E-commerce is a business line chosen by many investors in the era of information technology development. However, many foreign investors wonder what is the legal procedures for establishing an e-commerce service company, are the conditions for establishment different from domestic investors? To answer the above questions, Viet An Law Firm would like to provide the legal investment consultancy and procedure for clients to set up a company in Vietnam.

Table of contents

Foreign investors may set up an e-commerce service company and issue a business license when meeting the following conditions:

For foreign investors belonging to countries or territories participating in international treaties to which Vietnam is a contracting party to open the market for goods trading and activities directly related to the sale and purchase goods:

For foreign investors who do not belong to a country or territory to a treaty to which Vietnam is a signatory; For business services which are committed to open markets in international treaties to which Vietnam is a signatory:

The investor applies for an Investment Registration Certificate at the investment registration agency. A dossier of application for an investment certificate for electronic trading service includes the following documents:

Within 15 days after receiving a complete dossier, the investment registration agency shall grant an investment registration certificate; In case of refusal, it must be notified in writing to the investor, clearly stating the reason.

Investors shall submit their application for enterprise registration certificate through National Enterprise Registration Portal. The application includes the following documents:

Within 03 – 05 working days, if the application is valid and complete, the Department of Planning and Investment will issue the Enterprise Registration Certificate and publicize business registration information on the National Enterprise Registration Information Portal.

The Enterprise Law 2020 has removed the regulations on legal entity seals. Therefore, the Company can decide on its own whether or not to engrave the legal entity seal; at the same time, to have autonomy in the content, quantity, and use of the legal seal. In case there is a need to use a seal, the company will engrave the seal at the seal-making function.

Companies can authorize the implementation of the Law on Vietnam An insecticidal g this.

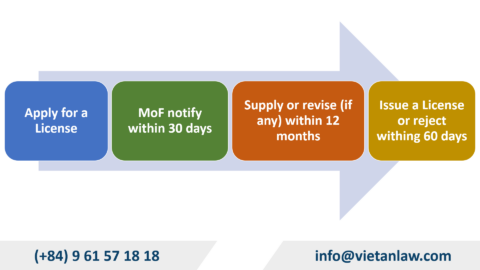

Under the provisions of Decree No. 09/2018 / ND-CP, a foreign-invested company wishing to operate an e-commerce service provider must have a business license. Accordingly, the Investor submits 02 sets of documents to the licensing agency. Records include:

Within 15 – 20 working days from the date of receipt of complete and valid dossiers, the licensing agency shall consult with the Ministry of Industry and Trade.

Within 15 days after receiving the dossier, the Ministry of Industry and Trade shall issue a written approval for the grant of a business license; In case of refusal, there must be a written reply clearly stating the reason.

Within 03 working days after receiving the written approval from the Ministry of Industry and Trade, the licensing agency issues the business license. In case the Ministry of Industry and Trade issues a written refusal, the licensing agency shall reply in writing, clearly stating the reason.

The goods are not allowed to trade on the e-commerce website.

In addition, when the company establishes an e-commerce service website, it is necessary to carry out the registration procedure for an e-commerce website under the law. Viet An Law Firm provides legal services related to foreign investment. If you have a need or have questions that need answers, please contact the company directly for advice and timely support.

Hanoi Head-office

#3rd Floor, 125 Hoang Ngan, Hoang Ngan Plaza, Trung Hoa, Cau Giay, Hanoi, Vietnam

Ho Chi Minh city office

Room 04.68 vs 04.70, 4th Floor, River Gate Residence, 151 – 155 Ben Van Don Street, District 4, HCM, Viet Nam

SPEAK TO OUR LAWYER

English speaking: (+84) 9 61 57 18 18 - Lawyer Dong Van Thuc ( Alex) (Zalo, Viber, Whatsapp)

Vietnamese speaking: (+84) 9 61 37 18 18 - Dr. Lawyer Do Thi Thu Ha (Zalo, Viber, Whatsapp)