Although not a major investor compared to other countries, Turkey is increasingly increasing its presence in Vietnam. With its favorable geographical location, abundant human resources, and open-door policy, Vietnam is an attractive destination for Turkish businesses, especially in areas such as infrastructure, manufacturing, and technology. In contrast, Turkey, with its dynamic economy and rich experience, can bring advanced technologies and large investment capital to Vietnam. Cooperation between the two countries is being strengthened in many fields, especially economy, trade and investment. In the first 6 months of 2024, Turkey has invested a total of 730.1 million USD in Vietnam. To guide Turkish investors, Viet An Law would like to guide the procedures for establishing a Turkish investment company in Vietnam through the following article.

Table of contents

The textile and garment industry is one of the most promising sectors in the economic cooperation between Vietnam and Turkey. With a long history and rich experience in the industry, Turkish textile and garment enterprises possess advanced production technologies, unique designs and strong global supply chains, including brands such as Mavi Jeans, Koton, LC Waikiki, Sarar… The transfer of technology from Turkish enterprises will help significantly improve the competitiveness of Vietnam’s textile and garment industry, from design, production to product completion. At the same time, Vietnam, with its abundant and flexible labor force, competitive production costs and attractive investment incentives, will be an ideal location for Turkish businesses to expand their production scale, reduce costs and access the vast Southeast Asian market.

Both countries have mutual advantages. Turkey is famous for its high-end textile and garment products, while Vietnam has the strength of producing garments in large quantities. By combining these strengths, the two countries can create diverse textile products, meeting the increasing demand of the world market, especially fastidious markets such as Europe and the US. In addition, cooperation in the textile and garment sector also contributes to promoting the development of supporting industries such as chemicals, and garment equipment, creating more jobs and increasing income for people.

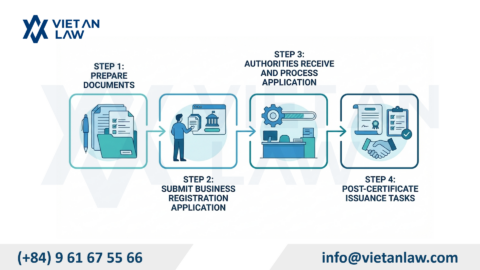

Step 1: Apply for an investment certificate;

Step 2: Register for business establishment;

Step 3: Proceed to engrave the legal entity’s seal when it has a tax identification number;

Step 4: Open an investment capital account and contribute capital;

Step 5: After completing the capital contribution procedure, business activities can be carried out. Note that it may be necessary to apply for sub-licenses for conditional business investment lines

Depending on whether the investor is an individual or a legal entity, it will be necessary to provide the following additional documents:

| Investors are individuals | Investors are legal entities |

| · Copy of identity card/identity card or passport for investors who are individuals subject to consular legalization and notarized translation; | · A copy of the consular legalized business registration certificate and notarized translation;

· Copies of personal legal papers of the legal representative of the organization that is consularly legalized and notarized. |

Place of application: Department of Planning and Investment where the head office is expected to be located.

Processing order: Within 15 days from the date of receipt of a complete and valid dossier, the Department of Planning and Investment will issue an Investment Registration Certificate to the foreign investor. In case of refusal, the Department of Planning and Investment will reply in writing and clearly state the reason.

Place of application: Department of Planning and Investment where the enterprise is headquartered.

Duration: 03 – 06 working days.

After the business has a tax identification number, engraving the legal entity seal is an important step to complete the establishment procedure. The legal entity seal is an official identification sign of the business, used in transactions and legal documents. What should be included on the seal:

Procedures for opening an investment capital account

Preparation of dossiers for opening investment capital accounts includes:

Place to apply: Submit the application at the selected bank.

The bank will conduct the appraisal of the dossier and open an investment capital account for the investor.

After having an investment capital account, the company with Turkish capital proceeds to contribute capital. Note that enterprises need to fully contribute the registered capital within 90 days from the date of issuance of the business registration certificate.

Place of application: Department of Planning and Investment where the head office is expected to be located.

Processing order: Within 15 days from the date of receipt of a complete and valid dossier, the Department of Planning and Investment will issue a written confirmation of the purchase of contributed capital to the foreign investor. In case of refusal, the Department of Planning and Investment will reply in writing and clearly state the reason.

Carry out procedures for changing shareholders and members on the Business Registration Certificate (Enterprise Registration Certificate) in accordance with the law at the Business Registration Office – Department of Planning and Investment.