Personal income tax is an amount of money that must be deducted and paid from part of the salary and other revenue sources of income generators paid to the tax agency for remittance into the state budget after it has been deducted. Personal income tax payment is the fact that an individual must deduct a salary or another income to be remitted into the state budget. In which, personal income tax is a direct tax, levied on some high-income individuals and this taxable rate will be clearly regulated by law. Here, Viet An tax agent will provide you with the latest updated personal income tax calculation method in 2025.

Table of contents

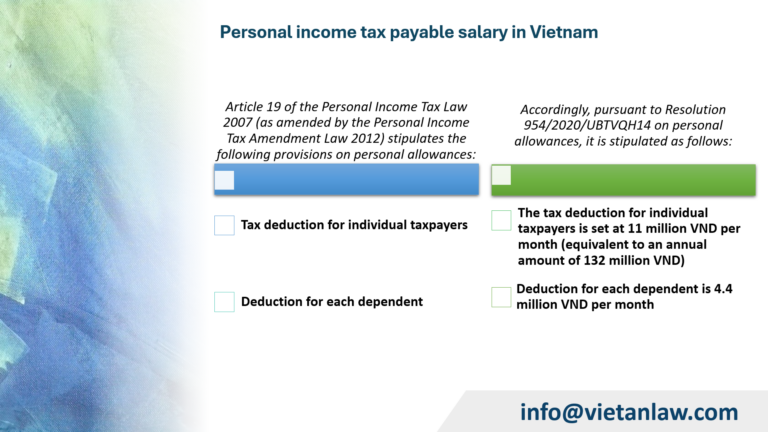

Thus, according to the above regulations, employees with a salary of over 11 million VND/month or over 132 million VND/year (after deducting all exempted or reduced amounts such as social insurance, health insurance,…, etc.) must be obliged to pay personal income tax

In case the employee has dependents: must have a salary of over 15.4 million VND/month if there is 01 dependent; over 19.8 million VND/month if there are 02 dependents,…

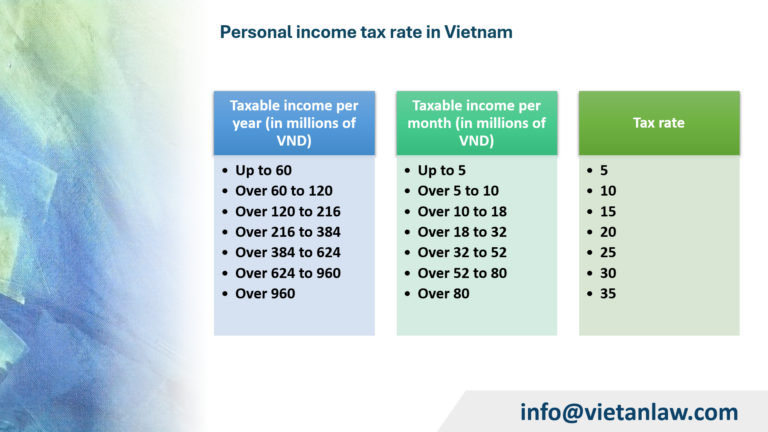

The method of calculating personal income tax in 2025 for income from salaries and wages is as follows:

“Payable PIT = Taxable income x Tax rate”

Personal income tax in 2025 for non-resident individuals is calculated based on the formula as prescribed in Article 18 of Circular 11/2013/TT-BTC as follows:

“Payable PIT = Taxable income x Tax rate of 20%”

In particular, taxable income from salaries and wages of non-resident individuals is determined by the total amount of salaries, wages, remuneration and other incomes of the nature of salaries and wages received by taxpayers in the tax period minus tax-exempt amounts.

The determination of personal income taxable income from salaries and wages in Vietnam in case an individual does not reside and works in Vietnam and abroad at the same time but cannot separate the income generated in Vietnam shall be carried out according to the following formula:

The formula for calculating personal income taxable income from salaries and wages for foreigners who are not present in Vietnam is calculated as follows:

| Total income generated in Vietnam | = | Number of working days for work in Vietnam | x | Income from global wages and wages (before tax) | + | Other taxable income (before tax) arising in Vietnam |

| Total number of working days in a year |

| Total income generated in Vietnam | = | Number of days in Vietnam/365 days | x | Income from global wages and wages (before tax) | + | Other taxable income (before tax) arising in Vietnam |

Other taxable incomes (before tax) arising in Vietnam mentioned above are other benefits in cash or non-cash that employees are entitled to in addition to salaries and wages paid by employers or paid on behalf of employees.

If you have any difficulties or questions related to how to calculate personal income tax in 2025, please contact Viet An Tax Agent for the most specific advice.