On December 10, 2025, the National Assembly passed the amended Law on Personal Income Tax (Law No. 109/2025/QH15) with many important changes regarding tax brackets, tax-exempt levels for business households, and the scope of taxable income. The roadmap for applying the 2026 Personal Income Tax (PIT) Law is a subject of special interest to many individuals and businesses in the context of significant changes to personal income tax policies. The following article will clarify the notable new points and the roadmap for applying Personal Income Tax Law (PIT Law) in 2026: Update on the latest Law No. 109/2025/QH15 according to the latest legal regulations.

Table of contents

Previously, personal income tax was governed by the Law on Personal Income Tax 2007, amended and supplemented through the years: 2012, 2014, 2024, 2025. However, starting from 2026, the PIT legal system will transition to a new phase under the Law on Personal Income Tax No. 109/2025/QH15.

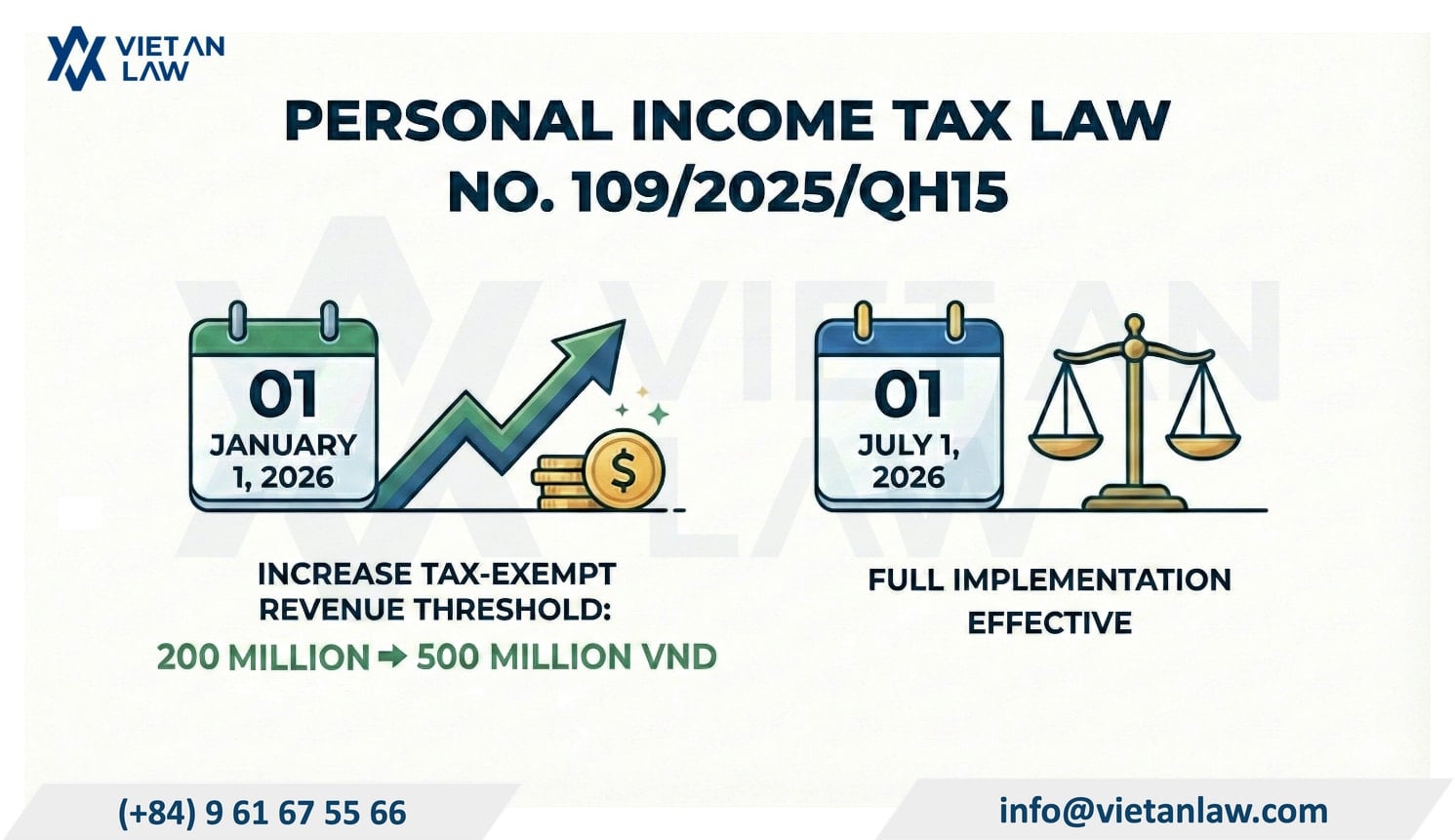

According to Article 29 of Law on Personal Income Tax No. 109/2025/QH15, the effectiveness of Law No. 109/2025/QH15 is as follows:

“1. This Law takes effect from July 1, 2026, except for the case prescribed in Clause 2 of this Article.

2. Regulations related to income from business, from salaries and wages of resident individuals apply from the tax period of 2026.”

This regulation leads to 2026 being a special transitional year, in which two PIT legal regimes exist in parallel depending on the timeline.

The roadmap for applying the 2026 Personal Income Tax Law is as follows:

From January 1, 2026 to June 30, 2026, the Law on Personal Income Tax 2007, amended and supplemented through the years 2012, 2014, 2024, 2025, is still applied. Along with it are the guiding documents for implementation including:

Important note: Enterprises must not apply the new regulations of Law 109/2025/QH15 early during this period. The declaration and deduction of PIT must still be performed according to old regulations, ensuring the correct tax period and avoiding errors during inspection and examination.

Although Law 109/2025/QH15 has general effect from July 1, 2026, specifically regulations related to income from business, from salaries and wages of resident individuals at Law on Personal Income Tax No. 109/2025/QH15 are applied from the tax period of 2026.

Accordingly, from January 1, 2026 (from the tax period of 2026), the non-taxable revenue threshold for PIT for business households and individuals is raised from 200 million VND/year to 500 million VND/year and this amount is allowed to be deducted before calculating tax based on the rate on revenue.

This regulation has great significance in reducing the tax burden and supporting small business households and individuals right from 2026, even though the law is not yet fully effective.

From July 1, 2026, the Law on Personal Income Tax No. 109/2025/QH15 will officially take effect and be applied comprehensively.

Accordingly:

Individuals, business households, and enterprises need to review internal processes to ensure compliance with new regulations.

Law on Personal Income Tax No. 109/2025/QH15 is an important milestone, marking a comprehensive and positive innovation step in tax management policy in the reform period, clarifying the legal framework, reducing the tax burden for low-income individuals and small business households. Among them, there are some notable new points:

A practical issue raised is: In 2026, two different laws apply, so how will tax finalization in 2027 be handled? Currently, Law 109/2025/QH15 does not have detailed guidance on the finalization method in the transition year; it is highly likely that income and tax will be separated by each period, instead of averaging the whole year.

Therefore, it is recommended that accountants and HR departments should:

The roadmap for applying the 2026 Personal Income Tax Law according to Law No. 109/2025/QH15 shows that this is a pivotal year with many important changes, requiring individuals and enterprises to pay special attention to the application time and implementation method. Correct understanding and application of each period not only helps ensure legal compliance but also optimizes tax obligations and limits risks arising during the finalization process.

The above is information related to the roadmap for applying Personal Income Tax Law in 2026: Update on the latest Law No. 109/2025/QH15. Customers who have related questions or need tax advice, please contact Tax Agent – Viet An Law Firm for the best support!