Loan registration is a mandatory administrative procedure for economic organizations that are enterprises, cooperatives, unions of cooperatives, credit organizations when borrowing money from abroad to return to Vietnam. Enterprises are responsible for registering loans, opening and using loan accounts, repaying foreign debts, withdrawing capital and transferring money for debt repayment, reporting on the loan performance according to regulations of the State Bank of Vietnam.

Borrowers are subject to registration for foreign loans under Article 14 of Circular 12/2022/TT-NHNN which must be obliged to register loans with the State Bank.

When there is a change in any content related to the loan as stated in the written confirmation of loan registration of the State Bank, the borrower is responsible for registering the change of foreign loans with the State Bank.

Responsibility to notify the State Bank when there is one of the following changes:

With regard to the content change at point g, Clause 2 of this Article, before withdrawing and repaying the remaining amount of that period, the borrower is responsible for registering changes to the plan for capital withdrawal, debt repayment for the remaining amount has not been implemented according to the provisions of Circular No. 12/2022/TT-NHNN.

According to Decree No. 88/2019/ND-CP on administrative sanctions in the monetary field, the sanctions are as follows:

A fine ranging from 20,000,000 VND to 30,000,000 VND shall be imposed for one of the following violations:

Failing to comply with the provisions of law on administrative procedures for: registration, registration for changes in foreign loans, international bond issuance; registration, registration for changes in offshore loans, the guaranteed debt recovery for non-residents…

Thus, for individuals, the fine is 20 million to 30 million VND. For organizations, the fine for organizations with the same act of administrative violation is equal to 02 times the fine for individuals. The fine for organizations will be 40 million to 60 million VND.

If the enterprise uses a loan without a loan account opened at a bank providing account services to withdraw capital, repay foreign loans and other money transfer transactions related to borrowing, repaying foreign debts, guaranting for foreign loans, but used through another account, violating the implementation of capital withdrawal, debt repayment for foreign loans, the specific fines are as follows:

A fine ranging from 30.000.000 VND to 50.000.000 VND shall be imposed for one of the following violations:

Performing the capital withdrawal, repayment foreign loans in contravention of regulations.

The fine for individuals is from 30 million to 50 million VND, the fine for organizations with the same violations is equal to 02 times the fine for individuals. The fine will be from 60 million to 100 million VND.

Loans under 01 year do not need to be registered. Self-borrowing and self-repaying foreign short-term loans (hereinafter referred to as short-term foreign loans) are foreign loans not guaranteed by the Government for a term of up to one (01) year. Except for you can’t repay the loan after 01 year, you must extend the loan term and register for a loan.

However, the law also allows that if the borrower completes the loan debt repayment within 10 days from the full date 01 year from the date of the first capital withdrawal of the short-term loan, registeration of the loan is not required.

Only foreign medium, long-term loans and short-term loans that are extended for a total of the loan term is more than one year, must be registered.

The maximum fine for violations in the monetary and banking sectors for violating organizations is 2.000.000.000 VND and for violating individuals is 1.000.000.000 VND;

For foreign loans must register with the State Bank, the borrower may only withdraw capital, repay the principal and interest of the foreign loan after the loan is certified the registration by the State Bank.

If an enterprise needs urgent capital that using money from an account not registered with the State Bank, it is a violation of regulations on cash flow transparency.

In addition to registering for a loan, enterprises also have reporting obligations. Quarterly, no later than the date 5th of the following month after the reporting period, the borrower must send the Branch a report written on the performance of short, medium and long-term loans. If you do not report, you will violate the reporting regulations and be fined.

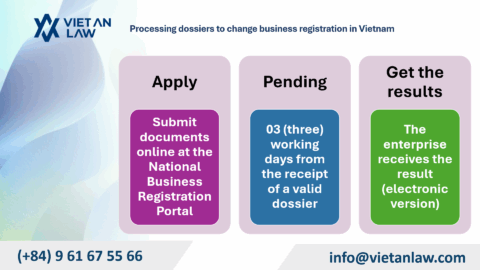

Viet An Law Firm will support in drafting dossiers, clients signing, we will submit dossiers on behalf of clients, explain, carry out all procedures and receive results, send results to clients. Clients please contact us for the best support.