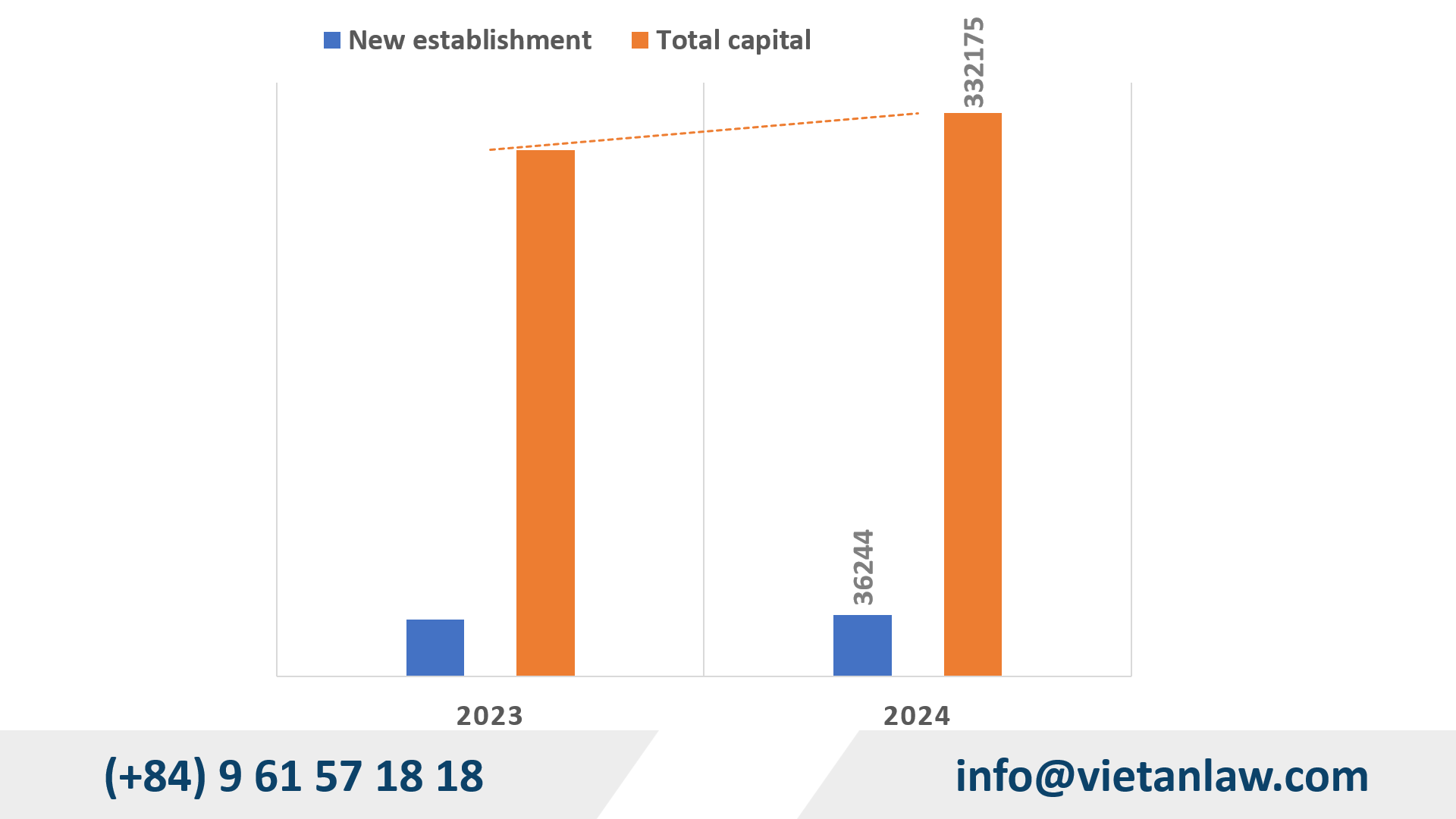

Key procedures after establishing a JSC company in Vietnam will be navigating in the next steps of this article. According to information from the Department of Business Registration Management (Ministry of Planning and Investment), 36,244 new enterprises were established in the first quarter of 2024 with a total registered charter capital of 332,175 billion VND. The above data shows growth momentum in the field of business establishment in 2024, specifically a 6.9% increase in the number of businesses and a 7.0% increase in newly registered capital compared to the same period in 2023.

However, besides the positive signs, many businesses also encounter difficulties and challenges in meeting regulations on capital, facilities, personnel, and post-establishment procedures to meet the requirements required under current Vietnamese law before going into official operation. This leads to the situation of many businesses being administratively sanctioned and consuming processing time for businesses, especially joint stock companies with complex internal structures and conditions.

Understanding that practical need, Viet An Tax Agent with many years of experience in the market in the field of Law & Accounting – Tax for businesses in Vietnam is always ready to accompany and support businesses from inception and during future operations. The joint stock company will be guided in detail on the steps to carry out documents and legal procedures related to its operations after receiving the Business Registration Certificate based on the professional knowledge and experience of the Joint Stock Company by specialists and lawyers Viet An Law Firm – Tax Agent. It is noted to complete immediately post establishment process of JSC company in Vietnam include:

Table of contents

According to the current regulations of the Enterprise Law 2020, the maximum time limit for founding shareholders in a joint stock company to complete procedures for capital contribution and establishment registration recorded in the dossier is 90 days from the date of issuance of the Enterprise Registration Certificate.

This period may be shorter according to the commitment between the founding shareholders recorded in the company charter / share purchase registration contract and in the company establishment documents. In this case, shareholders will have to make payment for shares registered to purchase according to the company charter or contract. Therefore, founding shareholders need to understand clearly to properly fulfill their obligation to contribute capital to the company’s account after being granted an Enterprise Registration Certificate. The Board of Directors is also responsible for supervising and urging full and timely payment of shares that shareholders have registered to purchase.

Not paid in full

Partial payment

Pursuant to Article 3.8 of Decree 139/2016/ND-CP on license fees amended and supplemented by Decree 22/2020/ND-CP, businesses will be exempted from license fees in the first year of establishment or production and business activities. Regulations on fee exemption apply to dependent units established in the same year.

Enterprises can carry out procedures to declare license fees from the date of establishment or the date of commencement of production and business activities to the directly managing tax agency, the declaration deadline is before January 30 of the consecutive year adjacent to the year of establishment.

For example: A joint stock company established in July 2024 will be exempted from license fees in 2024. This JSC company will begin paying license tax for 2025 onwards according to the above deadline.

License fee rates are prescribed as follows:

The company’s sign needs to be mounted at the address where the company’s headquarters, branches, representative offices, and business locations are located.

For content requirements, company signs will usually be A4 sized, use eye-catching colors and must be placed at easy positions to observe and recognizable. The sign must be written in Vietnamese characters and fully display basic information: name, tax code, address, contact phone number or business license code (if required by specialized law) of the business.

The joint stock company will have to engrave the corporate seal after receiving the Enterprise Registration Certificate. The management and engraving of the seal according to any form is decided and implemented by the company itself, which can be in the form of internal regulations without being managed by state agencies (except for other cases prescribed by law). The Board of Directors will hold a meeting, agree and make decisions on the number, form, content, sample, management and use of the seal.

According to current accounting laws, when established, businesses must register to use digital signatures. A digital signature can be understood as an encrypted device used instead of the signature and seal of the legal representative to sign a declaration or other operations to identify all operations as belonging to the enterprise. Digital signatures are often used in e-commerce transactions such as: issuing VAT invoices, declaring and paying taxes, completing insurance procedures, customs procedures… Newly established JSC company can adopt Viet An Law to get preferential rates for using digital signatures and the best support services.

Opening a bank account for a business is done by the legal representative of the business. Documents to prepare for opening a bank account according to the requirements of each bank, usually include:

Depending on each bank, businesses may be required to bring their business seal when checking in and request other documents. Businesses can open an account themselves or authorize Viet An Law to assist in the implementation.

Note:

After establishment, if an enterprise has business activities that record revenue, it is required to issue invoices.

According to current new regulations, electronic invoice registration has simplified administrative procedures. Therefore, after contacting the invoice supplier, the enterprise will declare the use of electronic invoices right in the establishment registration dossier or make a notice of registration to use electronic invoices in case it is not declared in the establishment documents. The tax authority will send an email notification of acceptance so that the business can issue invoices. The specific implementation process is as follows:

According to Clause 3 and Clause 4, Article 13 of Circular No. 45/2013/TT-BTC guiding on methods of depreciation of fixed assets:

Note:

The company only has to notify the tax authority once. When new assets arise, no additional notification is required. Therefore, businesses need to register to the situation when fixed assets arise, depreciation is automatically deducted according to regulations.

Tax authorities may inspect newly established businesses or have just submitted registration documents to use electronic invoices, so businesses should prepare documents according to the following contents if tax authorities come to inspect:

Is it mandatory to contribute charter capital to a joint stock company by bank transfer?

According to the law, individuals establishing a company can choose to contribute charter capital in cash or transfer money to the company’s account. Companies contributing capital to a new company, are required to contribute capital to establish the company by transferring money to the newly established company account.

Is it mandatory to open an account for a joint stock company?

Currently, there are no regulations forcing businesses to open bank accounts. However, company accounts play a vital role in paying electronic license taxes for the company. Using a company bank account shows the professionalism of the business and makes it more convenient to make payments and receive payments from customers. Furthermore, valid proof for invoices for each purchase of goods and services with a payment value of over 20 million VND (one of the conditions for deducting expenses when determining taxable income or deduction conditions of VAT). Once they have a bank account, businesses can withdraw cash at the bank.

Please contact Viet An Tax Agent at hotline: (+84) 988.856.708 for advice, support and answers to all questions about post establishment process of JSC company in Vietnam!