Limited liability companies include single-member limited liability companies and multi-member limited liability companies are the types of business entity which are liable for within the scope of capital contribution. Because of these particular characteristics, the procedures for foreign investors to contribute capital to limited liability companies are certain to differ. Currently, the proportion of Limited liability companies in the enterprise market is quite large with many different business lines. One of them belongs to conditional business of foreign investors. This means that foreign investors are required to carry out licensing procedures before they wish to contribute capital to limited liability companies. Some prominent business lines include: Real estate trading; Transportation services: bill of lading inspection, cargo brokerage; Inspection of goods, transport agents …; Constructing works, hospitals, specialist clinics;

In parallel with this, in addition to the provisions of the Law of Vietnam, based on the country of investors from China, Taiwan, Singapore, Korea,…ect businesses also have to consider the trade agreements. Bilateral, multilateral trade on the investment capital contribution into limited liability companies. Accordingly, WTO stipulated that roadmaps for investment in a number of industries, such as logictics, e-business, transportation services, Investment conditions for each member’s commitment.

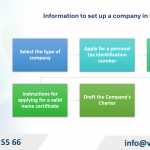

Based on these general conditions, foreign investors may contribute capital to limited companies in the following forms:

A written form for capital contribution/capital contribution purchases which specifies: information of the business organization that foreign investors intend to contribute capital/buy capital contribution purchase; charter capital ratio of foreign investors after contributing capital/buying capital contribution;

For foreign investors who are individuals: copies of ID cards or passports. A copy of the establishment certificate or other equivalent document confirming the legal status of the institutional investor.

The investors shall submit the application in the Register office;

Within 15 days from the day on which the satisfactory application, Notice for satisfy certain conditions is issued by the Register office.

Within 3 working days, the business registration office shall issue the Certificate of Business registration if the dossier is valid.

Case 1: The capital contribution leads to the holding of 51% or more of the charter capital by foreign investors

Procedure for registration of capital contribution, purchase of capital (as mentioned)

The procedures relevant the notification of changes to the corresponding business registration information

Dossier include:

Individuals having Vietnamese nationality: identity card or passport;

Individuals having foreign nationality: Passport; Temporary residence certificate granted by a competent Vietnamese agency (for legal representatives) if the member is an organization.

Procedure:

Case 2: The contribution of capital leads to the fact that the foreign investor does not hold more than 51% or more of the charter capital of the company (in case it is not a conditional business line for foreign investors, Enterprises only carry out procedures related to business change as case 1).

Case 1: The capital contribution leads to the holding of 51% or more of the charter capital by foreigner investors

Procedure for registration of capital contribution, purchase of capital (as mentioned)

The procedures relevant the notification of changes to the corresponding business registration information

Dossier:

Establishment decision or enterprise registration certificate or other equivalent document in case the new member is an organization; ID card or ID card or valid passport of the authorized representative and corresponding authorization decision (refer to the contents of authorization in Article 15 of the Law on Enterprises).

Procedure:

The business registration office will update the business registration certificate if the application is valid within 3 working days.

Case 2: The contribution of capital leads to the fact that the foreign investor does not hold more than 51% or more of the charter capital of the company (in case it is not a conditional business line for foreign investors, Enterprises only carry out the procedures relevant the notification of changes to the corresponding business registration information as case 1).

Procedure for registration of capital contribution, purchase of capital (as mentioned)

Procedures related to the change of business registration (similar to case 1 but will not include the document of the Department of Planning and Investment to approve the capital contribution, share purchase, capital contribution of investors)

Table of contents