For foreign investors who want to establish a business and investment foundation in Thailand, it is important to prepare company establishment documents. This process includes the preparation of pre-establishment information, preparation and completion of a complete dossier. In addition, choosing the right type of company, such as a limited liability company or a joint stock company, needs to be carefully considered to fit the business strategy. Careful preparation of documents is the key to the success and sustainable development of the business. Viet An Law would like to guide customers in preparing documents for establishing a company in Thailand through the article below.

Table of contents

The naming of the company is the first procedure when establishing a company in Thailand, which is carried out through the Business Development Department (DBD). The company name must not be duplicated or confusing with any previously registered company or form of cooperation, whether in English or Thai. This is especially important for foreign investors, because sometimes the name check is only done in English, while the Thai transcription violates the duplication rule. Therefore, it is extremely necessary to thoroughly test both language versions. In addition, some terms are prohibited from being used in the company name, and if the word “Thailand” is used, it must be placed in parentheses at the end of the name, e.g., “ABC (Thailand) Company Limited”. To maximize your chances of getting your desired name approved, you should have three names ready in order of priority. Basically, you don’t need to file separately just to name the company. The naming is carried out during the process of submitting the company establishment registration dossier at the Business Development Department (DBD). However, you need to have the following information ready:

Once the name is approved, it will be “set” for 30 days and will not be renewed. During this period, you must file a company incorporation application.

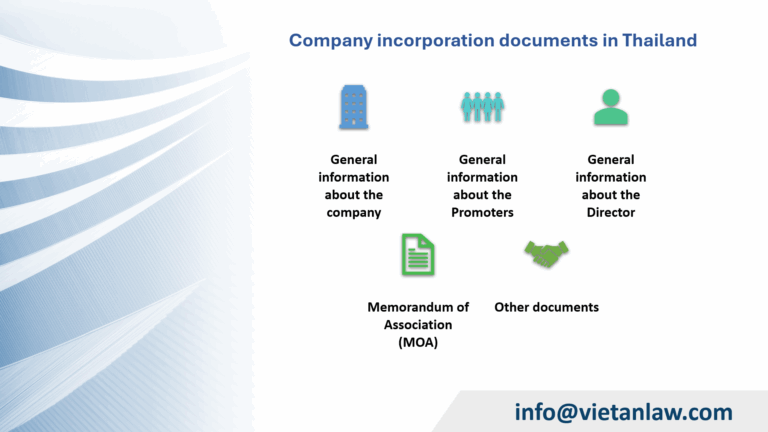

Customers need to prepare the following information:

After preparing the relevant information and documents, you will fill in the information according to the company registration form on DBD’s website with the following link: https://www.dbd.go.th/. In terms of registration costs, for a private limited company, the fee is set at THB 5,500 for every THB 1 million of registered charter capital. For example, if you register a charter capital of 10 million THB, the registration fee will be 55,000 THB.

Clients who need support to establish a company all around the world, please contact Viet An Law for the fastest support!