Tax in Vietnam, with its strategic geographical location, abundant and dynamic workforce, along with economic reform and opening policies, has become an increasingly frequently asked topic because Vietnam is an attractive market for international investors. The increase in the number of FDI companies in Vietnam not only provides an important source of capital, but also promotes technology transfer, improves production capacity, and creates millions of new jobs for the people. Industries such as manufacturing, information technology, and services have seen a significant increase in the number of investment projects, indicating diversification in the investment sector and the expansion of the economy. There are many ways to invest in Vietnam, among which is the form of buying contributed capital, which means that foreign investors can receive the transfer of contributed capital or shares from Vietnam. Thus, when transferring capital to foreign investors, what taxes need to be paid? Viet An Law would like to provide customers with more information through the article below.

Table of contents

When foreign investors transfer capital in Vietnam, they will be subject to certain taxes, depending on the type of transfer, type of business and current legal regulations.

Overview

Taxpayers: If foreign investors are individuals, they will have to pay PIT on the profits earned from capital transfers.

Tax rate: Applies according to the partial progressive tariff or the full tariff schedule, depending on the gross income and allowable deductions.

Details

When individuals transfer capital, depending on the type of company participating in capital contribution, they will have to declare and pay personal income tax arising from the transfer activities.

Example: Individual A who is a shareholder of ABC Joint Stock Company transfers shares with a value of VND 100,000,000 will have to submit a personal income tax declaration dossier at the tax sub-department where the company is headquartered and pay the corresponding personal income tax of VND 100,000,000 x 0.1% = VND 100,000

Example: Individual A is a capital contributor in ABC Co., Ltd. with a capital contribution value of VND 500,000,000. Now A wants to transfer the above contributed capital to individual B with a transfer price of 700,000,000 VND. Thus, personal income tax is calculated as follows: (700,000,000 – 500,000,000) x 20% = 40,000,000 VND. Thus, A must submit a PIT declaration dossier at the tax sub-department where the company is headquartered and pay PIT of VND 40,000,000.

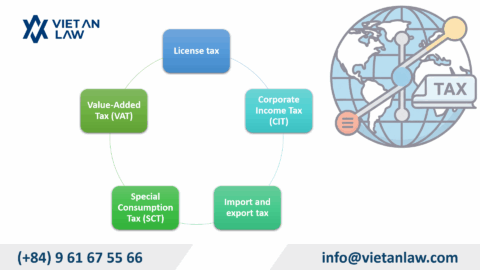

Taxes that organizations must declare and pay when transferring capital include value-added tax (VAT) and corporate income tax (CIT).

Overview

Tax payers: Legal entities transferring capital will have to issue invoices and be subject to value-added tax

Tax rate: Applied according to general regulations on VAT, currently 0% for legal entities transferring capital.

Details

Pursuant to Point 2.1, Appendix 4 promulgated together with the Circular No. 39/2014/TT-BTC dated March 31, 2014 of the Ministry of Finance guiding the implementation of Decree No. 51/2010/ND-CP dated May 14, 2010 and Decree No. 04/2014/ND-CP dated January 17, 2014 of the Government regulating invoices for sale of goods, provision of services and regulations:

“2.1. Organizations that pay tax by the method of tax deduction on the sale of goods and services not subject to VAT or eligible for VAT exemption shall use VAT invoices, on which only the selling price line is inscribed as the payment price, the tax rate line, the VAT amount not recorded and crossed out.”

Pursuant to Clause 7, Article 3 of Circular No. 26/2015/TT-BTC dated 27/02/2015 of the Ministry of Finance, it is stipulated:

“Article 3. Amending and supplementing a number of articles of Circular No. 39/2014/TT-BTC dated March 31, 2014 guiding the implementation of Decree No. 51/2010/ND-CP dated May 14, 2010 and Decree No. 04/2014/ND-CP dated January 17, 2014 of the Government stipulating invoices for sale of goods and provision of services as follows:

… 7. Article 16 is amended as follows:

a) To amend and supplement Point b, Clause 1, Article 16 (amended and supplemented in Clause 3, Article 5 of Circular No. 119/2014/TT-BTC) as follows:

b) Sellers must make invoices when selling goods and services, including goods and services used for sales promotion, advertising and sample goods; goods and services used for giving, donating, exchanging or paying salaries in lieu of salaries to employees (except for goods circulated internally or consumed internally to continue the production process).”

Based on the above provisions, when conducting capital transfer activities, organizations will have to issue VAT invoices. However, capital transfer activities are not subject to VAT as prescribed at Point b, Clause 2, Article 3 of the Government’s Decree No. 209/2013/ND-CP dated December 18, 2013. When issuing VAT invoices for capital transfer activities, the company shall write the selling price line on the invoice as the payment price, tax rate line, VAT amount not recorded and crossed out according to the guidance at Point 2.1, Appendix 4 issued together with Circular No. 39/2014/TT-BTC of the Ministry of Finance.

Overview

Tax payers: Normally, the company receiving the capital transfer will be obliged to declare and pay CIT on the profit earned from the capital transfer.

Tax rate: Applied according to general regulations on CIT in Vietnam, currently 20% on taxable profits.

Details

Income from capital transfer is one of the other incomes that are not usually generated at the enterprise, this is also the income that is included in the taxable income in the tax period of the enterprise. It will usually be calculated according to the following formula: Taxable income from capital transfer of a partnership is determined according to the following formula:

| Taxable income | = | Transfer price | – | Purchase price of the transferred capital | – | Transfer costs |

In which:

Example: Joint stock company A has a shareholder being legal entity B that contributes capital to buy shares of VND 1,500,000,000. After that, company B transferred the above-mentioned shares to company C at the price of VND 2,000,000,000, the contributed capital of company B at the time of transfer on the accounting books was VND 1,500,000,000, the transfer cost was VND 50 billion. Accordingly:

So, the income for calculation of corporate income tax from the transfer of capital of partnership A is:

2,000,000,000 – 1,500,000,000 – 100,000,000 = 400,000,000 VND

Note: All transactions when the legal entity transfers will be made via bank transfer.

The obligation to declare and pay taxes is the legal responsibility of all organizations and individuals earning income in Vietnam, including foreigners. This obligation is required to comply with the provisions of the tax law to ensure transparency in business activities, contribute to the state budget and create a fair business environment.

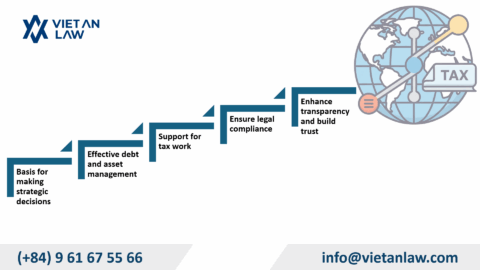

The compliance of foreign investors with the obligation to declare and pay taxes in Vietnam brings many benefits to both investors, businesses and the Vietnamese economy. Here are some of the outstanding benefits:

For foreign investors:

For businesses:

For Vietnam’s economy:

In short, the fact that foreign investors declare and pay taxes in accordance with regulations brings mutual benefits to both investors, businesses and the Vietnamese economy. This is an important part of building a healthy and sustainable investment environment.

For all question on tax in Vietnam, please contact Viet An Law – Tax Agent, hotline (+84) 9 61 67 55 66 (WhatsApp, Viber, Zalo, Wechat), for the best assistance.