When participating in international commercial transactions, it is crucial to ensure the accurate and lawful establishment and execution of contractual terms. Contracts involving foreign elements in sales transactions entail a multitude of considerations that extend beyond the mere exchange of goods or services. This complexity arises due to the significant disparity in legal frameworks among nations and the lack of universal participation in international agreements. To protect their interests and reduce the risk of conflicts, the parties involved in such transactions should utilize specialized legal knowledge. The parties involved in such transactions cannot overstate the necessity of legal consulting for international sale of goods contract. The following article, presented by Viet An Law, will elucidate the legal consulting for international sale of goods contract in Vietnam.

Table of contents

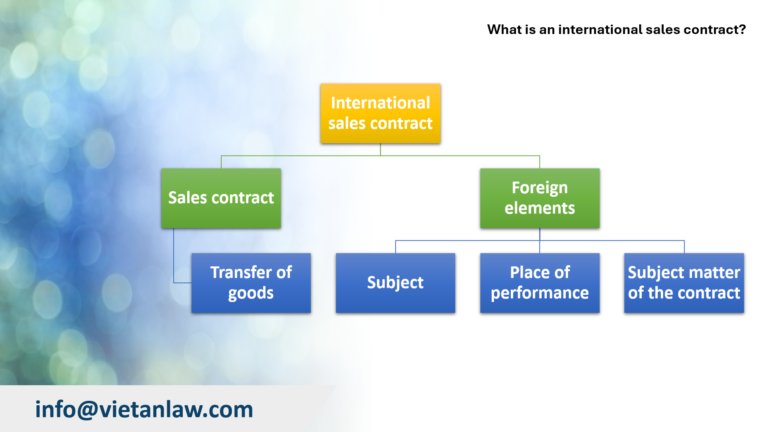

As of now, there are no official legal documents in Vietnamese law that establish the criteria for an international sales contract. Nevertheless, this concept can be comprehended using two key components, namely the “sales contract” and “foreign elements.”

As per the stipulation in Article 385 of the Civil Code 2015: “a contract is defined as an agreement between parties to establish, modify, or terminate civil rights and obligations”.

When two parties desire to validate their rights and obligations mutually, they do so by executing a contract. The parties have reached an agreement regarding the terms stipulated in the contract and are jointly responsible for its establishment. A sales contract is classified as a form of contract as well.

Consequently, a sales contract constitutes an agreement between the involved parties, in which the seller assumes the responsibility of delivering the goods, transferring ownership to the buyer, and receiving payment.

Under Article 663 of the Civil Code, civil relations involving foreign elements can be classified into the following categories:

In summary, an international sales contract can be defined as a contract that involves a foreign element in its execution.

Under Article 398 of the Civil Code 2015, the components of a civil contract may comprise:

The same article also provides that the parties may agree on the content of the contract. Therefore, the above provisions suggest the parties when establishing a contract.

For an international sales contract, though not mandatory, it is important to specify certain provisions, such as clauses related to transferring ownership of goods, the time of risk transfer, applicable law, the dispute resolution body, or arbitration agreements.

The contract may specify details such as the time, location, and method of delivery, among others. Contracts with foreign elements often involve the transportation of goods across customs borders or national borders between different countries.

Vietnamese law requires that international sales contracts be in writing or another legally equivalent form. Forms equivalent to written documents include telegrams, telex, fax, data messages (a data message is information created, sent, received, and stored electronically or by other means as stipulated by law) (Clause 2, Article 27, Clause 15, Article 3 of the Commercial Law 2005).

However, sometimes, Vietnamese law requires that, besides being in writing, competent state authorities must also register or approve international sales contracts to be effective (such as contracts for transferring industrial property rights with foreign elements).

An international sales contract must meet both substantive and formal requirements to be legally binding on the parties. However, each country has its own laws governing sales contracts, which can lead to situations where the same contract is regulated differently in different countries. Therefore, when entering into an international sales contract, it is crucial to determine which legal document will govern the contract’s content.

In the Vietnamese legal system, there are many regulatory documents, such as the Civil Code, the Commercial Law, the Investment Law, and others. There are sub-law documents like Government Decrees (Decree No. 09/2018/ND-CP detailing the Commercial Law and the Law on Foreign Trade Management regarding the activities of foreign investors and economic organizations with foreign capital in Vietnam), ministerial circulars, and others. Vietnamese law also recognizes other legal sources, such as customs, practice, the basic principles of civil law, judicial precedents, and equity.

Vietnamese law applies in the following cases:

In contracts with foreign elements, the parties may choose to apply foreign law. Except for cases where foreign law cannot be applied under Clause 1, Article 670 of the Civil Code 2015, other cases are legitimate:

“Foreign law referred to shall not be applied in the following cases:

a) The result of applying foreign law is contrary to the basic principles of Vietnamese law;

b) The content of foreign law cannot be determined despite the procedures being taken under the procedural law.”

Under Vietnamese law, the parties cannot choose an international treaty as the governing law for a sales contract. The parties may only agree to apply foreign law or international commercial practices. However, the parties may indirectly use international treaties by agreeing to apply the law of a member state of the treaty.

According to Vietnamese law, parties may apply international commercial custom only if applying them does not contradict the basic principles of Vietnamese law. If the parties invoke different custom, the place where the sale occurs recognizes the applicable custom.

The significance of contracts in business transactions is growing as most of a company’s contract counterparts are professional entrepreneurs who possess extensive expertise in the legal aspects of contract content, invalidity, and dispute resolution. With a team of highly knowledgeable lawyers specializing in business and commercial law, coupled with extensive practical experience in corporate business activities, Viet An Law provides comprehensive support to clients in contract drafting consultation, and the entire process of negotiating, signing, and executing international sales contracts.

For the best support regarding international sales contract advisory services or other consulting services, please reach out to Viet An Law.

Updated: 8/2024.