In the context of economic volatility and the significant increase in the Consumer Price Index (CPI) over recent years, the adjustment of personal income tax policies has become a focal point of discussion at National Assembly sessions. Recently, the National Assembly officially adopted Resolution 110/2025/UBTVQH15, adjusting the family deduction levels for personal income tax, replacing the current Resolution 954/2020/UBTVQH14. This change not only reflects the Government’s efforts in alleviating the burden on the people but also ensures equity in tax obligations. As a specialized legal consultancy firm, Viet An Law respectfully presents to our clients and readers a detailed analysis of the new regulations, specifically the changes in deduction levels for dependents and taxpayers effective from January 01, 2026, to assist individuals and enterprises in proactively managing financial plans and ensuring legal compliance.

Table of contents

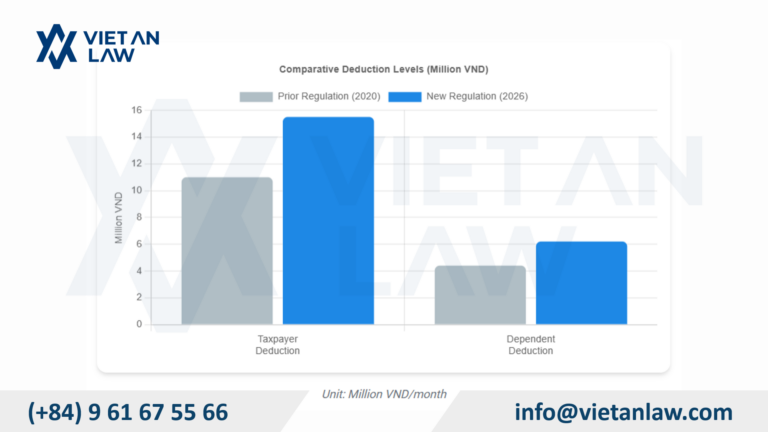

According to the new regulations under Resolution 110/2025/UBTVQH15, effective from January 01, 2026, the deduction levels for calculating Personal Income Tax (PIT) are significantly increased as follows:

The most notable point in this amendment is the substantial increase in the deduction level for the taxpayer personally, specified through the following key contents:

Parallel to raising the deduction level for the taxpayer, the deduction level for each dependent has also been adjusted upwards accordingly. Specifically, the deduction level for each dependent (including children, elderly parents, spouses unable to work, etc.) shall increase from 4.4 million VND/month to 6.2 million VND/month.

Consequently, the deduction levels for dependents and taxpayers from January 01, 2026, will create a much wider income “safety zone” below the taxation threshold.

Example: An employee has an income of 30 million VND/month and supports 2 small children. Previously, they bore a relatively high tax burden; however, under the new regulations, this burden will be significantly reduced or even fully exempted, depending on insurance contributions.

The difference of over 8 million VND in the total combined deduction will help employees save a considerable amount of monthly tax to reinvest in their daily lives.

Thus, the new deduction levels from 2026 have significantly raised the safety zone below the taxation threshold for employee income compared to the old regulations applicable from 2020, specifically:

The application of new deduction levels will fundamentally alter the calculation of the partially progressive tax. The groups benefiting most are those with upper-middle incomes and those with multiple dependents.

Let us examine a specific example to clearly see the impact: Ms. A has a total income from salary of 25 million VND/month, pays 10.5% compulsory insurance (approximately 2.6 million VND), and supports 1 small child.

Note: The partially progressive tax tariff for calculating PIT is also updated from 7 levels down to 5 levels according to the regulations of the Amended Law on PIT 2025, with tax rates of 5%, 15%, 25%, 30%, and 35% (the final tax rate level – 35% – applies to the portion of taxable income exceeding 100 million VND/month).

Clearly, the policy change regarding deduction levels for dependents and taxpayers from January 01, 2026, has assisted employees like Ms. A in retaining the majority of their income.

Although the deduction levels have increased, the regulations regarding the conditions for determining dependents essentially remain strict to prevent tax evasion. Taxpayers must note to prepare complete dossiers to lawfully enjoy the benefits from the new deduction levels for dependents and taxpayers.

Common categories of dependents pursuant to Point d, Clause 1, Article 9 of Circular 111/2013/TT-BTC include:

Enterprises and Human Resources (HR) departments need to note to update their payroll systems and notify employees to review their dependent dossiers. Tax codes of dependents must be registered accurately for the tax system to record the deduction level of 6.2 million VND/month starting from the tax period of January 2026.

Besides the increase in family deduction levels, the Amended Law on Personal Income Tax passed on December 10, 2025 (effective from July 01, 2026) also brings other adjustments that parties need to note to ensure rights and obligations:

To ensure compliance with legal regulations and optimize lawful tax benefits, taxpayers and enterprises need to clearly understand the details regarding dossiers proving dependents as well as the new tax calculation method.

Viet An Law is proud to be a leading prestigious unit in the field of tax consultancy, accounting, and corporate law. We provide comprehensive services, from finalizing personal income tax returns and reviewing tax dossiers for enterprises to representing clients in performing administrative procedures with tax authorities.

If clients have any questions regarding the Vietnam PIT Deduction Levels from January 01, 2026, please contact Viet An Law for in-depth, timely assistance.