All enterprises conducting production and business in the territory of Vietnam must fulfill tax obligations. If you’re a business owner but don’t have a good understanding of tax filing procedures, let us help you. Vietnam Tax Agent is proud to be a unit with experience in the field of accounting and taxation – specializing in providing tax consulting services and tax optimization solutions for businesses.

Table of contents

Consulting on tax procedures is one of the most important and necessary legal services for businesses. Consulting on tax procedures to help businesses fulfill their tax obligations in full, declare and pay taxes on time to avoid tax arrears with unnecessary fines.

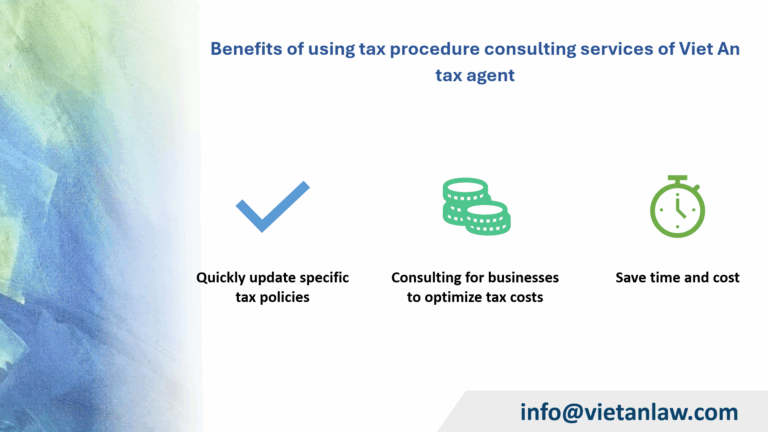

Tax consultancy services are one of the optimal services, suitable for small and medium-sized businesses. When using tax procedure consulting services from Viet An tax agent, your business will obtain practical benefits such as:

The current tax law is constantly changing. What happens when your corporate accountant or board of directors doesn’t update policies regularly? When using our tax consulting services, we promise that your organization will be updated with the latest tax policies as well as solutions to optimize taxes for your business.

Currently, there are 3 basic taxes that businesses are particularly interested in: Corporate income tax, value-added tax, and personal income tax. So how to optimize tax costs? That is a question that many business owners will ask. Viet An Tax Agent is proud to be a unit with extensive experience in the field of taxation, which will be obliged to provide specific advice to businesses and support tax finalization if there is an official letter of request.

What happens if your business hires an accountant with no professional qualifications to perform accounting and tax declaration work? When using tax consultancy services from our tax agents, we ensure that all figures and book records are declared on time, ensuring accuracy, minimizing tax risks. From there, cutting costs for businesses, promoting production and business activities.

Below we will list services related to tax procedure consulting services for businesses:

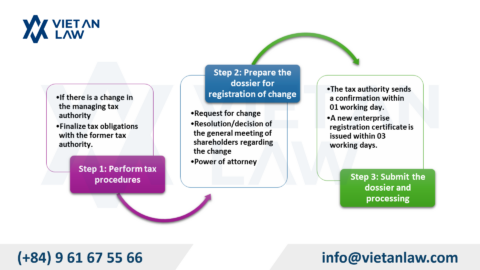

After receiving the business registration license, your unit needs to carry out the initial tax procedures, specifically as follows:

Above is information related to tax procedure consulting services for businesses of Viet An tax agent. Please contact us if your business is still ambiguous in financial accounting as well as tax obligations. We – experienced people in the profession guarantee to help you in solving problems related to tax obligations as well as optimizing costs in the production and business process!