Viet An Law Firm is proud to be a leading provider in the field of comprehensive company formation consulting services in Vietnam. With many years of experience, our team of professional lawyers is always ready to answer all questions related to the procedures, processes, and costs of establishing a business. The following article compiles a list of frequently asked questions (FAQs) regarding our full-service company formation services in Vietnam, helping clients gain a comprehensive overview and choose the most suitable solution. Viet An Law will guide you through the details to ensure a smooth and effective start to your business journey.

Table of contents

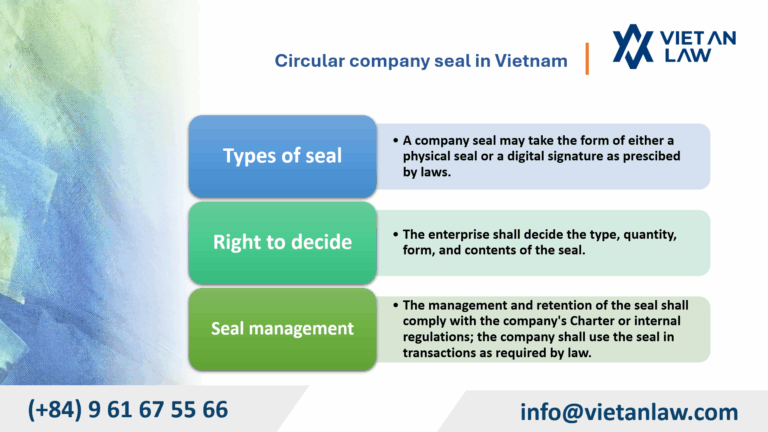

Full-service company formation is a comprehensive service that supports new businesses from A to Z during the business registration process. From legal consultation, document preparation, dossier submission, company seal engraving, to initial tax declaration – all procedures are handled by the service provider. This solution helps entrepreneurs save time and effort while minimizing errors during the setup process. It is especially suitable for first-time business owners or those unfamiliar with legal procedures.

Depending on the number of investors, capital scale, and development goals, you may consider the following options:

It is recommended to seek expert advice to select the optimal legal form for your business.

Pursuant to Article 42 of the Law on Enterprises 2020, amended in 2025, the company’s head office must be located within the territory of Vietnam, serve as the official contact address, and be identified based on administrative boundaries with contact details such as phone number, fax, and email (if any).

Applicable laws do not prohibit using a residential address as a company’s head office. However, using a private residence for trading in flammable or explosive materials, or providing services that cause environmental pollution, noise, or adversely affect public order, social safety, or the daily life of the residential community, without complying with legal business conditions, shall be prohibited (Clause 9, Article 3 of the Law on Housing 2020).

Thus, you may use your private residence as a registered office if it meets the legal conditions regarding a valid business address.

Under applicable law, there is no minimum charter capital requirement (except for conditional business lines), so businesses may self-determine this amount. However, charter capital should reflect your actual financial capacity and business strategy. A higher capital level may increase credibility with partners but also comes with greater legal responsibilities. It is advisable to consult an accountant or legal expert to determine an appropriate amount.

Pursuant to Article 43 of the Law on Enterprises 2020, amended in 2025:

Pursuant to Article 20 of the Law on Cadres and Civil Servants 2008 and the Law on Enterprises 2020, amended in 2025, government officials and civil servants are prohibited to establish, contribute capital to, manage, or operate a business, cooperative, or other economic organizations, except in cases permitted under the laws on science, technology, innovation, and national digital transformation.

Under Article 44 of the Law on Tax Administration 2019, enterprises that are not operating are not exempt from the obligation to submit tax declaration dossiers. Therefore, even if there is no revenue or business activity, the enterprise must still submit tax declarations on time and in full as required by law.

Thus, if the company is not operating, it may file “zero-activity” tax reports to fulfill its legal obligations. Alternatively, businesses can temporarily suspend operations for a certain period to avoid tax obligations during inactive periods.

As of 2022, all enterprises are required to use electronic invoices in accordance with the Law on Tax Administration. E-invoicing enables convenient storage, lookup, and quick tax filing. After registering for a tax identification number, the company must register for e-invoicing with the tax authority, after which it may issue and send invoices. Full-service company formation services typically include support for this procedure.

Some basic annual expenses include: digital signature costs, accounting service fees (if outsourced), costs for tax reporting, and social insurance (if there are employees). Additional costs such as office rent, operations, and marketing may apply depending on the scale of the business. Even if the company is not active, it must still pay the licensing fee and submit tax reports in accordance with regulations.

You can check the processing status of your application on dangkykinhdoanh.gov.vn after submitting it online. If the dossier is rejected, the system will indicate the specific reason for rejection. You can correct and resubmit it. If you use a full-package service, the service provider will review, submit, and handle the application professionally on your behalf.

Trademark registration is not mandatory, but highly recommended to protect your brand and prevent others from registering or infringing upon it. You should apply for trademark protection as early as possible to secure legal priority. This can be done after the company is formed or simultaneously during the startup phase.

As of January 1, 2026, under Resolution No. 198/2025/QH15, the licensing fee will be abolished for both newly established enterprises and business households.

Under Clause 1, Article 43 of Decree No. 168/2025/ND-CP, on changing the legal representative:

In case of a change in the legal representative, the company must submit a registration dossier for amendment of enterprise registration information to the Business Registration Office where the company’s head office is located.

The above is the complete content related to frequently asked questions (FAQ) on full-service company formation services in Vietnam. If you need full-service company formation services, please contact Viet An Law for the best support!