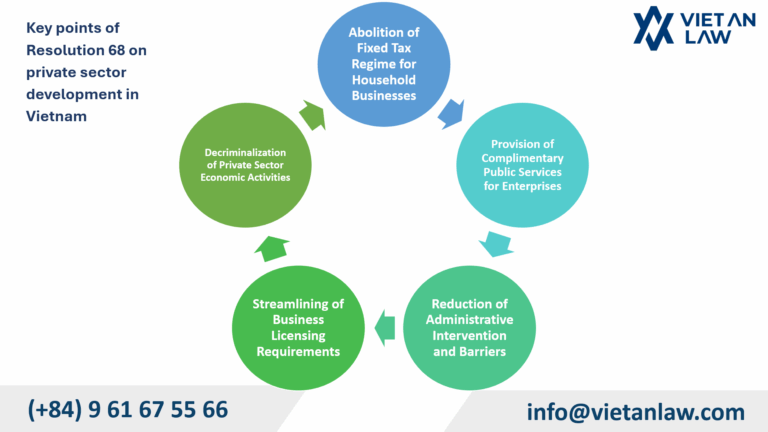

Following nearly forty years of economic reforms, particularly during the period of extensive international integration and openness, Vietnam’s private sector has emerged as a dynamic force. From a modest economic component, the private sector has grown exponentially in scale, quantity, and quality, significantly contributing to GDP, employment generation, and innovation. On May 4, 2025, the Politburo issued Resolution 68 on Private Sector Development, which is expected to mark a historic turning point, ushering in a breakthrough era for this vibrant economic sector while reaffirming its indispensable role in national construction and development. Hereinafter, Viet An Law presents key points of Resolution 68 on private sector development in Vietnam.

Table of contents

Vietnam’s private sector shall achieve rapid, sustainable, and competitive growth, actively participating in global supply chains. By 2045, the sector aims to sustain at least 3 million enterprises and contribute over 60% of GDP.

In Resolution 68-NQ/TW, the Politburo mandates a comprehensive review and enhancement of the legal framework governing individual business households, to minimize regulatory disparities and create optimal conditions for governance structures and financial reporting/accounting regimes applicable to micro-, small-, and household businesses. The Resolution emphasizes digital transformation to streamline tax compliance, accounting procedures, and insurance regimes, thereby incentivizing the formalization of household businesses into corporate entities.

Specially, the abolition of the fixed tax regime for household businesses no later than the end of 2026.

According to data from the Tax Department (Ministry of Finance), as of the end of March 2025, there were 1,975,373 business households filing taxes under the fixed tax regime, while only 6,142 households filed under the declarative method.

Historically, tax administration for business households has predominantly relied on the fixed tax method, where tax authorities assign a fixed annual revenue threshold, and households pay taxes based on this predetermined amount. The advantage of this method lies in its simplicity and ease of implementation, making it suitable for businesses with limited management capacity.

However, the fixed tax regime also exhibits significant disadvantages, including:

The abolition of the fixed tax regime is expected to revolutionize tax administration by enhancing income and cost transparency; ensuring equitable tax compliance across business types and mitigating tax revenue leakage…

One of the most substantive and effective support policies for micro, small, and household businesses is the “provision of free digital platforms, shared accounting software, legal advisory services, and training programs in business management, accounting, taxation, human resources, and legal compliance for micro/small enterprises and individual business households”.

This policy aims to reduce operational costs; enhance management capacity; facilitate technology adoption for disadvantaged enterprises that typically lack capital, specialized personnel, and resources to afford professional services like larger corporations.

To accelerate institutional reforms and enhance the quality of policies for the private sector, Resolution 68 emphasizes:

“Minimizing administrative interference and eliminating bureaucratic barriers, the ‘petition-grant’ mechanism, and the mindset of ‘banning what cannot be controlled.” Citizens and businesses are free to operate in any trade or profession not prohibited by law”.

The Resolution marks a significant shift in policymaking for the private sector, with the following objectives:

Resolution 68 emphasizes: “In 2025, complete the review and elimination of unnecessary, overlapping, or outdated business requirements that hinder private sector development; reduce administrative procedure processing time by at least 30%, cut compliance costs by at least 30%, and remove at least 30% of business conditions, with further significant reductions in subsequent years. Vigorously implement cross-jurisdictional public services for enterprises”.

Currently, many business regulations remain procedural, excessively interfering with internal corporate operations, and incur costly and time-consuming administrative complexities. Resolution 68 advocates for:

Resolution 68 emphasizes amendments to criminal, civil, and procedural laws to ensure the principle of prioritizing economic-civil and administrative measures when handling violations and economic-civil cases. This allows businesses and entrepreneurs to proactively remedy violations and damages. Specifically:

This policy reflects the spirit of Resolution 66-NQ/TW on Legal System Reforms, which states:

“Do not criminalize economic, administrative, or civil relations; refrain from using administrative measures to intervene in civil or economic disputes”.

Thus, the policy adopts a clear, protective approach toward entrepreneurs while ensuring no tolerance for deliberate legal violations.

The above highlights the key points of Resolution 68 on private sector development in Vietnam. If you have any further questions related inquiries or require legal procedure consultation for your business, please contact Viet An Law for specific legal consultation!