Tax finalization is one of the important and mandatory activities for businesses in the process of business activities. That is not only a step to synthesize and compare tax obligations performed in the year but also a basis for tax authorities to assess the legal compliance of enterprises. However, the settlement process often has many potential risks if businesses do not prepare carefully, from lack of documents, errors in declaration to improper determination of deductible expenses. Therefore, understanding the necessary notes when finalizing taxes will help businesses avoid unnecessary violations, limit tax arrears, sanctions, and at the same time build a transparent and professional corporate image. Viet An Tax Agent will summarize the points that businesses need to pay special attention to so that the tax finalization process takes place smoothly and in accordance with the law.

Table of contents

Tax finalization is the process by which an enterprise synthesizes, reviews and declares all tax obligations incurred in an accounting period, usually a fiscal year, in order to report to the tax authority in accordance with the law. Through this activity, enterprises determine the paid tax amount, the amount still payable or refunded, and at the same time check the completeness, accuracy and validity of tax declarations. Common taxes that must be finalized include corporate income tax, personal income tax and a number of other taxes if any. The tax finalization not only helps businesses fulfill their obligations to the State, avoid being sanctioned for administrative violations, but also contributes to demonstrating transparency and professionalism in the financial management of the unit.

Subjects who need to make tax finalization are individuals, organizations and enterprises who are obliged to declare and pay tax in accordance with Vietnamese law.

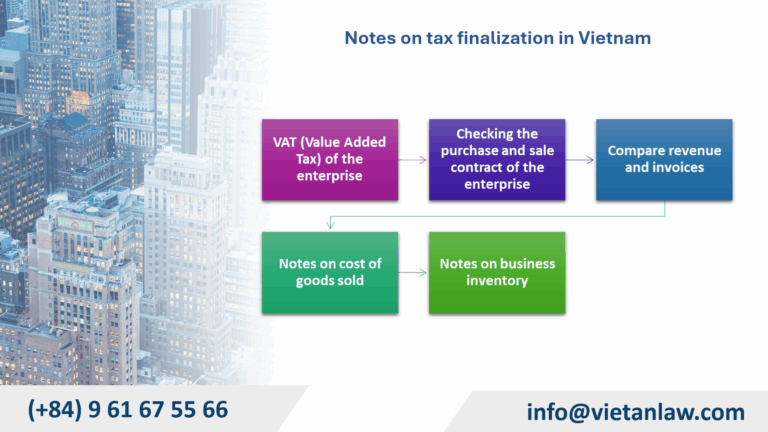

VAT is one of the most important factors that every commercial enterprise accountant needs to pay special attention to when making tax finalization. To ensure that the settlement is carried out quickly, accurately and minimize errors, accountants need to thoroughly check all documents and books related to VAT of the enterprise.

Periodically, accountants need to review whether tax returns have been filed on time. Making a separate excel sheet listing all declarations will make it easier to track and look up information when necessary. In addition, accountants need to compare tax returns with input and output VAT invoices every month to ensure full and accurate declaration; at the same time, promptly detect cases of lost or misplaced invoices, thereby determining the cause and taking timely handling measures.

This periodic inspection and comparison plays an important role in controlling the invoice situation of enterprises, helping accountants proactively respond to arising risks, protecting businesses from unfortunate errors in tax work.

In addition, in order for invoice information to be transparent, clear and limit errors when making books, accountants should pay attention to performing the following tasks every month:

Normally, the tax authorities will ask businesses to provide a summary of tax reports from January to December in the fiscal year. Therefore, accountants need to actively prepare this excel file to be ready to submit when requested.

Periodically checking the purchase and sale contracts of enterprises is an essential job, making tax finalization simpler and more effective later. Accountants not only need to make an Excel table to summarize all economic contracts for purchase and sale, but also have to check the status of liquidated contracts, ensuring that there are no unfinished contracts. At the same time, the verification of the contract value, as well as the information on the start and end dates of liquidation, should be carried out thoroughly to ensure accuracy and completeness.

In order to compare revenue, accountants need to check account 511 to identify issues and evaluate business results, and at the same time review the P01-1/GTGT list of invoices and documents related to goods and services sold.

In case the date on the delivery note and the invoice date do not coincide, the accountant needs to adjust it so that the invoice date and the delivery note match.

Note that canceled invoices need to be declared correctly in section 15 on the invoice usage report. In addition, accountants should make separate statements to record all invoices that have been deleted.

For the cost of goods sold, accountants should pay special attention to checking a number of important factors to ensure accuracy in accounting and tax finalization. Specifically, it is necessary to review whether the goods sold have been invoiced at the right time, whether the items sold are still in stock, and whether the delivery is in accordance with the delivery date on the document.

In case the goods are still in stock, the accountant must apply the appropriate inventory price calculation method and strictly comply with the provisions of current law, in order to ensure transparency and consistency in recording the cost price.

Finally, in order for the finalization of commercial enterprise tax to be carried out quickly and accurately, corporate accountants also need to pay attention to the inventory of enterprises.

The inventory in the books must ensure that it matches the reality. In case of a match, VAT and enterprise income tax must be retrospectively collected according to the fixed method, based on the inspection:

In addition, corporate accountants should also make a list of items sold lower than the cost price and make an appropriate explanation plan, if there is no legal basis to submit appropriately, it will be taxed.

If you have any difficulties or questions related to the notes when finalizing the company’s tax, please contact Viet An Tax Agent for the most specific advice.