Amendment of the investment registration certificate (IRC) is a critical legal procedure that many Chinese-invested enterprises in Vietnam must undertake whenever there is a change to their project details. However, the legal procedures governing foreign investors can be complex and require an in-depth understanding of the current investment laws. The investment certificate changes service for Chinese FDI companies in Vietnam is designed to support businesses in efficiently completing the procedure in compliance with legal requirements and minimizing delays. The following article by Viet An Law outlines the necessary steps, documentation, and advantages of using the service.

Table of contents

In the first nine months of 2024, registered capital from China reached more than USD 3.2 billion, accounting for 13% of Vietnam’s total FDI, representing a 4.5% decrease compared to the same period in 2023.

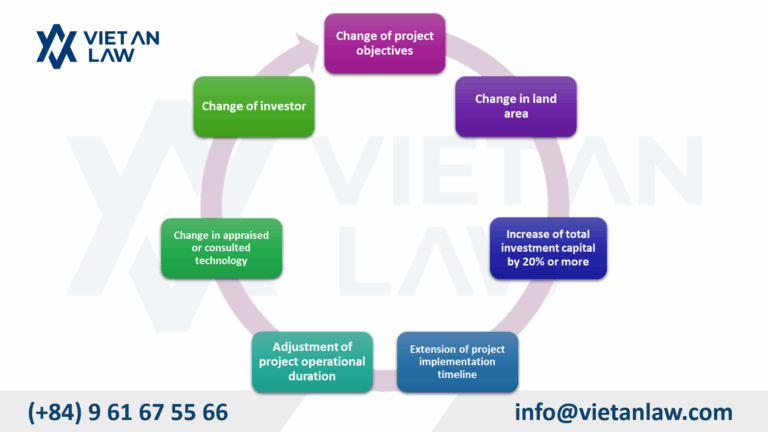

According to article 41 of the Law on Investment 2020, foreign investors whose projects were subject to investment policy approval must undertake procedures to modify such approval if any of the following apply:

Under article 41 of the Law on Investment 2020, investors with projects subject to investment policy approval are required to undergo procedures for amendment of the investment policy approval in the following cases:

Pursuant to clause 3, article 63 of the Law on Investment 2020, a dossier for amending an outbound investment registration certificate includes:

Procedures for amending the investment registration certificate

The enterprise shall prepare a dossier in accordance with the nature of the changes, including:

The enterprise shall submit the dossier to the Department of Finance in the locality where the project’s head office is located. For projects under the jurisdiction of Economic Zones or Industrial Parks Management Boards, submission must be made to those respective authorities.

The competent authority shall review the application within 3 to 10 working days and issue the amended investment registration certificate if the dossier is complete and valid.

If the amendment includes changes to the enterprise’s name, address, or capital, the company must update its business registration within 10 working days at the Department of Finance.

Yes. Documents such as business licenses, passports, and contracts issued in China must be consular legalized. This is a mandatory requirement to ensure the legal validity of foreign documents in Vietnam. Following legalization, these documents must be officially translated into Vietnamese and notarized. This process enables competent authorities to properly verify and authenticate the information.

However, it is important to note that for the new-format Chinese e-passports, the Hanoi Department of Finance (formerly the Department of Planning and Investment) issued Official dispatch No. 2611/KH&DT-KTDN dated 25 May 2023, stipulating that notarization of such passports must comply with Vietnam’s sovereignty principles. Consequently, if a Chinese FDI company presents an e-passport as identification for its legal representative or capital contributor, the authorities may refuse notarization and consular legalization. This could result in the inability to carry out company formation procedures in Vietnam.

The application is typically processed within 10 working days from the date a valid dossier is received. In cases involving changes to the project name or investor, the processing time may be shortened to 3 working days. If the dossier is incomplete, the competent authority shall notify the applicant within 3 working days for supplementation. This streamlined process helps enterprises complete the procedure efficiently.

Yes. Chinese-invested companies must comply with the list of conditional business lines applicable to foreign investors. When changing the project’s objectives, the enterprise must review its obligations under WTO commitments and the Vietnam–China Bilateral Agreements. Certain business sectors may require additional approval from competent authorities. Prior legal assessment is strongly recommended to avoid statutory violations.

Is it possible to submit the investment certificate amendment application online? Yes. Enterprises may submit their applications via the National foreign investment information Portal, which enhances transparency and saves processing time. However, in certain cases, original hard copy documents may still be required. It is critical that electronic submissions are complete and accurate.

Yes. All documents issued in China must be notarized translations into Vietnamese. This is a mandatory requirement to facilitate dossier review by regulatory authorities. Translations must be prepared by organizations legally authorized to perform certified translations in Vietnam to ensure legality and accuracy.

Changing the investment registration certificate for a Chinese FDI company is a critical legal procedure requiring accuracy and strict compliance with Vietnamese investment laws. To ensure a swift, lawful, and efficient process, seeking professional support from reputable legal service providers such as Viet An Law is highly advisable. With a team of seasoned legal consultants, we are committed to helping enterprises complete the investment certificate amendment quickly, lawfully, and cost-effectively. Contact Viet An Law for a free consultation and trusted legal services tailored to your business.