Discover the essential social insurance book reissuance service in Vietnam, designed to streamline the process for individuals and businesses seeking to manage their social insurance records efficiently. The social insurance book is one of the important papers for social insurance participants, used to record the process of paying and enjoying social insurance regimes of participants. The social insurance book is issued to each employee when participating in compulsory social insurance and is the basis for settling social insurance regimes in accordance with the Law on Social Insurance. The information in the book includes working time, the process of paying and enjoying social insurance. Each employee is only granted and maintained a single insurance book. However, in the process of use, users cannot avoid the case of losing or losing the social insurance book and do not know how to apply for a new social insurance book. Viet An Tax Agent will help customers solve this problem, with the service of applying for re-issuance of social insurance books, has affirmed its position as a reliable and professional partner in supporting customers to solve problems related to social insurance books in a convenient and effective way.

Table of contents

The Social Insurance Book is an important document to record the entire process of paying and receiving social insurance benefits of participants. When participating in compulsory social insurance, each employee will be issued a social insurance book, which is a basic diploma to confirm and settle social insurance regimes according to the provisions of the Law on Social Insurance.

Important information in the book includes working time, the process of paying and receiving social insurance benefits. Most importantly, each employee only owns and manages a single social insurance book.

The social insurance book is the guarantee for the process of participating in social insurance and the basis for settling all social insurance regimes in accordance with the law. Each social insurance book is characterized by a separate and unique code, issued by the social insurance agency.

Based on the provisions of Clause 2, Article 46 of Decision 595/QD-BHXH, the social insurance book will be re-issued in case of loss or damage; add up; change of book number; full name, middle name; date of birth; and persons who have enjoyed one-time social insurance but have not yet paid unemployment insurance. If the Social Insurance book is damaged, the re-issuance process will include both the cover and the loose sheet of the Social Insurance book.

For procedures for re-issuance of social insurance books, according to the provisions of Clause 1, Article 27 of Decision 595/QD-BHXH, customers need to prepare a declaration of participation and adjustment of social insurance and health insurance information according to Form TK1-TS. This dossier will be submitted at the district-level Social Insurance agency where you participate in Social Insurance. The processing time shall not exceed 10 days from the date of receipt of a complete dossier as prescribed.

For cases where social insurance premiums are being paid, in order to carry out the procedures, employees and enterprises need to submit dossiers to the social insurance agency. The insurance agency will compare the documents with each other. If they are eligible and confirmed to be in the case of remaking the book but have not yet enjoyed the lump-sum allowance, they are eligible to remake the social insurance book.

A re-issuance dossier comprises:

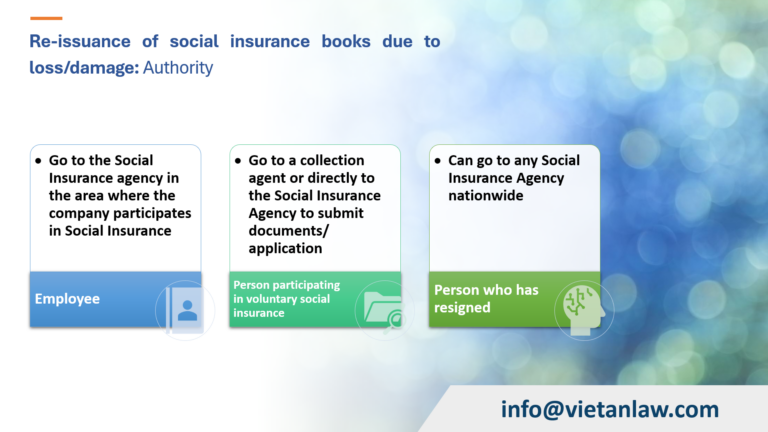

Where to submit the application:

Procedures for re-issuance:

A re-issuance dossier comprises:

Where to submit the application:

Procedures for re-issuance:

However, if there is no solid knowledge of the procedures for remaking the social insurance book, employees will struggle and face many difficulties in the process of carrying out procedures. On the side of Viet An Tax Agent, there is support for employees through the service of re-issuance of social insurance books.

With the accompanying complicated papers and records, many employees will have problems in the process of remaking the social insurance book. Viet An Tax Agent has a lot of experience in the process of making and settling documents and procedures related to social insurance. Together with a team of professional staff with many years of experience, we will provide maximum support for employees in the process of redoing social insurance books. The social insurance book re-issuance service was born to help employees avoid encountering risks in the process of making social insurance.

The dossier of application for re-issuance of the social insurance book will include the following documents:

The re-issuance of the social insurance book does not affect the benefits and all information about the right to enjoy benefits and related regulations is available on the portal. However, after re-issuance, there will be a few differences with the following first-time book:

If you have any difficulties or questions related to the social insurance book re-issuance service, please contact Viet An Tax Agent for the most specific advice.