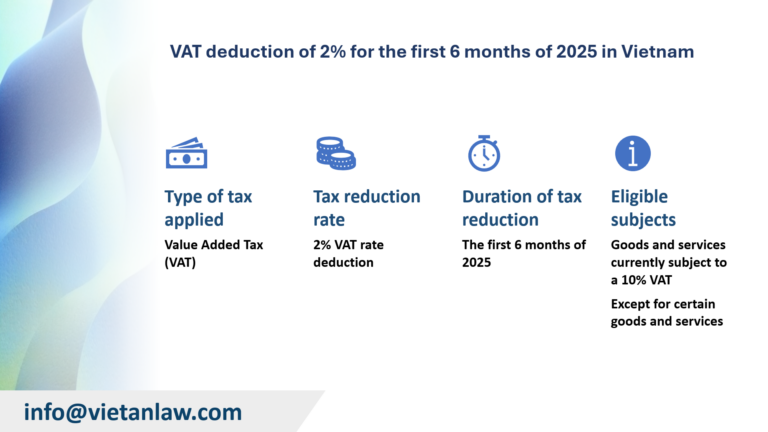

Value Added Tax (VAT) is a broadly based consumption tax assessed on the value of goods and services arising through the process of production, circulation, and consumption. On November 30, 2024, the National Assembly passed Resolution 174/2024/QH15 on the 8th Session, term XV. According to this resolution, the National Assembly agreed to reduce the VAT rate by 2% for the first half of 2025 (from January 1, 2025 to June 30, 2025). This regulation aims to implement fiscal and monetary policies to support the Economic-Social Recovery and Development Program. In the following article, Viet An Law Firm will provide more information about the VAT deduction of 2% for the first 6 months of 2025 in Vietnam.

Table of contents

Section 8 of Resolution 174/2024/QH15 states: “Continue to reduce the VAT rate by 2% for the groups of goods and services specified at point a subsection 1.1 clause 1 Article 3 of the Resolution 43/2022/QH15 of the National Assembly on fiscal and monetary policies supporting the Economic-Social Recovery and Development Program for the period from January 1, 2025 to June 30, 2025”.

Specifically, point a section 1.1 Clause 1 Article 3 of Resolution 43/2022/QH15 regulates the tax reduction, and exemption policies as follows:

“Article 3. Policies on support for the Economic-Social Recovery and Development Program

…1. Fiscal policies:

…1.1. Tax reduction, exemption policies:

…a) Reduce 2% of VAT in 2022 for goods and services currently subject to 10% VAT (to 8%), except for the following goods and services: telecommunication, financial activities, banking activities, securities, insurance, trading of real estate, metal, precast metal products, mining products (excluding coal mining), coke mining, refined oil, chemical products, goods, and services subject to excise tax”.

Thus, the tax reduction policy under Resolution 174/2024/QH15 has some key points to note:

The VAT rate reduction is part of an important fiscal policy:

Note that the duration of this policy is limited to the first half of 2025, indicating that it is a temporary measure to support the economy during its recovery phase after the crisis.

Based on Clause 8 of Resolution 174/2024/QH15 and point a, section 1.1, Clause 1, Article 3 of Resolution 43/2022/QH15, the goods and services eligible for the 2% VAT deduction in the first half of 2025 under Resolution 174/2024/QH15 include:

Group of goods and services currently subject to 10% VAT, except for the following goods and services:

These are key sectors in the economic system, usually with high added value, and requiring VAT stability to maintain operations or having specific nature so not not subject to the VAT deduction.

To implement the provisions of Resolution 174/2024/QH15, which states “The Government is tasked with ensuring the collection and budget balance for 2025 as decided by the National Assembly“, the Ministry of Finance has recently updated the Draft Decree on the 2% VAT deduction from January 1, 2025, to June 30, 2025 (Draft 3).

This draft is based on the regulations in Decree 72/2024/ND-CP issued on June 30, 2024.

In the draft, the Ministry of Finance specifies that the VAT deduction groups of goods and services currently subject to a 10% VAT, except for certain goods and services:

The VAT deduction for the above-listed goods and services will apply uniformly in the stages of import, production, processing, and commercial activities.

For goods and services listed in Annexes I, II, and III of the Draft Decree, if they are exempt from VAT or subject to a 5% VAT rate according to the VAT Law, they will follow the current regulations and will not receive the VAT deduction.

Currently, the VAT rate is specified in Article 8 of the VAT Law 2008, as amended and supplemented in 2013, 2014, and 2016. The VAT rates are 0%, 5%, and 10%, depending on the type of goods or services.

However, starting from July 1, 2025, the new VAT rate according to the VAT Law 2024 will be applied, especially in Article 9 of the VAT Law 2024, which includes changes to the categories of goods and services subject to the 0%, 5%, and 10% VAT rates.

Clients who have related questions or need legal support regarding VAT deduction of 2% for the first 6 months of 2025 in Vietnam, please contact Viet An Law Firm for the best support!