In the context of global economic integration, Vietnam has been attracting a significant number of foreign direct investment (FDI) projects. As a result, the transfer of foreign currency abroad for purposes such as payment, profit remittance, or business operations has become a critical issue for FDI companies. However, Vietnamese law imposes strict and specific conditions on such transfers. In this article, Viet An Law will clarify: When are FDI Companies allowed to transfer foreign currency?

Table of contents

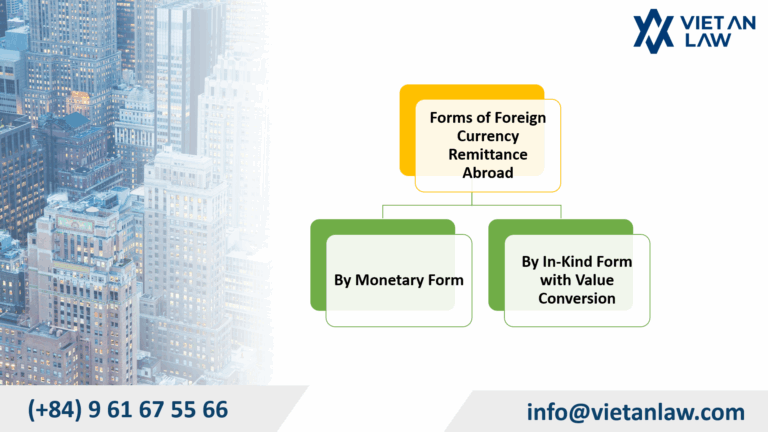

According to Article 2 of Circular No. 186/2010/TT-BTC, the Ministry of Finance provides specific guidance on the remittance of profits abroad by foreign organizations and individuals earning profits from direct investment activities in Vietnam, in accordance with the Law on Investment. There are two forms of profit remittance as follows:

Based on these regulations, in addition to monetary profit remittance, enterprises in Vietnam may also choose to remit profits in the form of in-kind assets. This requires a clear determination of the value of the in-kind assets to be converted into an equivalent profit amount. Enterprises may independently decide the form of profit remittance and must specify it in the profit remittance notification as stipulated in Article 5 of Circular 186/2010/TT-BTC.

The profit remittance notification must be prepared using the form attached to Circular 186/2010/TT-BTC and submitted to the tax authority directly managing the foreign-invested enterprise. The notification must be submitted at least 07 working days prior to the actual profit remittance. It must clearly state the details of the profits being remitted abroad, including the values remitted in both monetary form and in-kind form.

So, when are FDI Companies allowed to transfer foreign currency? The answer lies in the conditions and timing set by law, ensuring that all transfers are legitimate and transparent.

According to legal regulations, FDI companies are permitted to remit foreign currency abroad in the following cases:

According to Clause 1, Article 6 of Decree No. 70/2014/ND-CP, FDI enterprises are allowed to remit foreign currency abroad to pay for imported goods and services. Such payments must be made through foreign currency accounts in Vietnam.

However, these transactions must satisfy the following conditions:

FDI enterprises are permitted to remit remaining profits abroad after fulfilling all tax obligations. This applies only when the enterprise has fully paid all taxes and other financial obligations in Vietnam, per Circular 186/2010/TT-BTC issued by the Ministry of Finance and other relevant legal documents.

In cases where an FDI enterprise terminates its investment activities or transfers its project, the invested capital may be remitted abroad.

According to Article 66 of the 2020 Law on Investment, investors are allowed to transfer investment capital abroad to conduct investment activities if the following conditions are met:

FDI enterprises are allowed to remit foreign currency abroad to cover other legitimate expenses such as salaries for foreign experts, premises costs, or technology transfer fees.

According to Article 9 of Decree No. 70/2014/ND-CP, in cases where there is a need to transfer lawful incomes in Vietnamese dong derived from direct investment activities in Vietnam, foreign investors are permitted to purchase foreign currency from licensed credit institutions and remit it abroad within 30 (thirty) working days from the date of purchasing the foreign currency.

The dossier includes:

Submit the complete dossier to the bank where the enterprise maintains its investment capital account or payment account to execute the transaction. The bank will verify the validity of the dossier before processing the remittance.

In case of profit remittance abroad, the enterprise must submit a Profit Remittance Notification to the directly managing tax authority at least 07 working days prior to the transaction.

Processing Time: The processing time depends on the completeness and validity of the dossier. If the dossier is complete, banks typically process the transaction within 3–5 working days.

In What Cases Are FDI Companies Allowed to Remit Foreign Currency Abroad?

FDI companies are permitted to remit foreign currency abroad in the following cases:

Yes. FDI companies are required to open a direct investment capital account at a bank licensed to conduct foreign exchange operations in Vietnam. This account must be used for all transactions related to direct investment capital, including:

Profits can be remitted abroad annually or at any time deemed appropriate by the foreign investor, provided that:

No. Corporate income tax is calculated and paid in Vietnam before profits are remitted. Once all tax obligations in Vietnam are fulfilled, the remitted profits are not subject to additional taxation under the amended Law on Corporate Income Tax 2013 (as amended in the following year).

The above is the legal advice for the question: When are FDI companies allowed to transfer foreign currency? If you need legal consultation, please contact Viet An Law for the best support!