Peru is currently an attractive investment rendezvous destination not to be missed by investors. This South American country owns an economy that is on a stable development trajectory, besides owning abundant natural resources, especially minerals and energy. Peru currently has potential key economic sectors such as agriculture, fisheries, textiles, and tourism, providing diverse opportunities for investors from all over the world. The Peruvian government is also constantly improving the business environment, introducing many preferential policies and actively participating in important international trade agreements, creating an open and favorable legal corridor for foreign capital flows. The procedure for establishing a company in Peru will become fast, time-saving and cost-saving if investors understand the process, Viet An Law would like to provide some information about the procedure for establishing a company in Switzerland through the article below.

Table of contents

The choice of the right type of company is a decision that directly affects the organizational structure, legal and tax obligations of the enterprise in the future. In Peru, foreign investors often prefer Sociedad Anónima Cerrada (S.A.C.) for small and medium-sized projects due to its flexibility and simple management, or Sociedad Anónima (S.A.) for larger scales.

For foreign investors or directors who do not plan to reside permanently in Peru, it is mandatory to appoint a legal representative in the country. This representative (usually a Peruvian citizen or a foreigner who already has a valid residence card – Carné de Extranjería) will act as a legal bridge, on behalf of the non-resident investors to carry out all necessary procedures related to the establishment of the company and ensure compliance with Peruvian legal regulations in the initial stage.

The authorization of the representative is done through a Power of Attorney (POA). This POA needs to be consular legalized at the Peruvian Embassy or Consulate in the investor’s country. If the investor’s country is a member of the Hague Convention on Consular Legalization (Apostille Convention), the issuance of an Apostille stamp replaces the consular legalization step. After having a legalized POA or Apostille, this document needs to be notarized into Spanish for legal validity.

The current Enterprise Law does not stipulate a mandatory minimum charter capital for popular types such as S.A.C. or S.A. However, investors still need to determine a reasonable charter capital, which is sufficient for the company to have initial costs and maintain business operations.

The condition for naming a company is unique and does not duplicate or cause confusion with any business that has been previously registered in Peru.

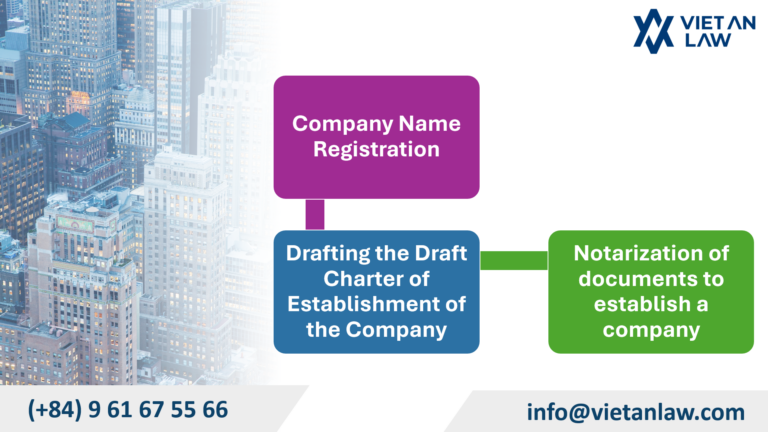

After choosing a company name, you need to carry out the procedure for registering a company name reservation at the Peruvian National Public Registry (Superintendencia Nacional de los Registros Públicos – SUNARP). When your request to apply for a name reservation is approved, SUNARP will issue you a Name Reservation Certificate (Certificado de Reserva de Nombre). Normally, this Name Reservation Certificate is valid for 30 days.

The draft charter of the company is a document that serves as a draft for the company’s charter. This document must be drafted to ensure compliance with the provisions of the Peruvian Enterprise Law. The content includes all basic and detailed information about the company to be established such as:

After drafting, you need to bring all the documents to the notary office. They will conduct a review of the contents of the document, verify the identity of the signatories (including the founding shareholders or duly authorized representatives on their behalf), and witness the signing of the document. After completion, the Notary will formalize the Draft Charter of Establishment into a Public Document.

After notarizing the documents, you need to go through the procedure at the National Public Registry of Peru (Superintendencia Nacional de los Registros Públicos – SUNARP).

Submission of Establishment Documents

The company’s legal representative (or authorized attorney) will proceed to submit the original documents along with the accompanying documents (if required).

After receiving the application, the registrars at SUNARP will conduct a review and appraisal (calificación registral) of the validity of the application. If the dossier is validated and there is no request for amendment, SUNARP will proceed to record the incorporation of the company in the Register of Entities. Upon completion of the bookkeeping, SUNARP will issue a Certificate of Incorporation of the Company, commonly known as the “Testimonio de la Escritura Pública de Constitución Social”.