Nowadays, when setting up a business, business owners need to clearly understand the regulations on capital contribution to establish a business, as well as the capital contribution time limit to avoid problems in business operations later. In the following article, Viet An Law will provide information on the time limit for capital contribution to set up a business in Vietnam, capital contribution and capital contribution certificate, and the penalty for not contributing enough charter capital to set up a business according to provisions of current law.

Table of contents

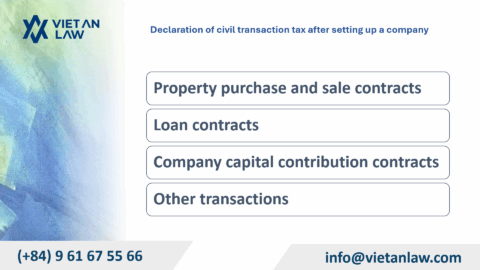

According to Clause 18, Article 4 of the Enterprise Law 2020, capital contribution is the contribution of assets to form the charter capital of a company, including capital contribution to set up a company or additional contribution to the charter capital of an established company.

Contributed capital assets are VND, freely convertible foreign currency, gold, land use rights, intellectual property rights, technology, technical know-how, and other assets that can be valued in VND.

Only individuals and organizations that are legal owners or have legal rights to use assets have the right to use those assets to contribute capital according to the provisions of the law.

According to Article 75 of the Enterprise Law 2020, the company owner must contribute capital to the company in full and with the correct type of assets as committed when registering to establish the enterprise within 90 days from the date of being granted the Enterprise Registration Certificate, excluding the time for transporting and importing contributed assets and performing administrative procedures to transfer ownership of assets. During this period, the company owner has the rights and obligations corresponding to the committed capital contribution.

In case the charter capital is not fully contributed within the prescribed time limit, the company owner must register to change the charter capital by the value of the contributed capital within 30 days from the last day of the full contribution of the charter capital. In this case, the owner must be responsible for the financial obligations of the company arising during the period before the last day of registration of change of charter capital.

Under Article 47 of the Enterprise Law 2020, members must contribute capital to the company in full and with the correct type of assets as committed when registering to set up the enterprise within 90 days from the date of being granted the Enterprise Registration Certificate, excluding the time for transporting and importing contributed assets and performing administrative procedures to transfer ownership of assets.

During this period, members have rights and obligations corresponding to the committed capital contribution ratio. Company members may only contribute capital to the company with assets other than the committed assets if approved by more than 50% of the remaining members.

After the prescribed period, if a member has not contributed capital or has not fully contributed the committed capital, it will be handled as follows:

Pursuant to Article 113 of the Enterprise Law 2020, shareholders must fully pay for the registered shares within 90 days from the date of issuance of the Enterprise Registration Certificate, unless the Company Charter or the share purchase registration contract stipulates a shorter period.

In case shareholders contribute capital in the form of assets, the time for transporting, importing, and completing administrative procedures to transfer ownership of such assets shall not be included in the capital contribution period. The Board of Directors shall be responsible for supervising and urging shareholders to pay in full and on time for the shares registered for purchase.

In case after the prescribed time limit, the shareholder has not paid or has only paid a part of the registered shares, the following provisions shall apply:

Pursuant to Article 178 of the Enterprise Law 2020, general partners and capital contributors must fully and timely contribute the committed capital.

A general partner who fails to contribute the committed capital in full and on time, causing damage to the company, shall be liable to compensate the company for such damage.

In case a capital contributing member fails to contribute the committed capital in full and on time, the uncontributed capital shall be considered as that member’s debt to the company; in this case, the relevant capital contributing member may be expelled from the company according to the decision of the Board of Members.

At the time of contributing the full amount of committed capital, members are issued a capital contribution certificate. The capital contribution certificate must include the following main contents:

The charter capital of a limited liability company with two or more members when registering to establish a business is the total value of the capital contribution that the members commit to contribute and is recorded in the company’s charter.

Members must contribute capital to the company in full and with the correct type of assets as committed when registering to establish the enterprise within 90 days from the date of being granted the Enterprise Registration Certificate, excluding the time for transporting and importing contributed assets and performing administrative procedures to transfer ownership of assets.

During this period, members have rights and obligations corresponding to the committed capital contribution ratio. Company members may only contribute capital to the company with assets other than the committed assets if approved by more than 50% of the remaining members.

After the prescribed period, if a member has not contributed capital or has not fully contributed the committed capital, it will be handled as follows:

In case a member has not contributed capital or has not fully contributed the committed capital, the company must register to change the charter capital and the capital contribution ratio of the members equal to the contributed capital within 30 days from the last day to fully contribute the capital contribution. Members who have not contributed capital or have not fully contributed the committed capital must bear responsibility corresponding to the committed capital contribution ratio for the company’s financial obligations arising during the period before the date the company registers to change the charter capital and the capital contribution ratio of the members.

Except for the case specified in Clause 2, Article 189 of the Enterprise Law 2020, a capital contributor becomes a member of the company from the time the capital contribution is paid and the information about the capital contributor specified in Points b, c and d, Clause 2, Article 48 of the Enterprise Law 2020 is fully recorded in the member registration book. At the time of full capital contribution, the company must issue a capital contribution certificate to the member corresponding to the value of the contributed capital.

The certificate of capital contribution must include the following main contents:

According to Clause 3, Article 46 of Decree 122/2021/ND-CP, a fine of VND 30,000,000 to VND 50,000,000 shall be imposed on founding shareholders who do not contribute enough capital but no member or founding shareholder fulfills the capital contribution commitment.

This is the penalty for individuals, and for organizations that violate the penalty will be twice as much as individuals. In addition, remedial measures will be applied as follows:

Above is the advice of Viet An Law on the time limit for capital contribution to set up a business in Vietnam. If you have any related questions or need support, please contact Viet An Law for the best support!

Update: 10/2024