For foreign capital companies, after being granted an Investment Registration Certificate, foreign investors must open a foreign direct investment account (capital transfer account) at the Bank and contribute capital through that account within the time limit prescribed by the Enterprise Law and in the Investment Registration Certificate.

The timely contribution of capital is considered extremely important because if it overdue according to the time limit for capital contribution specified on the Investment Registration Certificate, the Bank will not allow to receive investment capital, the company will not be able to receive investment capital to conduct operations. However, being able to contribute capital on time depends on many factors and does not always happen on time. At this time, foreign investors are required to carry out procedures for extending the time limit for contributing investment capital (contents are recorded on the Investment Registration Certificate) or procedures for adjusting the Investment Registration Certificate. In this article, Viet An Law Firm would like to give some legal opinions related to the procedures for extension of capital contribution of foreign capital companies as follows:

Investors should note the regulations on capital contribution as follows:

On the Investment Registration Certificate of the enterprise, there are criteria of Total investment capital, which includes contributed capital and other types as registered. For capital contributions in accordance with the Law on Enterprises, investors must contribute in full within 90 days from the date of issuance of the Certificate of Business Registration.

The total investment capital on the Investment Registration Certificate shall be transferred from abroad to the investment capital account in accordance with the time limit for capital contribution recorded in the Investment Registration Certificate. If the time limit stated on the Investment Registration Certificate is exceeded, the bank opening the capital account will refuse to accept the capital transferred to the account. Thus, at this time, in order to transfer capital to an investment account, investors need to carry out procedures for adjusting the Investment Registration Certificate, extending the time limit for capital contribution.

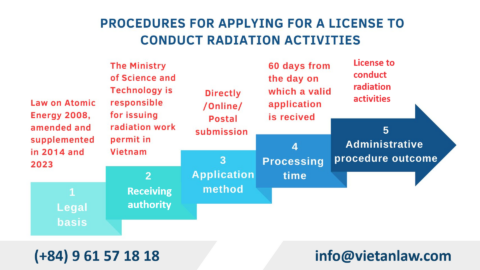

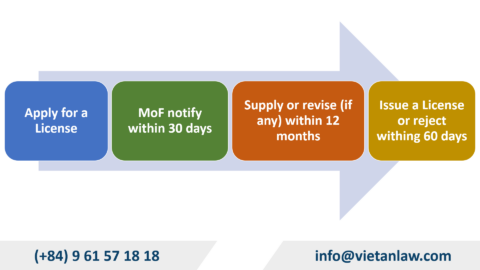

Extension of the time limit for capital contribution is the adjustment of the Investment Registration Certificate, capital contribution progress item. The procedure is as follows:

A dossier of adjustment of the Investment Registration Certificate includes:

Within 7 working days, the Department of Planning and Investment will examine the dossier and issue a notice of transfer of the dossier to the Inspection Department of the Department for work related to the failure to comply with the capital contribution schedule.

After the application is transferred to the Inspection Department, the investor waits to receive the Job Offer. When coming to work, investors need to prepare documents as follows:

The person competent to sanction administrative violations must issue a decision to sanction administrative violations within 07 days from the date of making a record of administrative violations.

According to Article 13, Decree 50/2016/ND-CP stipulates violations of regulations on investment activities in Vietnam. Depending on the profile and seriousness of the violation, investors may be subject to the following penalties:

Based on the explanation dossier and consideration of the violating contents, the inspection agency will decide on the appropriate fine.

After receiving the Decision on sanctioning administrative violations, the investor goes to the State Treasury to pay the fine and provide back documents proving the payment of the fine so that the Inspection Department can complete the dossier and transfer it back to the Foreign Economic Department for further processing of the dossier of extension of the time limit for capital contribution.

The time limit for capital contribution in a foreign investment company is specified in the Enterprise Law and on the Investment Registration Certificate.

According to the Law on Enterprises, the time limit for capital contribution in a newly established foreign investment company is 90 days from the date of issuance of the enterprise registration certificate of the economic organization implementing the project.

Before the expiry of investment capital contribution, investors need to submit an application for extension of the time limit for capital contribution. In case of expiry of capital contribution, the extended investor may not be approved by the investment registration agency and must carry out inspection and sanction procedures for failure to comply with the project implementation schedule and failure to adjust the investment registration certificate.

Hanoi Head-office

#3rd Floor, 125 Hoang Ngan, Hoang Ngan Plaza, Trung Hoa, Cau Giay, Hanoi, Vietnam

Ho Chi Minh city office

Room 04.68 vs 04.70, 4th Floor, River Gate Residence, 151 – 155 Ben Van Don Street, District 4, HCM, Viet Nam

SPEAK TO OUR LAWYER

English speaking: (+84) 9 61 57 18 18 - Lawyer Dong Van Thuc ( Alex) (Zalo, Viber, Whatsapp)

Vietnamese speaking: (+84) 9 61 37 18 18 - Dr. Lawyer Do Thi Thu Ha (Zalo, Viber, Whatsapp)