Personal income tax is an indispensable part that employees in Vietnam must pay. With the constant changes in tax law and the complexity of regulations, calculating and paying taxes yourself can cause many difficulties. Therefore, tax consulting services were born, helping taxpayers reduce the burden. The following article of Viet An Law will help clients consult on personal income tax consulting in Vietnam to ensure clients comply with the law and optimize personal benefits.

Table of contents

Pursuant to Article 2 of the Law on Personal Income Tax 2007 (as amended and supplemented in 2014), the subjects who must pay personal income tax are resident individuals with taxable income arising within and outside the territory of Vietnam and non-resident individuals with taxable income arising within the territory of Vietnam. Specifically, a resident individual is a person who meets one of the following conditions:

Pursuant to Article 3 of the Law on Personal Income Tax 2007 (as amended and supplemented in 2014), subjects must pay personal income tax when having the following income:

This tax calculation formula applies to employees with labor contracts of 03 months or more.

| Personal Income Tax payable = Taxable income x Tax rate |

| Taxable income = Taxable income – Deductions |

| Taxable income = Gross income – Exemptions |

Deductions include:

Personal income tax rates on income from business, salaries, and wages are applied according to the progressive tax schedule, specifically as follows:

| Tax level | Taxable income/year (million VND) |

Taxable income/month (million VND) |

Tax rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Above 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

According to Point i, Clause 1, Article 25 of Circular 111/2013/TT-BTC, individuals who do not sign a labor contract or sign a labor contract for less than 3 months but have income from salary or wages of 2 million VND or more each time must pay tax at a rate of 10%, except in cases where they make a commitment according to Form 08/CK-TNCN if eligible.

The tax payable is calculated as follows:

|

Personal income tax payable = 10% x Total income before payment |

Pursuant to Article 18 of Circular 111/2013/TT-BTC, personal income tax on income from salaries and wages of non-resident individuals is determined as follows:

|

Personal income tax payable = Taxable income from salary, wages x Tax rate (20%) |

In which, taxable income from salaries and wages of non-resident individuals is determined as for taxable income from salaries and wages of resident individuals according to the guidance in Clause 2, Article 8 of Circular 111/2013/TT-BTC.

Taxable income from capital transfer is determined by the selling price minus the purchase price and reasonable expenses related to generating income from capital transfer.

|

Personal income tax payable = Selling price – (Purchase price + Related expenses) |

The time to calculate personal income tax is the time of income payment.

There are 2 methods of calculating tax:

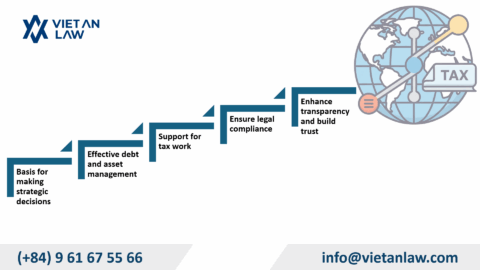

With many years of experience in the field of tax consulting, Viet An Law has helped thousands of clients successfully resolve issues related to personal income tax. Together with a team of experienced experts with deep knowledge of tax law, we are committed to providing clients with the most professional, effective and dedicated personal income tax consulting services.

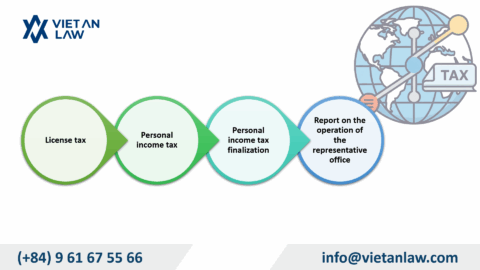

Viet An Law’s PIT tax services include without limitation of following tasks:

If in the year you have had many other businesses, whether at the same time or not at the same time, please contact the units that have paid your income to apply for the following documents: certificate of PIT tax withholding, income confirmation letter, dependent deduction registration information. After receiving all the above documents, you can send them to us. Viet An Tax Agent will receive the information and notify you of the results after checking the provided data. We commit to accompany and support the procedure until you complete the procedure.

For any difficulties or problems related to personal income tax consulting in Vietnam, please contact Viet An Law Firm for advice!