Setting up a company in Italy, one of Europe’s major economies, is an opportunity to open the door for businesses to access a vast and potential market. However, not all investors are familiar with the process of establishing a company in Italy, Viet An Law would like to present a preliminary through the article below.

Table of contents

The first step in the procedure for setting up a company in Italy is to choose the right type of company. In Italy, the two most common types of companies are:

This is the most popular type of company by small and medium-sized businesses. Members are only liable for limited liability within the scope of their capital contribution. The minimum charter capital is 10,000 Euros, but may be lower in some statutory cases. Flexible management structure, which can be managed by one or more people. This type is suitable for small and medium-sized businesses.

This is a type of company suitable for large businesses that plan to raise capital from the public. The minimum charter capital to establish is 50,000 Euros. The management structure is more complex, including a board of directors and a supervisory board. Shares can be traded on the stock market. This type is suitable for large enterprises, large investment projects, and companies that plan to list on the stock market.

After choosing the type of company, you can prepare the application to set up a company in Italy.

The list of documents includes:

Then proceed to notarize the company’s charter.

You can apply in person at your local Chamber of Commerce or online through the Chamber of Commerce website. If the dossier fully meets the requirements prescribed by Italian law, the Chamber of Commerce will proceed to register the company. After the company is successfully registered, the Chamber of Commerce will issue a business registration number. This number is the company’s unique identifier, which is used in all business transactions and related administrative procedures.

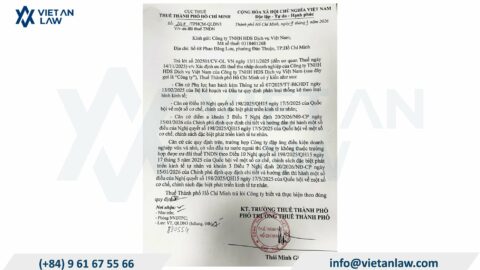

Registering for a corporate tax identification number is a mandatory step when setting up a company in Italy. This tax code is called Partita IVA (Imposta sul Valore Aggiunto), which is equivalent to the value-added tax (VAT) number in other countries. After the company has been registered at the Chamber of Commerce, the next and equally important step is to register for a VAT identification number, also known as Partita IVA, at the Tax Authority (Agenzia delle Entrate). The Partita IVA is a unique identifier for VAT purposes, and is a mandatory condition for a company to be able to carry out legitimate business activities in Italy.

The Partita IVA application can be submitted directly at the local office of the Tax Authority (Agenzia delle Entrate). After receiving the dossier, the Tax Authority will conduct a check on the validity of the documents and information provided. If the dossier meets all the requirements, the Tax Authority will proceed to issue a Partita IVA to the company.