Do online business individuals have to pay taxes? This is one of the common questions related to online business tax. In fact, taxes have never been simple for taxpayers in general or business households and individuals in particular. To simplify the online business tax accounting process for individuals, businesses can refer to and consider using the tax declaration service at Viet An Tax Agent with the following information.

Table of contents

Pursuant to the provisions of Article 11 of Circular 40/2021/TT-BTC on tax administration for business households and individuals paying tax by the method of declaration as follows:

“Article 11. Tax administration for business households and individuals paying tax by the declaration method.

…1.Tax declaration dossiers

…Tax tariff dossiers for business households and individuals paying tax according to the declaration method specified at Point 8.2, Appendix I – List of tax declaration dossiers issued together with the Government’s Decree No. 126/2020/ND-CP dated October 19, 2020, specifically as follows:

a) A tax declaration for business households and individuals, made according to form No. 01/CNKD issued together with this Circular;

b) An appendix to the list of business activities in the business period and business individuals (applicable to business households and individuals paying tax by the declaration method) made according to form No. 01-2/BK-HDKD issued together with this Circular. In case business households and individuals pay tax by the declaration method, if there are grounds to determine turnover certified by functional agencies, they are not required to submit the Appendix to the list of forms No. 01-2/BK-HDKD issued together with this Circular.

…2. Places to submit tax declaration dossiers

The place of submission of tax declaration dossiers for business households and individuals that pay tax by the declaration method specified in Clause 1, Article 45 of the Law on Tax Administration is the Sub-Department of Taxation directly managing the locality where business households and individuals conduct production and business activities.”

Thus, according to regulations, individuals selling online goods can submit tax declaration dossiers at the Sub-Department of Taxation directly managing the place where the individual conducts production and business activities

In particular, the tax declaration dossier for individuals selling online goods by the declaration method includes:

In case a business individual pays tax by the declaration method, if there are grounds to determine the turnover certified by the functional agency, it is not required to submit the Appendix to the List

Pursuant to the provisions of Clause 1, Article 44 of the Law on Tax Administration 2019, the deadline for submitting tax declaration dossiers is as follows:

“Article 44. Deadline for submission of tax declaration dossiers

The time limit for submission of tax declaration dossiers for tax declared on a monthly or quarterly basis is prescribed as follows:

…a) No later than the 20th day of the month following the month in which the tax liability is incurred, for cases of monthly declaration and payment

…b) No later than the last day of the first month of the quarter following the quarter in which the tax liability arises, in case of quarterly declaration and payment”

Pursuant to the provisions of Clause 3, Article 11 of Circular 40/2021/TT-BTC on tax administration for business households and individuals paying tax by the declaration method as follows:

“Article 11. Tax administration for business households and individuals paying tax by the declaration method

…3. Deadline for submission of tax declaration dossiers

The time limit for submitting tax declaration dossiers for business households and individuals paying tax by the declaration method is specified in Clause 1, Article 44 of the Law on Tax Administration, specifically as follows:

a) The deadline for submission of tax declaration dossiers for business households and individuals that pay tax by the monthly declaration method is the 20th day of the month following the month in which the tax liability arises

b) The deadline for submission of tax declaration dossiers for business households and individuals that pay tax by the quarterly declaration method is the last day of the first month of the quarter following the quarter in which the tax obligation arises”

Thus, according to regulations, the deadline for submitting tax declaration dossiers for individuals selling online goods by the quarterly and monthly declaration method is prescribed as follows:

With the online business tax declaration service for individuals, the unit will need to provide Viet An Tax Agent with the following basic information:

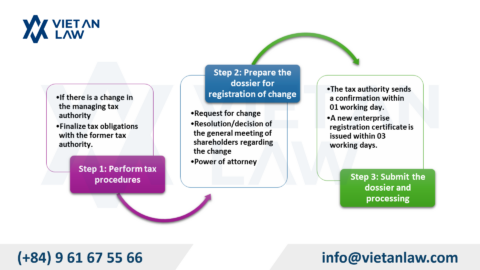

After receiving all the necessary information provided by the unit, Viet An Tax Agent will carry out online business tax declaration with a professional and comprehensive process, including the following tasks:

When using the tax declaration service for individuals selling online, the unit will be completely assured of the right to profit because Viet An Tax Agent commits:

If you have any difficulties or questions related to tax declaration services for online sellers, please contact Viet An Tax Agent for the most specific advice.