Currently, intellectual property regulations in general remain relatively unfamiliar to a significant portion of our population, as this issue has not garnered much attention. Therefore, in the process of assigning intellectual property rights, individuals may encounter certain tax-related issues. In the article below, Viet An Law will address your concerns related to tax for copyright assignment in Vietnam.

Table of contents

Copyright is defined in Clause 1, Article 4 of the Intellectual Property Law 2005, as amended and supplemented in 2022, as the rights of an organization or individual concerning a work they have created or own.

The assignment of copyright refers to the act whereby the owner of the copyright assigns ownership of the rights to publish the work, property rights, performer’s rights, the rights of producers of sound and video recordings, and the rights of broadcasting organizations to other organizations or individuals, either through a contract or as prescribed by relevant laws.

In cases where the work, performance, sound or video recording, or broadcast program has joint ownership, the assignment of copyright must be agreed upon by all co-owners. Moreover, if the work, performance, sound or video recording, or broadcast program contains distinct parts that can be used independently, the copyright owner of those parts may assign them to other organizations or individuals without needing the consent of the other co-owners.

The assignment of copyright must be documented in writing and should include the following essential contents:

According to the provisions on taxable income in Clause 7, Article 2 of Circular 111/2012/TT-BTC, personal income tax must be paid on income from royalties. Specifically, income from royalties is the income received when assigning or transferring ownership or usage rights of intellectual property objects under the provisions of the Intellectual Property Law; income from technology transfer is also taxable as per the provisions of the Law on Technology Transfer.

The intellectual property objects subject to tax when assigned are as follows:

Thus, individuals who are copyright owners, when assigning copyright, specifically when assigning copyright for literary, artistic, or scientific works, must pay personal income tax.

According to the provisions of Article 13 of Circular 111/2013/TT-BTC, the basis for tax calculation on income from royalties is assessable income and tax rate.

Specifically, assessable income is the income exceeding 10 million VND under the copyright assignment contract, regardless of the number of payments or installments the taxpayer receives when assigning the rights to use copyright objects. In the case of multiple assignment contracts for the same copyright object, assessable income is the portion exceeding 10 million VND based on the total value of the contracts.

For cases where co-owners assign copyright, assessable income will be divided among the individual copyright owners. The allocation ratio is based on the ownership or usage certificate issued by the competent State authority.

The personal income tax rate for assigning copyright is 5%.

The assessable income is determined at the time the assignee pays the copyright royalties to the owner of the literary, artistic, or scientific work.

Personal income tax calculation method:

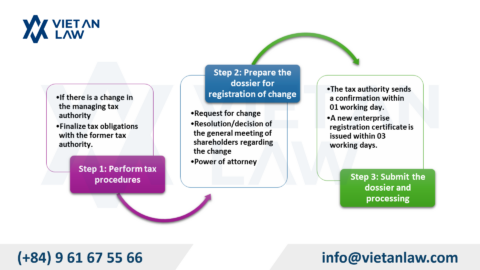

After receiving the assigned copyright, the organization or individual assignee must apply for the reissuance of the Copyright Registration Certificate.

The application dossier for reissuance of the Copyright Registration Certificate includes the following documents:

The application dossier is submitted to the Copyright Office of Vietnam under the Ministry of Culture, Sports, and Tourism at the following address: 33 Alley 294/2 Kim Ma, Ba Dinh District, Hanoi, phone number: (024)-3.823.6908.

Within 12 working days from the date of receipt of a complete and valid dossier, the competent authority shall issue a Copyright Registration Certificate to the assignee of the copyright.

Thus, when the copyright owner assigns the copyright to another organization or individual, they are required to pay personal income tax at a rate of 5%.

The above is the legal consultation provided by Viet An Law about tax for copyright assignment in Vietnam. Should you have any questions or need further assistance with matters related to intellectual property in general or copyright registration in particular, please feel free to contact Viet An Law for specific advice!

Updated: 8/2024