Social insurance is a guarantee to replace or partially compensate the income of social insurance participants when they have reduced or lost income due to illness, maternity, work accidents, occupational diseases, retirement or death, based on contributions to the social insurance fund or guaranteed by the state budget.

Social Insurance Law No. 41/2024/QH15 was just passed at the 7th session of the 15th National Assembly. The law takes effect from July 1, 2025, replacing the Social Insurance Law 2014 and Resolution No. 93/2015/QH13 implementing the policy of receiving lump-sum social insurance benefits for employees. Below, Viet An Law will clarify for you key updates of Vietnam Social Insurance Law 2024.

Table of contents

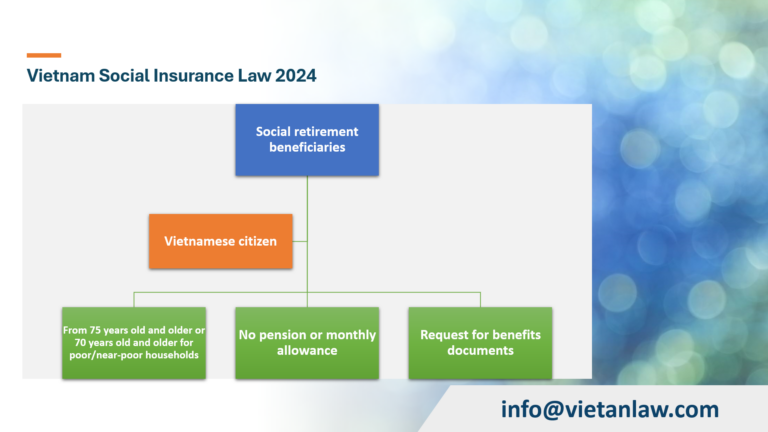

Social retirement benefits under the provisions of the Social Insurance Law 2024 are a type of social insurance guaranteed by the state budget, built on the basis of inheriting and partly developing from the regulations on monthly social allowances for the elderly without pensions or monthly social insurance benefits, in which the age of receiving social retirement benefits is reduced to 75 years old (the old regulation is 80 years old).

To receive social retirement benefits, Vietnamese citizens must meet the conditions in Article 21 of the Social Insurance Law 2024:

Accordingly, Vietnamese citizens who are old enough to retire but do not have enough time to pay for pensions (underage of 15) and are not old enough to receive social pensions (underage of 75) if they do not receive a lump sum social insurance and do not reserve it but have a request, will receive monthly allowances from their own contributions. During the period of receiving monthly allowances, the state budget will pay for health insurance.

The Social Insurance Law 2024 stipulates the expansion of the subjects eligible to participate and fully enjoy social insurance regimes by expanding the subjects participating in compulsory social insurance to business owners of registered business households; Part-time workers at the commune, village, and residential group levels; Part-time workers; Business managers and cooperative managers who do not receive salaries.

Participants of voluntary social insurance who meet the prescribed conditions are entitled to a maternity allowance of VND 2 million for each newborn child, guaranteed by the state budget, and employees do not have to pay additional contributions. This is a new provision compared to the previous Social Insurance Law 2014.

For female workers who are ethnic minorities or female workers who are Kinh people whose husbands are ethnic minorities in poor households, residing in communes and villages with special difficulties when giving birth, in addition to the above benefits, they are still entitled to support policies when giving birth according to the Government’s regulations. The condition to receive this maternity allowance is that the employee participating in voluntary social insurance has a period of voluntary social insurance payment or has a period of both compulsory social insurance payment and voluntary social insurance payment for at least 06 months within 12 months before giving birth.

According to the Social Insurance Law 2014, in order to be eligible for monthly pension, in addition to the age requirement, employees must also pay social insurance for at least 20 years (except for female employees who are commune-level cadres, civil servants or non-professional workers at the commune level, who only need to pay insurance for at least 15 years).

The new Law on Social Insurance, which takes effect in 2024, has shortened the time requirement for social insurance payment to receive pension for both compulsory social insurance participation and voluntary social insurance participation. Accordingly, based on Articles 64 and 98 of the Social Insurance Law, employees only need to accumulate at least 15 years of social insurance payment to be eligible for pension when they reach the age. Thus, the minimum number of years of social insurance payment to be eligible for pension has been reduced by 5 years compared to the former regulations.

However, the Law also clearly states that employees participating in compulsory social insurance who withdraw money in one lump sum after the new Law takes effect must accumulate 20 years of social insurance contributions in the next payment to receive pension, except in cases of retirement due to reduced working capacity.

The Social Insurance Law 2024 adds provisions to increase benefits, increase attractiveness, and encourage employees to reserve their contribution period to receive pension instead of receiving social insurance in one lump sum

The Social Insurance Law No. 41/2024/QH15 has been amended and supplemented in the direction of increasing benefits, increasing attractiveness, and encouraging employees to reserve their contribution period to receive pension instead of receiving lump-sum social insurance. Employees who have stopped participating in social insurance but have a request can receive lump-sum social insurance if they fall into one of the following cases:

Thus, for those who start participating in social insurance from July 1, 2025 onwards, lump-sum social insurance will be settled in the first four cases mentioned above. The new Social Insurance Law has many amendments and supplements in the direction of increasing benefits, increasing attractiveness, and encouraging employees to reserve their contribution period to receive pensions instead of receiving lump-sum social insurance.

Employees who do not pay social insurance at one time but reserve the payment period to continue participating have the opportunity to enjoy higher benefits such as:

The Social Insurance Law 2024 better ensures the right to participate in and enjoy social insurance for Vietnamese workers working abroad and foreign workers working in Vietnam by adding provisions in cases where international treaties to which the Socialist Republic of Vietnam is a member have provisions on the time of participation in social insurance of workers in Vietnam and abroad are calculated to consider the conditions for enjoying social insurance regimes.

The Social Insurance Law 2024 has provisions on improving the efficiency of investment in the Social Insurance Fund, strengthening management and improving the efficiency of using the Social Insurance Fund through expanding the portfolio and methods of investment in the Social Insurance Fund.

However, the new Law has removed the provision on allowing people with long-term illnesses to take leave for up to 180 days. Instead, Article 43 of the Social Insurance Law 2024 stipulates that the sick leave period of employees is determined by the insurance payment period and working conditions, regardless of the illness.

Accordingly, employees with long-term illnesses are only entitled to 75% of the salary for social insurance payment during the following period:

After the above-mentioned leave period, if a person with a long-term illness still needs to continue treatment, he/she is still entitled to take leave from work and enjoy a lower level of sick leave.

Salary used as the basis for compulsory social insurance payment is stipulated as follows:

The income used as the basis for voluntary social insurance payment is at least equal to the poverty line of rural areas and at most 20 times the reference level at the time of payment.

The new Law has stipulated the “reference level” to replace the “basic salary”. Accordingly, the “reference level” is used to calculate the contribution level and the benefit level of some social insurance regimes; when the basic salary has not been abolished, the reference level is equal to the basic salary. The reference level is adjusted based on the increase in the consumer price index, economic growth, in accordance with the capacity of the state budget and the Social Insurance Fund.

Previously, according to Article 87 and Article 89 of the Social Insurance Law 2014, the contribution level of employees participating in voluntary social insurance and compulsory insurance was based on the poverty line, the basic salary and the regional minimum wage. The new Social Insurance Law stipulates that the social insurance contribution level of employees is based on the reference level.

Article 7 of this Law stipulates that the reference level is the amount of money used to calculate the contribution level and the level of enjoyment of some social insurance regimes decided by the Government. The reference level is adjusted based on the increase in the consumer price index, economic growth, in accordance with the capacity of the state budget and the social insurance fund.

Enhance compliance with the law, protect the rights and legitimate interests of employees by dedicating a chapter to regulate the collection and payment of social insurance; clarify the content and handling of late payment and evasion of social insurance.

The Social Insurance Law 2024 creates favorable conditions for participants and beneficiaries of social insurance benefits through the addition of regulations on electronic transactions in the social insurance sector; adjust, reduce and simplify records and procedures for social insurance implementation.

Above is the advice of Viet An Law on Vietnam Social Insurance Law 2024: Key Updates. If you have any other legal problems related to social insurance, please contact Viet An Law for more specific and detailed advice. Sincerely.