Korea, with its developed economy and dynamic business environment, is an attractive destination for many foreign investors. In order for the process of establishing a company in Korea to be fast and simplified, investors also need to find out information to understand the above process. Viet An Law would like to provide information through the article below.

Table of contents

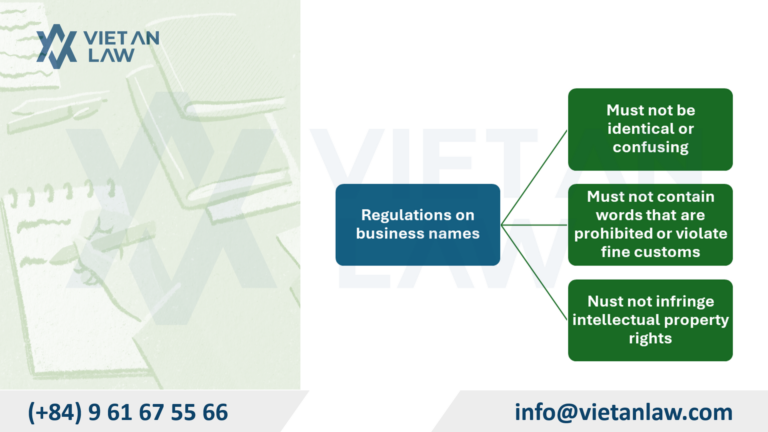

Regulations on business names in Korea:

You can visit the website of the Ministry of Justice of the Republic of Korea to look up the availability of the business name through the following link: https://www.moj.go.kr/moj_eng/index..do

Business address requirements in Korea:

List of documents to prepare

Filing company incorporation documents at the Korea Commercial Register

After preparing the dossier, customers can submit it directly or online through the website: https://www.krs.co.kr/kor/

If the application is approved, you will receive a Certificate of Registration from the Korean Commercial Register – confirming that your company is duly registered and has the right to conduct business in Korea. This certificate will include essential information such as the company’s name, head office address, and business registration number, which will serve as the basis for the company’s later legal and business activities.

The company needs to register for a tax identification number after completing the business registration procedures.

A tax identification number registration dossier usually includes:

Submission: Applications can be submitted in person at the NTS office or through the online registration system.

Steps can be found through the website of the National Tax Service of Korea (NTS) https://www.nts.go.kr/ or https://www.nts.go.kr/english/main.do . The NTS tax website offers the following services:

After completing the procedures for opening a bank account, the capital contribution is the next step for the company to officially operate. Members or shareholders will contribute capital in an agreed form, which can be cash, bank transfer, or other assets such as land use rights, machinery, and equipment. After contributing capital, it is necessary to make a record of capital contribution, clearly stating information about the capital contributor, the amount or value of the capital contribution, and the time of capital contribution. In case of capital contribution with assets, the valuation of assets and making a record of delivery and receipt are mandatory. All capital contribution documents should be carefully stored to ensure transparency and serve as a basis for future financial activities.