I have over 1.5 years of experience in accounting and finance. As a part of Viet An Law Firm, I always desire and wish to contribute my best for the development of the company. I firmly believe that Viet An will become one of the leading consulting firms in financial accounting and taxation not only in Vietnam but also in the world.

I have graduated from National Economics University with excellent university degree. The National Economics University is the leading school of accounting field in Vietnam, Therefore I am very proud of that.

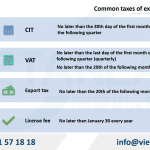

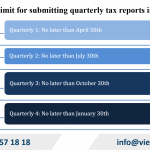

I have trained in-depth knowledge on how to make financial statements for businesses, analyze financial statements to give solutions to optimize profitability for businesses. In addition, I also learned about current tax laws such as: value added tax (VAT) , personal income tax (PIT) , corporate income tax (CIT) Foreign contractor tax (FCT).

I would like to provide the best perfect services for all customers with my enthusiasm, dedication and talent. Please come with Viet An Law company, where every customer is our first and prime concern.

Email: acc@vietanlaw.vn.

Table of contents

Hanoi Head-office

#3rd Floor, 125 Hoang Ngan, Hoang Ngan Plaza, Trung Hoa, Cau Giay, Hanoi, Vietnam

Ho Chi Minh city office

Room 04.68 vs 04.70, 4th Floor, River Gate Residence, 151 – 155 Ben Van Don Street, District 4, HCM, Viet Nam

SPEAK TO OUR LAWYER

English speaking: (+84) 9 61 57 18 18 – Lawyer Dong Van Thuc ( Alex) (Zalo, Viber, Whatsapp)

Vietnamese speaking: (+84) 9 61 37 18 18 – Dr. Lawyer Do Thi Thu Ha (Zalo, Viber, Whatsapp)