Currently, our country is attracting a lot of foreign investment capital, so more and more foreign investors are investing in Vietnam. Therefore, the demand for transferring capital contributions from foreigners to Vietnamese organizations and individuals is also increasing. In the article below, Viet An Law would like to introduce to customers the legal regulations that need to be noted when transferring capital from foreigners to Vietnamese people (including individuals and legal entities) in companies established in Vietnam.

Table of contents

According to Clause 27, Article 4 of the Enterprise Law 2020, the capital contribution is defined as the total value of assets that a member has contributed or committed to contribute to a limited liability company or partnership. The capital contribution ratio is the ratio between the capital contribution of a member and the charter capital of the limited liability company or partnership.

Contributed capital assets according to current regulations in Article 34 of the Enterprise Law 2020 may include the following types of assets:

Note that only individuals and organizations who are legal owners of assets have the right to use them to contribute capital to economic organizations. Thus, the owner of the asset cannot authorize other individuals or organizations to contribute their capital to any economic organization.

When a foreigner transfers the capital of this individual in a certain enterprise to a Vietnamese person, it means that there will be a change in personnel and capital in this enterprise. Specifically, it is divided into cases of companies with Investment Registration Certificates and companies without Investment Registration Certificates.

According to the provisions of Point a, Clause 1, Article 23 of the Investment Law 2020, economic organizations with investors being foreign individuals or organizations holding more than 50% of charter capital or with the majority of general partners being foreign individuals (for general partnerships) must apply for an Investment Registration Certificate.

In this case, it will be divided into two smaller cases, which are:

In this case, the company will have to carry out 02 procedures, including procedures to change the Investment Registration Certificate and procedures to change the Enterprise Registration Certificate.

Procedures for changing the Investment Registration Certificate, specifically changing the investor of an investment project, it is carried out according to the provisions of Clause 4, Article 36 of Decree 31/2021/ND-CP. The dossier includes:

The company will apply to the Investment Registration Agency. Within 10 working days from the date of receiving the complete application as prescribed, the Investment Registration Agency will adjust the Investment Registration Certificate for the investor.

After that, the company needs to carry out the procedure to change the Certificate of Business Registration at the Department of Planning and Investment where the company is headquartered. Specifically, the company needs to submit the following documents to carry out the procedure to change the Certificate of Business Registration:

Please contact Viet An Law for support in performing all of the above procedures.

If an enterprise no longer has foreign investor capital, the project to establish that enterprise is no longer subject to the requirement of an Investment Registration Certificate. Therefore, after changing the Enterprise Registration Certificate at the Department of Planning and Investment related to the transfer of capital like domestic enterprises, the company can carry out the procedure to terminate the implementation of the investment project under the case specified in Point a, Clause 1, Article 48 of the Investment Law 2020.

The dossier for the termination of the investment project includes:

Investors must submit this dossier to the Investment Registration Authority within 15 days from the date of the decision to terminate operations.

In case a company has foreign capital but does not need an Investment Registration Certificate, when foreigners transfer their capital contribution to other Vietnamese individuals or organizations, they only need to carry out procedures to change the Enterprise Registration Certificate.

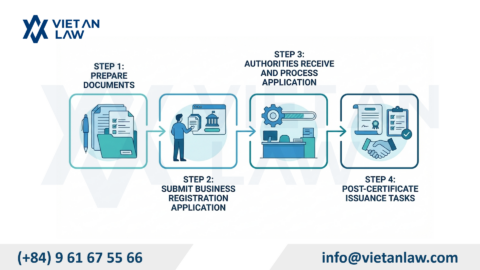

For business registration procedures, it is necessary to carry out procedures to change business licenses, including the following procedures:

Regarding tax obligations, it is necessary to carry out procedures for declaring and paying personal income tax (in case the transferor is an individual) or corporate income tax (in case the transferor is an enterprise) from capital transfer.

Income from capital transfer is a type of income subject to personal income tax according to the provisions of Article 3 of the Law on Personal Income Tax 2007 as amended and supplemented in 2014. Therefore, individuals conducting capital transfer activities must fulfill their obligation to pay personal income tax according to the provisions of the law.

According to the provisions of Point g, Clause 4, Article of Decree 126/2020/ND-CP, personal income tax from capital transfer activities is declared for each occurrence.

How to calculate personal income tax from capital transfer as follows:

Tax payable = Taxable income x Tax rate 20%

In which, income from capital transfer is calculated as follows:

| Taxable income | = | Transfer price | – | Purchase price of transferred capital | – | Expenses related to generating income from capital transfers |

Please note that within 10 days after the capital transfer activity occurs, the transferor must submit a personal income tax declaration to the tax authority and pay personal income tax.

Income arising from capital transfer by an enterprise is one of the types of taxable income specified in Clause 2, Article 3 of the Law on Corporate Income Tax 2008, amended and supplemented in 2014.

Income from capital transfer includes the following two basic types of income:

Corporate income tax arising from capital transfer is declared for each occurrence and is determined from the time of transfer of capital ownership.

The calculation of corporate income tax from capital transfer is as follows:

Tax payable = Taxable income x Tax rate

In which, income from capital transfer is calculated as follows:

| Taxable income | = | Transfer price | – | Purchase price of transferred capital | – | Transfer costs |

Unlike individuals, the tax rate that enterprises must pay when having income arising from capital contribution transfer is stipulated in Article 10 of the Law on Personal Income Tax 2007, amended and supplemented in 2014, specifically as follows:

Above is the advice of Viet An Law on foreigners transferring capital to Vietnamese people. If you need more detailed advice on the procedures to be performed when transferring capital, please contact Viet An Law Firm for the best support.

Update: 9/2024