Establishing a company is the initial procedure for entrepreneurs to step into the market. Accordingly, for a company to come into existence, it is necessary to follow the procedures for obtaining a Enteprise Registration Certificate and comply with relevant legal and accounting procedures. With nearly 20 years of experience in providing legal advice for business entities and commercial operations, along with a team of lawyers, tax experts, and certified accountants possessing in-depth knowledge and extensive experience, Viet An Law Firm has assisted thousands of aspiring entrepreneurs in establishing enterprises each year. We take pride in being the most professional law firm providing company establishment services with the most reasonable costs and the shortest processing time in all 63 provinces and municipalities throughout the country.

Table of contents

Businesses strive to find a reputable law firm to support them in establishing their companies for the following reasons:

If businesses have activities related to the following, it is advisable to establish a company:

In practice, establishing a company is more advantageous for the company owner compared to other forms of business entities due to its clarity. Especially when the company is not yet profitable, it is exempt from certain taxes (except for the business license fee from the second year onwards), and value-added tax (VAT) is collected and remitted in place of the authority. The company has the right to carry forward losses continuously for up to five years. The most challenging aspect of a company is tax declaration and reporting. However, with our tax and accounting services available at a modest cost, companies can confidently manage their tax reporting activities (without the need to hire independent accountants who may lack experience and incur unnecessary expenses).

The requirements for establishing a company are relatively straightforward:

It is noted that you can establish a company in any province or municipality without restrictions on registering residency or permanent address.

Except for certain special cases, the law does not limit the number of companies an individual can establish. Therefore, if you are ready to embark on entrepreneurship, do not hesitate to contact Viet An Law Firm for support and advice further solution.

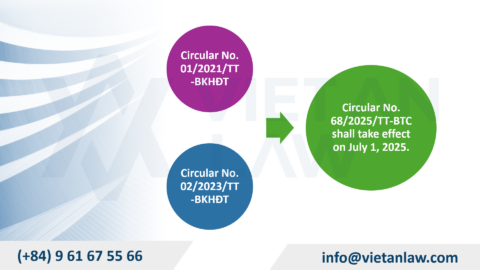

Frequently asked questions from our clients regarding company formation revolve around the necessary documents and information. According to the provisions of Vietnamese Law on Enterprises 2020 and Decree No. 01/2021/ND-CP on Enteprise Registration, the following information and documents need to be prepared to apply for a enterprise registration certificate:

Based on the information provided by our clients, Viet An Law Firm will provide detailed advice and comprehensive support for all the necessary procedures for company formation, as well as guidance on post-incorporation procedures and fulfillment of conditions for conducting business activities in accordance with the regulations.

For further information, kindly refer to article: Establishing a company in Vietnam – Detailed procedures of Viet An Law or contact us as below information.

In order for our esteemed clients to make an decision on the appropriate type of company, Viet An Law Firm has prepared a comparison chart of the main types of companies commonly established in practice. This will assist aspiring entrepreneurs in selecting the most suitable option for their endeavors.

| No. | Criteria | Single member Limited Liability | Multiple member Limited Liability | Joint Stock Company |

| 1 | Member | Only 1 member | From 2 to 30 members | From 3 shareholders and unlimited |

| 2 | Capital mobilization on the stock market | No | No | Yes |

| 3 | Governance structure | Simple | Quite sophisticated | Extremely sophisticated |

| 4 | Conversion of business entity types | Yes | Yes | Yes |

| 5 | Liability basis | Under charter capital | Under capital contribution ratio | Under shareholding ratio |

| 6 | Legal entity | Yes | Yes | Yes |

| 7 | Transfer of capital | Transfer of sale to new owner or conversion of company type | Internal or external transfer if no one buys | The first 3 years can only be transferred to founding shareholders, only transferred to the outside if agreed by founding shareholders. After 3 years of free transfer. |

| 8 | Through a meeting | Following decision of the owner | Ratio with significant decision is 75%, others is 65% | Ratio with significant decision is 65%, others is 51%. In case of 50%, the Chairman of the Board of Directors will decide. |

For the foreign investors, the initial step to set up a bussiness in Vietnam is obtaining Investment Registration Certificate. Kindly refer to the attached link of our website to further understanding.

In order to successfully establish a company and ensure compliance with legal requirements, the procedures for establishing a company should be carried out in the following steps:

For detailed procedure and some key considerations when establishing a company in Vietnam, kindly refer to article: Establishing a company in Vietnam – Detailed procedures of Viet An Law.

For more detail on this topic, please refer to the article: Types of basic taxes that a company required to pay in Vietnam of Viet An Law.

What should businesses do after receiving their Enteprise Registration Certification? The procedures to be carried out and the deadlines to comply with, as stipulated in the Law on Enterprises 2020, after obtaining Enteprise Registration Certification are as follows:

Starting from the initial advisory steps and obtaining the Enteprise Registration Certificate, to tax-related matters and accounting, businesses can make use of the relevant services provided by Viet An Law Firm.

For your information, please refer to the article: Things enterprises have to do after establishing in Vietnam of Viet An Law.

Viet An Law Firm was established in 2007 and has since established companies and provided legal advice to tens of thousands of domestic and international clients. The range of advisory services offered by Viet An Law Firm is diverse and always prioritizes the interests of clients. For nearly 20 years, Viet An Law Firm has been chosen by numerous customers due to its reputable services that align with our guiding principle: “Find Viet An Law. Find Answers.”

– Sole proprietorship

– Private enterprise

– Single-member Limited Liability Company

– Multiple member Limited Liability Company

– Joint Stock Company (JSC)

– Partnership

– Foreign-invested companies

– Offshore companies

– State-owned company establishment

– Joint venture

– Establishing companies in Hanoi

– Establishing companies in Ho Chi Minh City

– Establishing companies in Da Nang

– Establishing companies in Binh Duong

– Establishing companies in Dak Lak

– Establishing companies in Thua Thien Hue

– Establishing companies in Nam Dinh

– Establishing companies in Ha Nam

– Establishing companies in Bac Ninh

– Establishing companies in Bac Giang

Viet An Law Firm receives many questions related to business establishment. Below are the commonly asked questions during the process of legal consultancy for business:

Companies can choose the submission date to display as the registration date on the Enteprise Registration Certificate. However, this date cannot fall on holidays or weekends. The selection of the date is not 100% accurate and carries certain risks. If you wish to choose a specific date, you can contact Viet An Law Firm for the best advice and support.

If establishing an individual business household, Clients can submit at the People’s Committee of the District where the business household is located. When establishing a company, you submit it at the Enterprise Registration Office – Department of Planning and Investment where its head office located.

The establishment of a company is not based on the permanent residence of the founder, but the start-up can establish a company in any province as demand.

According to current legal provisions, apartment buildings and collective housing are not eligible to be registered as the company’s head office, as well as the address of its branches, representative offices, or business locations of the company.

After the establishment of a company, if there is no revenue or expenses, the company is not required to pay taxes (except for the business license fee in subsequent years). However, on a quarterly basis, the company still needs to declare taxes as follows:

The results that customers receive when using the company establishment services of Viet An Law Firm are based on the contractual service packages. Therefore, each customer’s outcomes depend on the agreed-upon tasks between both parties. The following are typical results that customers usually obtain after utilizing the company establishment services at Viet An Law Firm:

If you have any questions or concerns about these legal matters or any other issues related to the sequence of procedures and steps required company establishment, please don’t hesitate to contact Viet An Law Firm at the following phone number: (+84) 9 61 57 18 18 or email: info@vietanlaw.com