When an FDI company decides to expand its operations or change its business strategy, it is understandable that it would relocate its headquarters to a more potential province or city. However, the process of implementing this change is not simple and requires the enterprise to have a clear understanding of the relevant legal regulations. The following article by Viet An Law will help enterprises better understand the necessary procedures for relocation of headquarters address of FDI company to another province in Vietnam to ensure that the process of relocating the headquarters is smooth and in compliance with legal regulations.

Table of contents

Under the Enterprise Law 2020, the headquarters of an FDI company is the company’s contact point in Vietnam. It has a specified address. Including house number; alley; lane; street; road or village; hamlet; commune, ward, town; district, county, town, provincial city; province, centrally run city. Telephone number, fax number, and email (if any) can be added.

FDI companies can change their headquarters when needed. Tax issues related to FDI companies are managed by the Tax Department. Therefore, companies do not have to confirm their tax obligations like domestic companies when they want to relocate their headquarters to another district. FDI companies are only required to close the transfer tax when they want to relocate their headquarters to another province.

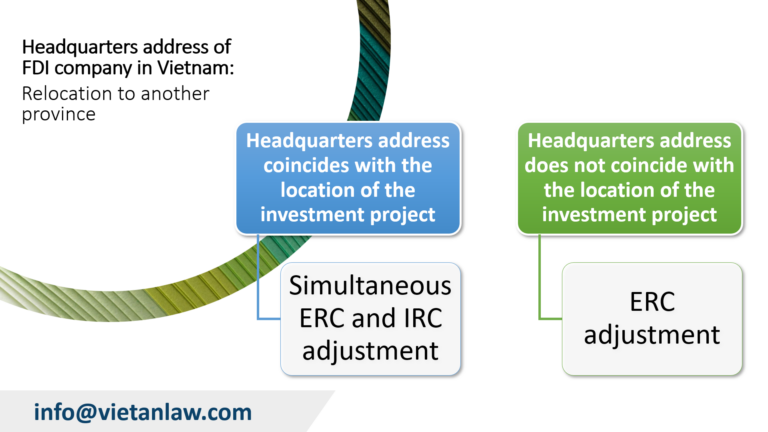

When an FDI company needs to change its headquarters, it should pay attention to one of the following two cases:

Changing the headquarters address and simultaneously changing the project implementation location of the company recorded on the Investment Registration Certificate, the company must carry out procedures to adjust the Investment Registration Certificate and procedures to change the Enterprise Registration Certificate.

Only changing the company’s headquarters address without changing the project implementation location, the company only needs to carry out procedures to change enterprise registration (in the case of an FDI company that has separated its Investment Registration Certificate and Enterprise Registration Certificate).

Notes:

Step 1: The enterprise carries out the procedure to change the investment registration certificate at the investment registration management agency of the Department of Planning and Investment of the province/city where the enterprise is headquartered or the Industrial Park Management Board if the enterprise’s headquarters is located in an Industrial Park. (Not applicable to enterprises in Case 2).

Step 2: The enterprise carries out the procedure for changing enterprise registration at the Business Registration Office – Department of Planning and Investment of the province/city where the enterprise is located.

Step 3: Post Enterprise registration information on the National Business Registration Portal.

Step 4: Reissue the legal seal according to the new information (In case the company has not yet reissued according to the new regulations or the seal shows the company’s old district headquarters)

Step 5: Register for adjustment of the Investment Registration Certificate (if the head office address is also the location of the investment project);

Completion time: from 10-15 working days.

For projects that require an investment policy decision, before carrying out procedures to change the content of the investment registration certificate, the enterprise must complete the procedures to change the investment policy decision.

In case of relocating to another district/province, the enterprise needs to complete the tax closing procedure for changing district or province before proceeding to change the enterprise registration certificate and investment registration certificate.

The enterprise applies to the old tax authority. After receiving the complete application, the old tax authority will issue a notice of the enterprise’s transfer to the tax authority (Form 09-MST issued with Circular No. 105/2020/TT-BTC). The enterprise then submits the notice to the Department of Planning and Investment and continues the process of relocating the company’s headquarters address.

Above is the advice of Viet An Law on the relocation of the headquarters address to another province of the FDI company in Vietnam. If you have any related questions or need support, please contact Viet An Law for the best support!

Update: 9/2024