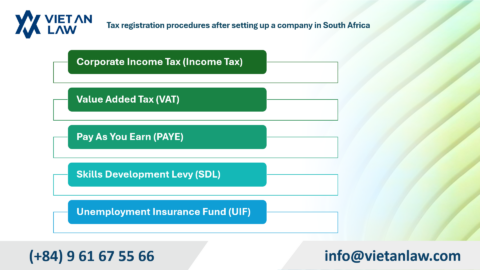

Tax is a compulsory contribution to state revenue as well as a tool of economic management. Therefore, enterprises have their duties to perform tax accounting. Tax accounting is a process of performing tasks serving tax declaration and payment. Tax declaration and payment shall be following the law.

Based on professional practicing, the competence of law application and regular updating the legal documents in general and legal documents of tax in particular, Viet An Law Firm is confidential to provide enterprises with effective legal consulting services of tax and to minimize the risks arising from procedures of tax declaration and payment in Vietnam.

Besides that, tax accounting helps enterprises’ business more explicit and transparent. To establish grounds for tax duties, enterprise must record their transactions in the business and create reports, collect invoices… Performing tax accounting well also helps enterprises make business decisions.

Large-scale enterprises always have the accounting department to perform the tax accounting. However, now, more than 97% of enterprises in Vietnam are small and medium enterprises, in which tax accounting performance is quite difficult due to the lack of experiences and legal knowledge.

To help enterprises save time and money during the lack of an accounting department, Viet An Law Firm provides tax accounting services during the establishment and operation of enterprises with several packages at reasonable prices.