(Applied from 1.7.2024)

Decree 74/2024/ND-CP regulating the minimum wage for employees working under labor contracts in Vietnam, effective from July 1, 2024. It has replaced the previous Decree 38/2022/ND-CP and has demonstrated the State’s concern for the lives and needs of the majority of workers in today’s society. Below, Viet An Law Firm will present the legal provisions on statutory minimum wages in Vietnam applied from July 1, 2024.

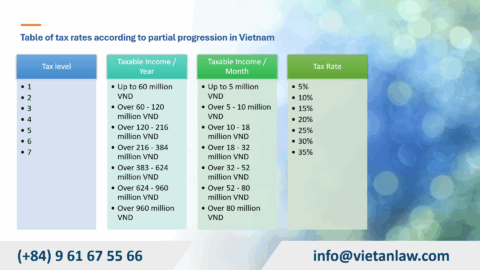

According to Article 3 of Decree 74/2024/ND-CP stipulates the minimum monthly and hourly wages for employees working for employers by region:

With this regulation, the regional minimum wage applied from July 1, 2024 for the region I will increase the highest at 280,000 VND/month, the lowest increase is 200,000 VND for the region IV. For regions II and III, the increase is 250,000 VND/month and 220,000 VND/month, respectively.

Correspondingly in this regulation, the minimum hourly wage increases from 1,000 VND to 1,300 VND in order from region IV to region I.

Thus, compared to the regional minimum wage applied before July 1, 2024 in Decree 38/2022/ND-CP, the current regional minimum wage has increased by 6%.

The minimum monthly wage is applied to monthly salary payment, i.e. in the case where the employee works enough normal working hours in a month and completes the agreed labor or work norms for the requirements of each job or position that the employee holds.

The minimum hourly wage is applied to hourly wages, i.e. that workers will receive wages according to the work for each hour worked or the title of the worker working in one hour and completing the agreed labor norm or work.

In case the Labor Contract does not stipulate a monthly or hourly salary, the converted salary will not be lower than the minimum monthly or hourly salary, which is stipulated as follows:

The monthly salary is calculated in one of the following ways:

Hourly wages are calculated in one of the following ways:

Subjects affected by changes in regional minimum wages include:

Note:

In case the agreed and committed salary payment contents are more beneficial to the employee, the more beneficial direction will continue to be applied.

For example: The salary regime for employees doing jobs or positions that require vocational training and education is at least 7% higher than the minimum wage, and the salary regime for employees doing jobs or positions with arduous, toxic, or dangerous working conditions is at least 5% higher; jobs or positions with especially arduous, toxic, or dangerous working conditions are at least 7% higher than the salary of jobs or positions of equivalent complexity, working under normal working conditions.

According to current regulations, the monthly salary for compulsory social insurance contributions must not be lower than the regional minimum wage at the time of contribution for normal employees. Therefore, when the minimum wage increases, the social insurance contribution will also increase and employees will have to declare the increase in social insurance to the social insurance agency.

Thus, to implement Decree 74/2024/ND-CP on increasing regional minimum wages, employers need to make a list of employees participating in social insurance, health insurance, unemployment insurance, occupational accident insurance, and occupational disease insurance (according to form D02-LT) on electronic records to report increases in social insurance, adjust the contribution level if the contribution level is lower than the regional minimum wage in 2024. The records are sent to the social insurance agency where the enterprise is managed. Currently, several social insurance agencies in districts, towns, and cities have notified enterprises about the deadline for a declaration to promptly implement in practice, protecting the rights of employees.

According to Article 5.3 of Decree 74/2024/ND-CP, employers are not allowed to arbitrarily eliminate or reduce wage regimes when employees work overtime, work at night, in-kind allowances, and other regimes as prescribed by labor law.

The above regulation will apply to all employers without distinction between state-owned or private enterprises.

Pursuant to Clause 3, Article 17 of Decree 12/2022/ND-CP, employers who pay employees less than the minimum wage prescribed by the Government shall be subject to the following penalties:

In addition to paying fines to state agencies, employers are also subject to remedial measures: Requiring employers to pay full wages plus interest on the amount of wages that are late or underpaid to employees calculated at the highest non-term deposit interest rate announced by state-owned commercial banks at the time of sanctioning the violation.

Note: The above provisions apply to individual employers. For organizational employers, the fine is twice the fine for individuals.

If you need advice on the statutory minimum wages in Vietnam in 2024, please contact Viet An Law Firm for the best support!

Update: 9/2024