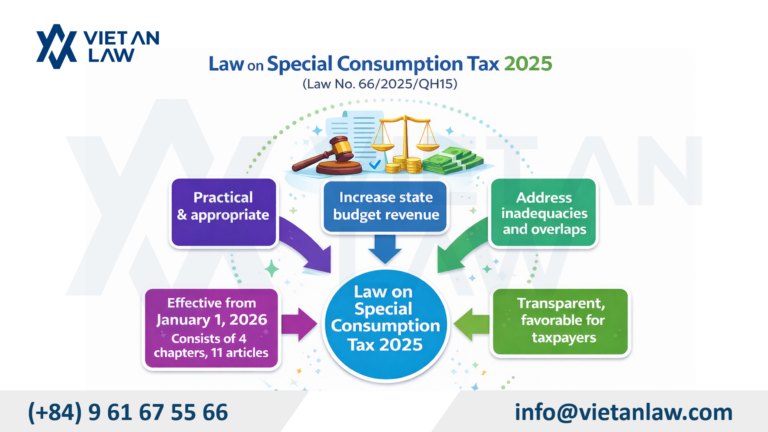

The Law on Special Consumption Tax 2025 was issued in the context of Vietnam’s economy entering a period of fiscal policy adjustment towards sustainability, transparency, and conformity with international integration commitments. With many important amendments and supplements, the Law not only aims to perfect the legal framework on special consumption tax but also aims to orient healthy production – consumption, control items having great impact on community health, the environment, and social order. Grasping the new contents of the Special Consumption Tax Law 2025 will help enterprises and taxpayers proactively comply with legal regulations, and simultaneously build appropriate business strategies in the coming period. In the article below, Viet An Law Firm will point out the new and outstanding points in this new tax Law.

Table of contents

Thus, it can be seen that expanding the tax base in the new Law reflects a selective approach to regulating consumption, in line with socio-economic realities, while contributing to protecting public health, the environment, and increasing sustainable revenue for the state budget.

The 2025 Law adds many more cases exempt from excise tax, such as:

Meanwhile, the 2008 Excise Tax Law, amended in 2014, only stipulated tax exemptions for exported goods, temporarily imported and re-exported goods, tax-exempt items, ambulances, or specialized vehicles based on certain old criteria, and has not been expanded as in the new law.

Expanding the scope of tax-exempt items in the new Law contributes to resolving practical difficulties, ensuring the rationality and flexibility of tax policy, while creating favorable conditions for production and business activities and being more in line with the objectives of state management in each period.

This is a completely new point in the 2025 Law. Previously, the 2008 Special Consumption Tax Law only stipulated that: The basis for calculating special consumption tax is the taxable price of taxable goods and services and the tax rate. The amount of special consumption tax payable is equal to the taxable price multiplied by the special consumption tax rate.

The 2025 Law stipulates two methods for calculating special consumption tax:

This creates a more flexible tool for tax management and aligns with international trends. At the same time, it enhances the efficiency of consumption regulation and increases the stability and transparency of state budget revenue.

Special Consumption Tax Law 2025 for the first time stipulates the application of an absolute tax on tobacco products, in addition to the percentage-based tax rate. Accordingly, cigarettes, cigars, and other tobacco products will be subject to an absolute tax rate specifically determined in stages, with a gradual increase from 2027 to 2031. Specifically:

Previously, the old law mainly calculated the excise tax on tobacco based on a percentage (%) of the tax rate without a mandatory absolute tax bracket.

The new regulations help address the situation where businesses adjust selling prices or taxable prices to a lower level in order to reduce their tax obligations. In addition, it contributes to controlling the consumption of products harmful to health, ensuring stable budget revenue, and aligning with modern tax management trends worldwide.

The 2025 law increases tax rates on:

The old law only had fixed tax rates (or increased periodically through amendments) but lacked a clear long-term roadmap like the new law.

Designing a tax increase roadmap directly in the law helps businesses proactively adapt, while limiting policy shocks and stabilizing the investment and business environment in the long term.

One of the next notable points is that the new law adds soft drinks with sugar content exceeding National Standards to the list of taxable items.

The old law did not include sugary soft drinks in the list of items subject to special consumption tax. However, in practice, the consumption of these products is increasing and has negative impacts on health, especially the risk of obesity and non-communicable diseases.

The 2025 Law standardizes regulations on tax refunds and deductions, such as:

These regulations are stricter and more in line with practical conditions compared to the old law, which was based on simpler cases for refunds and deductions, thereby limiting disputes and complaints about taxes. At the same time, these regulations ensure the legitimate rights of taxpayers and are consistent with the principles of modern tax administration.

Although the implementation details depend on the guiding documents, the 2025 Law emphasizes reforming tax collection procedures and processes towards greater transparency and simplicity to create a favorable environment for taxpayers.

Compared to the 2008 Special Consumption Tax Law, the new regulations represent a shift from a management mindset heavily focused on collection to a modern tax management model that is taxpayer-centered, encouraging self-awareness, transparency, and compliance with the law.

The above is legal advice from Viet An Law Firm regarding legal issues surrounding the Special Consumption Tax Law 2025: New rules & excise updates in Vietnam. If you have any related questions or require in-depth legal advice, please contact Viet An Law Firm for the best support.