E-commerce sales websites are online platforms established by merchants, organizations, or individuals to promote their commercial activities, sell goods, or provide services. With the rapid growth of e-commerce, the number of sales websites has significantly increased. However, a substantial number of websites have yet to comply with the mandatory notification requirements, thereby facing the risk of adverse legal consequences, directly affecting their business operations. Currently, the procedure for notifying a sales website has been streamlined and simplified, allowing merchants, organizations, and individuals to either complete the process directly or utilize third-party notification services. In the following article, Viet An Law will provide clients with detailed information about our comprehensive sale website notification service in Vietnam.

Table of contents

Currently, it is mandatory for merchants, organizations, or individuals engaged in business activities via a sales website to notify the Ministry of Industry and Trade of their e-commerce sales website. Complying with the sales website notification requirement brings certain benefits to businesses, including the following:

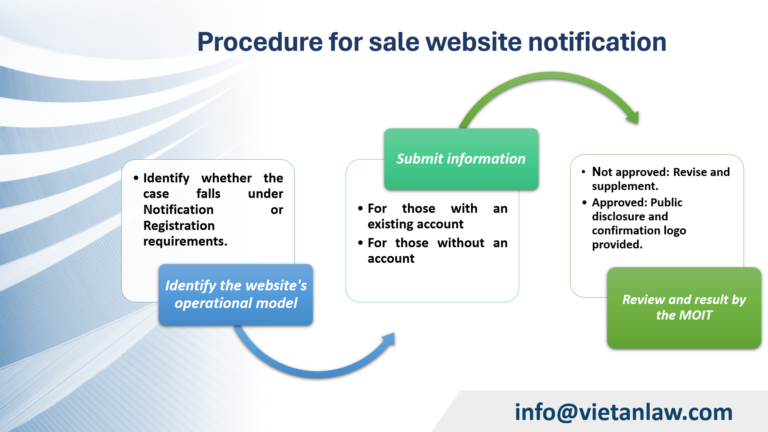

Merchants, organizations, or individuals can either conduct their own research or use the services of Viet An Law to determine whether their website falls under the category requiring “Notification” or “Registration” with the Ministry of Industry and Trade.

For sales websites, businesses, organizations, or individuals that own this website must notify the Ministry of Industry and Trade through its online portal at: http://online.gov.vn.

Merchants, organizations, or individuals using Viet An Law’s services will receive assistance in registering an account on the homepage www.online.gov.vn by following these steps:

Step 1: Submit information according to the form: Viet An Law selects the appropriate entity to register for an account and proceed with the notification process based on the type of organization:

Step 2: Receive feedback on account registration via email: The Ministry of Industry and Trade will review the account registration information within 3 working days from the receipt of the application and will send feedback via email:

Upon request from merchants, organizations, or individuals, Viet An Law will log into the system (using the merchant’s or individual’s tax code as the account), input the website information for notification, and attach the necessary documents. Merchants, organizations, or individuals must provide Viet An Law with the information needed for the notification process.

Content of notification information:

Documents required to be attached include:

Note: When conducting the sale website notification service in Vietnam, the submission of documents is done online, and all files must be in one of the following formats: jpg, png, jpeg, doc, docx, pdf, rar, zip, xls, xlsx.

After Viet An Law has completed the application and submitted it through the portal, the status of the application will show as “Pending Review.” The Department of E-commerce and Digital Economy (under the Ministry of Industry and Trade) is responsible for reviewing and approving the application. Within 3 working days, the Ministry of Industry and Trade will send an email to the website owner to inform them of the registration results.

If the application requires additional information or corrections, Viet An Law will assist clients in completing and resubmitting the application as necessary.

If the application is approved, the Ministry of Industry and Trade will proceed with the following actions:

Note: After successfully notifying the Ministry of Industry and Trade, the merchant, organization, or individual owning the website is responsible for placing this logo at the footer of the notified sales e-commerce website. Merchants, organizations, or individuals may request support from a website service provider (partner of their choice) to insert the code into the website interface (updating the logo and link on the website), thereby enhancing credibility and increasing customer trust.

After utilizing sales website notification service of Viet An Law, clients can verify the completion of the notification process through the following methods:

As analyzed above, once the procedure is completed, the Ministry of Industry and Trade is responsible for sending the merchant, organization, or individual a link presented in the form of a logo, indicating that the website has been successfully notified to the Ministry. Therefore, to confirm the completion of the procedure, the confirmation logo issued by the Ministry of Industry and Trade must be present.

Note: The logo is valid and legally recognized if clicking on it redirects to a link that displays information about the website owner on the homepage of the Ministry of Industry and Trade’s E-commerce Management Portal.

To verify the completion of the website notification procedure, clients can search for information in the ‘notified websites’ section on the homepage of the Ministry of Industry and Trade’s E-commerce Management Portal at http://online.gov.vn. If the website has been successfully notified, the website address and relevant information regarding the website owner will be fully displayed in the Ministry’s completed notification database.

The above is Viet An’s advice regarding its comprehensive sale website notification service. Should you have any questions or require further assistance, please feel free to contact to Viet An Law Firm for the best support!

Updated: 8/2024