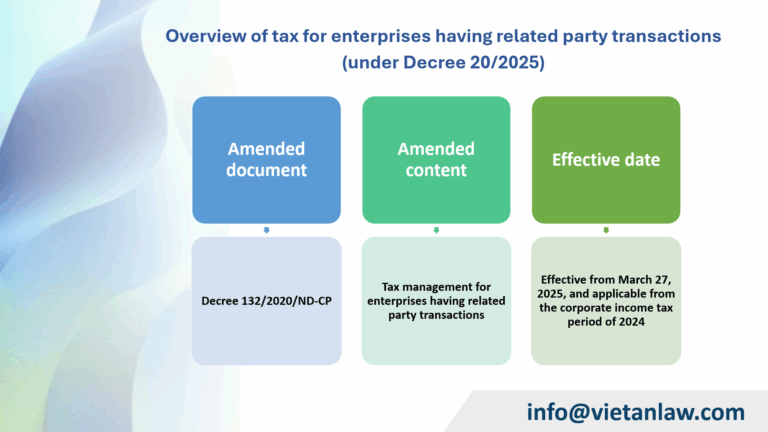

On February 10, 2025, the Government issued Decree No. 20/2025/ND-CP amending and supplementing several articles of Decree No. 132/2020/ND-CP on tax for enterprises having related party transactions. This Decree will take effect from March 27, 2025, and apply from the corporate income tax period of 2024. In this article below, Viet An Law Firm will update some noteworthy points from the new provisions in Decree 20/2025/ND-CP amending Decree 132/2020/ND-CP on tax for enterprises having related party transactions (under Decree 20/2025).

Table of contents

According to the provisions in the Tax Administration Law 2019, “related-party transaction” means a transaction between related parties. Under the provisions in Clause 1, Article 5 of Decree 132/2020/ND-CP, related parties are parties having relationships where:

Enterprises having related party transactions include cases specified in Clause 2, Article 5 of Decree 132/2020/ND-CP. The new provisions in Decree 20/2025/ND-CP have amended and supplemented points d, k, and added point m to Clause 2, Article 5 of Decree No. 132/2020/ND-CP regarding related parties as follows:

The regulations in point d, Clause 2, Article 5 of Decree No. 132/2020/ND-CP have been clarified. Decree 20/2025/ND-CP specifies cases where the provisions on the conditions for providing guarantees or loans between related parties do not apply. Specifically, the extent of the outstanding balance of the loan amount of the borrowing enterprise equals 25% of its equity and makes up for more than 50% of the total medium and long-term debts of the borrowing enterprise.

It is not effective in the following cases:

Thus, the new provisions exclude some cases from the regulations in point d, Clause 2, Article 5 of Decree 132/2020/ND-CP. From March 27, 2025, the loan amount of the borrowing enterprise equals 25% of its equity and makes up for more than 50% of the total medium and long-term debts of the borrowing enterprise will not be considered a related party if one of the two following conditions is met:

Point k, Clause 2, Article 5 of Decree 132/2020/ND-CP has been amended as follows:

“k) In other cases where an enterprise (including independent branches implementing declaration and payment for declaring and paying corporate income tax) has its business activities managed, controlled, or decided de facto by the other enterprise”

Thus, Decree 20/2025/ND-CP amending Decree 132/2020/ND-CP on tax management for enterprises having related party transactions has clarified that enterprises considered related parties include independent branches implementing declaration and payment for declaring and paying corporate income tax. This means that not only parent companies but also independent accounting branches may have their business activities managed, controlled, or decided de facto by the other enterprise. These branches must also fulfill the obligations of filing and paying corporate income tax like independent enterprises.

Decree 20/2025/ND-CP has added Point m to Clause 2, Article 5 of Decree 132/2020/ND-CP as follows:

“m) Credit institutions with their subsidiaries, or with their controlling companies, or with their associate companies as prescribed in the Law on Credit Institutions and related amending, replacing documents (if any);”

According to this new provision, credit institutions with their subsidiaries, or with their controlling companies, or with their associate companies are also considered related parties. The nature of the related party in this case concerns the management, control, or actual influence exerted by the credit institution over its subsidiaries or companies it controls or is associated with.

This relationship is important for determining transactions between related parties, as credit institutions may conduct transactions with their subsidiaries or associated companies, and these transactions can affect the declaration, calculation of corporate income tax, and other financial obligations.

Decree 20/2025/ND-CP has amended and supplemented Clause 2, Article 21 of Decree 132/2020/ND-CP as follows:

“2. The State Bank has the following responsibilities within its jurisdiction:

Cooperate in the provision of information or data on foreign loans and debt repayments of particular enterprises engaged in related party transactions by reference to the lists compiled by tax authorities, including data on loan amounts, interest rates, periods of interest payment, and principal repayment, actual fund withdrawal, debt (principal or interest) repayment and other related information (if any).

Cooperate in the provision of information reported by the law on related persons of the members of the Board of Directors, members of the Board of Members, members of the Board of Controllers, General Director (Director), Vice General Director (Vice Director), and equivalent titles as prescribed in the Charter of the credit institution; related persons of shareholders owning above 01% of the charter capital of the credit institution; associated companies of the credit institution in accordance with the data of management system of the State Bank of Vietnam by the time the tax authority makes the request.”

Thus, the new provisions add the State Bank of Vietnam’s responsibility to coordinate in providing reported information on related persons:

This information will be provided from the data of the management system of the State Bank of Vietnam by the time the tax authority makes the request. This helps the tax authority inspect the related party relationships within credit institutions and clarify the related transactions between related parties in enterprises, thereby enabling measures to control and prevent tax evasion through non-transparent transactions.

Along with the Corporate income tax finalization declaration, enterprises must submit the amended Appendix I – Information about interrelationships and related party transactions, which replaces the Appendix I issued with Decree 132/2020/ND-CP with the new Appendix I issued with Decree 20/2025/ND-CP.

Therefore, from March 27, 2025, the new Appendix will be applied as follows Viet An Law’s instructions.

In case in the corporate income tax period for the years 2020, 2021, 2022, and 2023, the borrowing enterprise only has an interrelationship with an economic organization operating following regulations of the Law on credit institutions, the borrowing enterprise and the guaranteeing or lending enterprise has related-party transactions, and the loan interest cost is not deductible, from the tax period of 2024 the following applies:

Above is the advice of Viet An Law on the issue of tax for enterprises having related party transactions (under Decree 20/2025). Clients who have related questions or need legal support about this issue, please contact Viet An Law Firm for the best support!