The National Assembly has passed the Law amending and supplementing a number of articles of the Law on Enterprises, bringing about important changes to perfect the legal framework for business activities in Vietnam. This amended and supplemented Law will officially take effect from July 1, 2025, with which the provisions on legal representatives are given special attention, ensuring transparency, responsibility, and efficiency in business management. Legal representatives play a key role in representing enterprises before law enforcement agencies, business partners, and performing legal obligations. Viet An Law, with nearly 20 years of experience, is proud to be a unit that accompanies enterprises in consulting and implementing legal procedures related to the provisions on legal representatives under Vietnam Law on Enterprise 2025, helping enterprises operate in accordance with regulations and protect legitimate interests.

Table of contents

Pursuant to Clause 1, Article 12 of the Law on Enterprises 2020 (amended and supplemented in 2025), the legal representative of an enterprise is an individual authorized to exercise the rights and obligations arising from the enterprise’s transactions. This role includes representing the enterprise as a person requesting settlement of civil matters, plaintiff, defendant, person with related rights and obligations before the Arbitration Court, and exercising other rights and obligations as prescribed by law. This is an important position, acting as a bridge between the enterprise and external agencies and organizations, ensuring that the enterprise operates legally and effectively.

Legal representatives under Vietnam Law on Enterprise 2025 emphasize transparency and accountability, making it easier for enterprises to identify who is responsible for legal transactions and activities. This is especially important in the context of increasingly complex business transactions requiring a high level of professionalism.

Pursuant to Clause 2 and Clause 3, Article 12 of the Law on Enterprises 2020 (amended and supplemented in 2025), limited liability companies and joint stock companies have the right to freely decide on the number of legal representatives, which can be one or more people. The company charter will specify the number, management titles, as well as the rights and obligations of each representative. Enterprises must ensure that there is always at least one legal representative residing in Vietnam.

In case an enterprise has more than one legal representative, if the Company Charter does not clearly stipulate the division of rights and obligations, each representative is considered to have full authority to represent the enterprise before third parties and is jointly liable for damages caused to the enterprise according to the provisions of civil law and other relevant regulations. This provision helps ensure flexibility but also places high demands on clarity in the Company Charter.

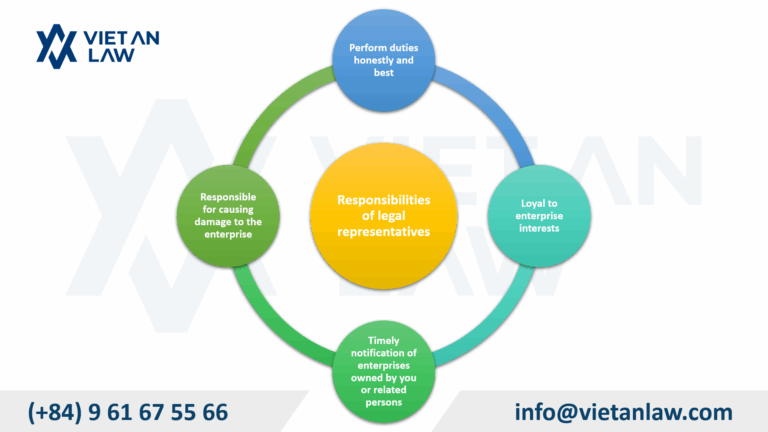

Pursuant to Clause 1 and Clause 2, Article 13 of the Law on Enterprise 2020 (amended and supplemented in 2025), the legal representative is responsible for performing the assigned rights and obligations honestly, carefully, and to the best of his/her ability to protect the legitimate interests of the enterprise. Specifically, the main responsibilities include:

These provisions in the Law on Enterprise 2025 emphasize the personal responsibility of the representative to ensure transparency and protect the interests of the enterprise as well as related parties.

Pursuant to Clause 5, Article 12 and Clause 1, Article 101 of the Law on Enterprises 2020 (amended and supplemented in 2025), to become a legal representative, an individual must meet specific conditions and standards. This person must not fall into prohibited cases, such as:

These standards ensure that legal representatives have the capacity and qualifications to perform their duties effectively and in compliance with the law.

Pursuant to Article 14 of the Law on Enterprises 2020 (amended and supplemented in 2025), an owner, member, or shareholder that is an organization may authorize an individual to act as a legal representative. This authorization must be made in writing, and the authorized individual must meet the prescribed standards and conditions, including not being a prohibited subject under Clause 2, Article 17, and other standards prescribed by the Company Charter. The authorization document must include information such as the name, enterprise code, head office address of the organization, number of representatives, ownership ratio, and personal information of the authorized person.

This provision gives organizations more flexibility in choosing their representatives, while ensuring that the authorized person has the capacity to fulfil legal obligations.

Pursuant to Clause 5 and Clause 6, Article 12, Clause 5 and Clause 6, Article 26 of the Law on Enterprises 2020 (amended and supplemented in 2025), when there is a change in the legal representative, the enterprise must carry out the change registration procedure with the business registration authority within 03 working days from the date of receipt of the dossier according to Decree 168/2025/ND-CP of the Government. This procedure can be carried out via the electronic information network, helping to simplify administrative procedures and save time for the enterprise. The change of legal representative must be carried out in accordance with regulations to ensure the legality and continuity of the enterprise’s operations.

Pursuant to Article 54, Article 137, Article 184, and Article 190 of the Enterprise Law 2020 (amended and supplemented in 2025), regulations on legal representatives are specifically adjusted for each type of enterprise, including:

These regulations help clearly define the roles and responsibilities of legal representatives in each type of enterprise, ensuring consistency and transparency.

Pursuant to Clause 5, Article 25 of the Law on Enterprise 2020 (amended and supplemented in 2025), one of the highlights of the Law on Enterprise 2025 is the provision on the list of beneficial owners. This list includes information such as full name, date of birth, nationality, ethnicity, gender, contact address, ownership ratio or controlling rights, and information on legal documents of the beneficial owner. This provision aims to increase transparency in business management, especially in international transactions and anti-money laundering.

The provisions on representatives under the Law on Enterprise 2025 play an important role in ensuring that business operations are transparent, legal, and effective. However, with changes in legal policies taking effect from July 1, 2025, businesses may face many challenges in adapting and complying. To ensure proper operation and protect legitimate interests, businesses need support from experienced legal experts.

Viet An Law, with a team of experts with profound knowledge of the Law on Enterprise, is ready to accompany enterprises in consulting, carrying out registration procedures, changing legal representatives, and resolving related legal issues according to regulations on legal representatives under the Vietnam Law on Enterprise 2025. Please contact Viet An Law for the best support!