On June 19, 2023, the National Assembly voted to pass the Price Law (amended), effective from July 1, 2024. This is an important Law project, having a wide impact on many sectors and fields. To guide and promptly implement the new regulations of the Price Law 2023, the Government recently issued Decree 78/2024/ND-CP and Decree 85/2024/ND-CP. Below, Viet An Law will analyze the Vietnam Legal New on price law under Decree 78 and 85 in 2024.

Table of contents

| Decree 78/2024/ND-CP | Decree 85/2024/ND-CP | |

| Date of issue | 01/07/2024 | 10/07/2024 |

| Effective Date | 01/07/2024 | 10/07/2024 |

| Text Replacement | Decree 89/2013/ND-CP guiding the Price Law on price valuation, amended and supplemented by Decree 12/2021/ND-CP | Decree 177/2013/ND-CP guiding the Price Law, amended and supplemented by Decree 149/2016/ND-CP |

| Main content | Guiding the Price Law about valuation | Detailed regulations on several articles of the Price Law |

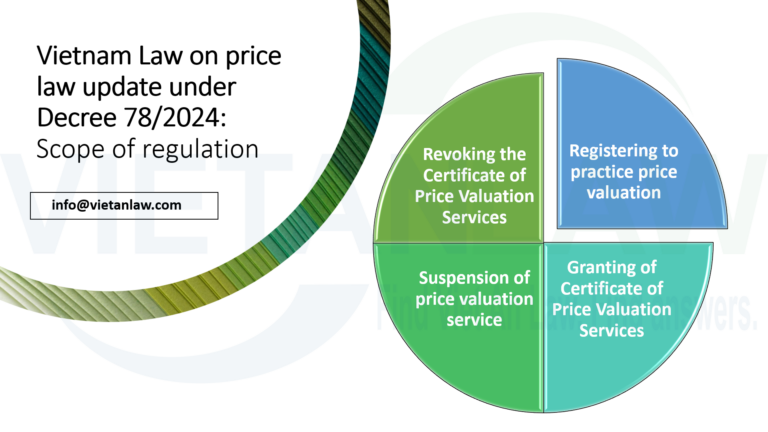

This Decree details Articles 45, 49 and 54 of the Price Law 2023 about:

This Decree details a number of articles of the Price Law, including:

The list of price-stabilized goods and services in the Price Law 2023 will include 9 goods and services. Thus, the new point of the Price Law 2023 for the list of price-stabilized goods and services is the addition of animal feed and the removal of electricity, salt and sugar from the list.

In case it is necessary to adjust the List of price-stabilized goods and services, the Ministry, the ministerial-level agency managing the sector or field, and the Provincial People’s Committee shall prepare a document requesting an adjustment and send it to the Ministry of Finance for synthesis and submission to the Government for submission to the National Assembly Standing Committee for consideration and decision.

To provide detailed guidance on this content, Decree 85/2024/ND-CP has detailed regulations on the order and procedures for adjusting the List of price-stabilized goods and services. This is a new content added compared to the previous Decree 177/2013/ND-CP. Specifically:

The new point of the Price Law 2023 is the clear regulation that the scope of price negotiation is only implemented between enterprises with the State acting as an arbitrator. The above regulation clearly shows the nature of price negotiation measures aimed at promoting agreements between parties, including the intermediary role of organizations, aiming at the goal of harmonizing interests, and ensuring that transactions take place transparently, by the laws of the market economy. At the same time, it avoids cases of taking advantage of the negotiated price for other purposes, which are not by the negotiation requirements and the purchase and sale case.

Article 13 of Decree 85/2024/ND-CP specifically stipulates the order and procedures for organizing price negotiations, including some new points as follows:

The general pricing method for goods and services priced by the State as prescribed in Clause 2, Article 23 of the Price Law 2023 is guided in detail in Circular 45/2024/TT-BTC. Accordingly, there are 2 general pricing methods for goods and services priced by the State, including the cost method and the comparison method.

The Price Law 2023 stipulates that a declaration must be made by organizations and individuals trading in goods and services after deciding on prices to facilitate practical implementation at the unit, replacing the previous regulation that a declaration must be made before organizations and individuals trading in goods and services decide on prices. This is one of the fundamental changes in price declaration measures to facilitate units in making declarations. Decree 85/2024/ND-CP has amended and supplemented regulations on price declaration as follows:

The declared price is the price of goods and services decided by the organization trading in goods and services and notified to the competent authority receiving the declaration.

While Article 15 of Decree 177/2013/ND-CP stipulates 13 goods and services subject to price declaration, Decree 85/2024/ND-CP specifically stipulates the list of goods and services subject to price declaration as prescribed in Appendix V. Accordingly, several goods and services subject to price declaration are added, such as:

Article 15 of Decree 85/2024/ND-CP specifically stipulates the procedures for requesting adjustments to the List of goods and services subject to price declaration, specifically:

Valuation is a consulting activity to determine the value of an asset at a location and time, serving a certain purpose, carried out by a valuation enterprise or valuation council according to Vietnamese Valuation Standards.

In addition to the regulations on Vietnamese valuation standards; standards and price appraiser cards as in Decree 89/2013/ND-CP, Decree 78/2024/ND-CP provides specific and detailed instructions on the dossier, procedures, and order of registration for practicing price valuation. Specifically:

The above list of documents is built based on inheriting and consolidating the current regulations in Circular No. 60/2021/TT-BTC, ensuring compliance with the conditions for registering to practice price valuation in Clause 1, Article 45 of the Price Law. The regulation of the list of documents must include a Criminal Record Certificate No. 02 issued by a competent authority no more than 06 months from the time of registration to practice to review subjects not allowed to practice price valuation as prescribed in Clause 2, Article 45 of the Price Law.

Procedures for registering to practice price valuation as prescribed in Article 4 of Decree 78/2024/ND-CP.

The guidance on regulations on registration for practicing price valuation aims to ensure that the provisions of the Price Law are put into practice. At the same time, the legal basis for price valuation is completed to enhance the effectiveness and efficiency of state management on price valuation for price valuation enterprises and price practitioners.

According to the Investment Law 2020 on conditional investment and business lines, price valuation services are conditional business lines. Therefore, it is necessary to have a Certificate of eligibility for price valuation services business before conducting business activities.

The new point of the Price Law 2023 is that a business providing price price valuation services must have at least 05 people with price appraiser cards who meet the conditions to register to practice price valuation (previously, the minimum requirement was 3 people).

Note: Registration dossiers of at least 05 people with price valuation cards registering to practice price valuation at the enterprise; in case the enterprise requests to have a branch of the price valuation enterprise, each branch of the price valuation enterprise must have at least 03 registration dossiers of people with price valuation cards.

The Price Law 2023 and Decree 78/2024/ND-CP have added 2 more cases of suspension of the Certificate of eligibility for price valuation service business, including:

These are all cases of serious professional violations or violations of valuation standards, so they cannot meet the conditions to continue operating price valuation services.

Decree 78/2024/ND-CP also clearly stipulates how to handle the following cases:

It can be seen that Decree 78/2024/ND-CP and Decree 85/2024/ND-CP have new amendments and supplements to comply with the Price Law 2023, and at the same time to enhance the effectiveness and efficiency of law enforcement by organizations and individuals trading in goods and services; consumers; state agencies; other organizations and individuals related to activities in the field of prices and price valuation in the territory of Vietnam.

Above are the analyses of Vietnam Legal New on price law under Decree 78 and 85 in 2024. If you have any related questions or need legal advice, please contact Viet An Law for the best support!