Foreign loans are known as the borrower receives a credit from a non-resident through the signing and execution of foreign loans. In addition to the forms of foreign loans guaranteed by the government, some forms of self-borrowing and self-responsibility become more popular, especially short term foreign loans. To manage the borrowing and use of loans, the law has regulations about the borrower’s responsibility to report. Viet An Law Firm will analyze the report on short term foreign loans in Vietnam as follows.

Table of contents

A short-term foreign loan is a foreign loan that is not guaranteed by the government with a loan term of up to 01 year. Thus, unlike the mid-term, long-term foreign loans, short term foreign loans have a loan term of less than 01 year.

A short term foreign loan is also known as self-borrowing and self-paying a short-term foreign loan.

For borrowers who are in a credit institution, foreign bank branches, foreign short term borrowers serve some purposes as follows:

For the borrower who is a credit institution, foreign bank branch, or foreign short-term borrower to serve some purpose as follows:

Having a short term foreign loan, the borrower must ensure the regulations of law on ensuring safety ratios in Credit Institutions Law at the end of the last 03 months before the day of signing the foreign loan agreement, change the increase foreign loan agreement. Besides, the borrower needs to pay attention to the limit of short term foreign loans following Article 15 of Circular 08/2023/TT-NHNN. Specifically, the borrower only borrows short term foreign loans in case they meet the limit of short term foreign loans at 31/12 of the year preceding the time the loan arises. The limit of a short term foreign loan is the maximum rate of total the principal balance of a short term foreign loan calculated on the individual own capital, applicable to the following subjects:

According to Chapter VI of Circular 12/2022/TT-NHNN, the regulation of reports on short term foreign loans include:

Banks providing account services carry out the reporting regulation as prescribed by the State Bank on the statistical reporting regulations applied to the units of the State Bank and credit institutions and foreign bank branches.

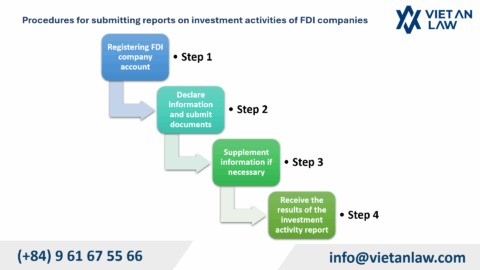

Every month, no later than the 5th of the following month of the reporting period, the borrower must report online the implementation of long-term, medium, and short-term foreign loans on the website. In case the website has a technical error so that it is unable to be submitted, the borrower shall submit a written report.

In unexpected cases or when necessary, the borrower and bank providing account services shall make reports upon the request of the State Bank.

Compared to Circular 03/2016/TT-NHNN, some new points in regulations of the report on short-term foreign loans in Circular 12/2022/TT-NHNN are as follows:

Unlike Circular 03/2016/TT-NHNN, according to Circular 12/2022/TT-NHNN, the borrower must register an account on State Bank’s website and send a report on their foreign loans to State Bank through this website.

Website address: www.sbv.gov.vn or http://www.qlnh-sbv.cic.org.vn/.

The borrower must report the status of short-term loans to the State Bank on State Bank’s website monthly, instead of quarterly as per regulations in Circular 03/2016/TT-NHNN.

Residents are enterprises, cooperatives, unions of cooperatives, credit institutions, and foreign bank branches established and operating business activities in Vietnam make detailed reports on the implementation of short term foreign loans not guaranteed by the Government outstanding debt on the reporting period.

Covered loans are short-term loans (with a term of up to 01 year). The loan term starts from the expected date of loan proceed withdrawal (receipt of money or customs clearance of goods) to the expected date of final repayment as the loan agreement. Short-term foreign loans that are overdue but the borrower has arranged to repay the loan within 10 days from one year of the loan (thus not having to register the loan with the State Bank), will be reported as a short-term loan.

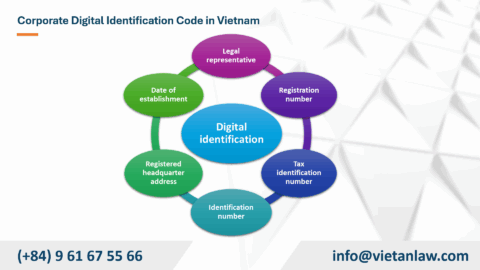

The borrower sends a report to fill in the type code of the borrower according to the categories as follows:

| No | Type of business entity of the borrower | Code |

| Category of enterprises (not combine commercial banks, foreign bank branches) | ||

| 1 | State-owned enterprises as defined in the Law on Enterprises 2015 | SOE |

| 2 | Enterprises with 50% to less than 100% of charter capital owned by the State | S50 |

| 3 | Enterprises with 51% to less than 100% of charter capital owned by foreign investors | F51 |

| 4 | Enterprises with 10% to 51% of charter capital owned by foreign investors | F10 |

| 5 | Other enterprises | KHA |

| Category of banks | ||

| 6 | Joint venture banks, banks with 100% of foreign capital, foreign bank branches | FOB |

| 7 | Other joint-stock commercial banks | BAK |

Clients who have related questions or need legal support regarding reporting short term foreign loans or registering foreign loans, please contact Viet An Law Firm for the best support!

Disclaimer: This article was last updated in February 2024. Laws may have changed since then. Please contact Viet An Law to confirm the information in this article is current and for any legal assistance.