “Terminate the collection and payment of business license fees from January 1, 2026”.

To implement uniformly, the Government issued Decree 362/2025/ND-CP, in which Clause 4 Article 6 prescribes:

“4. Abolish Decree No. 139/2016/ND-CP dated October 4, 2016 of the Government regulating business license fees and Decree No. 22/2020/ND-CP dated February 24, 2020 of the Government amending and supplementing a number of articles of Decree No. 139/2016/ND-CP dated October 4, 2016 of the Government regulating business license fees.”

Decree 362/2025/ND-CP takes effect from January 1, 2026, meaning that from this time, business license fees are no longer applied in the legal system on fees and charges.

Thus, according to the above regulations, business license fees will be officially abolished from January 1, 2026. Therefore, this means that setting up an enterprise in 2026 will not require declaring or paying business license fees in the first year or subsequent years. This regulation applies simultaneously to all types of enterprises, regardless of charter capital or scale.

The official abolition of business license fees from January 1, 2026 is not only a technical change in fee collection and payment but also carries the meaning of extensive institutional reform, directly impacting the investment and business environment and the development orientation of the private economic sector.

Although the business license fee is not large in absolute value, it is the first mandatory expenditure that enterprises must make immediately after being granted the Enterprise Registration Certificate.

The abolition of this fee helps:

Business license fee is not only a payment obligation but also entails:

When abolishing business license fees, the State simultaneously:

The abolition of business license fees is one of the contents directly concretizing Resolution 68-NQ/TW of the Politburo on private economic development – considered one of the strategic orientations in the new development era.

Resolution 68-NQ/TW clearly defines:

Therefore, abolishing business license fees is not only a financial incentive but also has political-institutional significance, demonstrating a change in state management thinking towards enterprises.

In the context of Vietnam competing to attract investment in the region, reducing “input” fees helps:

The abolition of business license fees from 2026 is an important reform step, bringing multi-dimensional positive impacts, both directly supporting enterprises and demonstrating the determination to improve the business environment and develop a sustainable private economy.

When setting up an enterprise in 2026, from the date of business operation, the enterprise needs to fully perform tax obligations according to the provisions of Vietnamese law. Specifically as follows:

Value added tax is a tax calculated on the added value of goods and services arising in the process from production, circulation to consumption.

Goods and services used for production, business, and consumption in Vietnam are subject to value added tax, except for subjects prescribed in Article 5 of the Law on Value Added Tax 2024, such as: Transfer of land use rights; Life insurance, health insurance; Securities business;…

VAT is calculated according to the direct or deduction method depending on the case, and is declared monthly/quarterly.

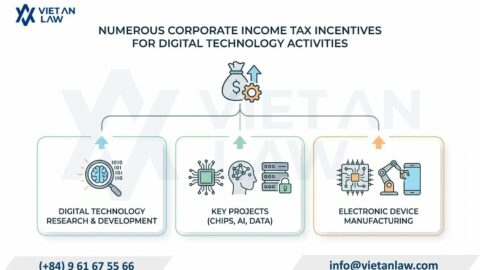

CIT applies to enterprises with taxable income. Income subject to corporate income tax includes income from production and trading of goods and services and other income prescribed in Article 3 of the Law on CIT 2025.

Note special incentives, according to Clause 3 Article 7 of Decree 20/2026/ND-CP, small and medium-sized enterprises registering for business for the first time are exempt from corporate income tax for 03 years from the time of being granted the first Enterprise Registration Certificate. The tax exemption period is calculated continuously from the first year of being granted the first Enterprise Registration Certificate.

Enterprises when paying salaries and wages to employees are responsible for deducting, declaring, and paying PIT according to regulations for taxable income of employees.

Note: According to Article 5 of the Law on Personal Income Tax 2025, some subjects are exempt from personal income tax from salaries and wages such as:

Depending on the profession and field of activity, enterprises may have to declare and pay:

To maximize capital flows and policies in 2026, Viet An Law recommends:

The above is the answer to the question: Is the business license fee exempted when setting up an enterprise in 2026? Customers wishing for advice on setting up an enterprise or tax law advice, please contact Viet An Law Firm for the fastest and most effective support!