With the current development trend, companies and corporations in many fields often tend to establish subsidiaries when implementing important projects. So what is a subsidiary? Why establish a subsidiary? What is the procedure when setting up a subsidiary company of a company in Vietnam? Viet An Law will summarize the above contents in the following article.

Pursuant to Article 195 of the Enterprise Law 2020, a subsidiary company is a case in which a company contributes more than 50% of its charter capital to another company.

Subsidiaries will be subject to the appointment of important positions such as members of the Board of Directors, Director, or General Director of that parent company.

Thus, the company contributing capital is called the parent company. Subsidiary is a company that will be subject to the full control of the parent company.

Nowadays, establishing a subsidiary is one of the top choices of businesses, especially for multi-industry and multi-field companies because the subsidiary will bring benefits such as: after:

According to Decree 122/2020/ND-CP and Decision 1523/QD-BKHDT, the application for the establishment of a subsidiary company will be similar to the application for registration of establishment of a new enterprise, corresponding to the types of enterprises such as joint-stock company, single-member limited liability company (limited liability) and multiple-member limited liability company. Specific dossiers include:

In addition to the above documents, enterprises wishing to establish a subsidiary will need to add the following documents to the establishment dossier:

Number of records: 01 set.

Note: In the application file for the establishment of a subsidiary, it must be shown that the parent company is a shareholder/capital-contributing member owning more than 50% of the total number of ordinary shares or charter capital.

Place of application: directly at the business registration office.

Duration: 03 working days from the date of submission of valid documents.

To establish a subsidiary, businesses need to prepare the following procedures:

The first step to establishing a subsidiary is to prepare documents and submit the application to establish a subsidiary. After preparing all the documents, the application is submitted to the business registration office. The agency competent to receive and process the application for the establishment of a subsidiary is the Business Registration Office of the Department of Planning and Investment of the locality where the enterprise is located.

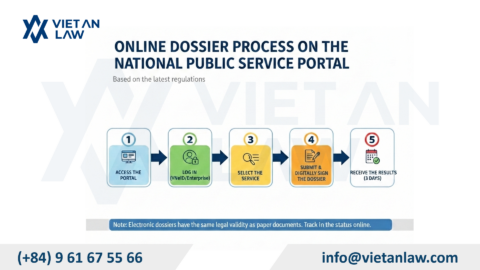

Currently, there are usually two ways to submit an application as follows:

After submitting the application for registration of business establishment, the business registration office of the provincial Department of Planning and Investment will be responsible for reviewing the validity of the business registration dossier and granting or refusing to issue the Enterprise Registration Certificate.

Accordingly, in the process of reviewing the application for registration of the establishment of a subsidiary, if the application is complete and valid, the company will be granted an Enterprise Registration Certificate (within 03 days). When receiving the results, the legal representative of the company must bring a receipt for handling the application. In case he is not the legal representative, the authorized person must bring the power of attorney and submit a valid copy of one of the following papers:

Pursuant to Article 32 of Decree No. 01/2021/ND-CP, enterprises must pay fees and charges for business registration at the time of submitting the application for company establishment. Accordingly, the fee for registration of business establishment in Circular 47/2019/TT-BTC is 100,000 VND/time. Enterprise founders pay fees directly by electronic payment service. In addition, enterprises that register their businesses online are exempt from business registration fees.

Thus, the fee for establishing a subsidiary will be 100,000 VND/time. If you register through the National Business Registration Portal, you will be exempted from the fee. In addition, there will also be some related costs such as the cost of opening a bank account, the cost of buying a digital signature, and creating a seal… These costs will depend on the actual situation of the customer. enterprise.

After being granted a license for establishment and business operation, a subsidiary company needs to perform the following tasks:

If you want to find out more information about a subsidiary of a company in Vietnam, please contact Viet An Law Firm to get the best support!