Currently, most businesses declare their license tax online due to the convenience and speed of going through the system. However, some businesses still declare incorrectly, leading to a lot of wasted time. In the following article, Viet An Law Firm – Tax Agent would like to provide instructions for declaring license tax online as follows.

License tax is a common term in the business world when referring to the amount of money that must be paid annually or when starting production or business based on the charter capital recorded in the business registration certificate/investment capital. investment recorded in the investment registration certificate (for organizations) or annual revenue (for business households and individuals).

In legal terms, the correct name of this amount of money paid into the state budget is license fee, which is governed by regulations on fees and charges, not tax regulations. However, the Law on Tax Administration 2019 also has the scope to simultaneously regulate license fees, so the above naming also partly comes from the above regulations.

Pursuant to Article 2 of Decree 139/2016/ND-CP stipulating that the person obliged to submit license fee declaration documents are organizations and individuals engaged in the production and trading of goods and services, including :

Note: The following subjects are exempt from license fees according to Article 3 of Decree No. 139/2016/ND-CP amended by Decree No. 22/2020/ND-CP, including:

According to the provisions of Decree 126/2020/ND-CP, which is still in effect, the deadline for submitting license fee declaration is January 30 every year after the year of establishment or commencement of production and business activities. joint.

In case there is a change in capital during the year, the license fee payer shall submit the license fee declaration no later than January 30 of the year following the year in which the change information occurred.

Note: Business households and individuals do not have to submit license fee declaration documents, so they do not have to comply with the license fee payment deadline. Instead, the payment of license tax will be based on the notification from the Tax Authority as prescribed in Article 13 of Decree 126/2020/ND-CP.

Necessary documents include a digital signature and a registered business account for electronic tax payment.

Please access the link: https://thuedientu.gdt.gov.vn/ , select “Enterprise ” then select “sign in”. Next, the screen displays login information. You enter your Company’s login information and need to register for a tax code and fill in the confirmation code. Then select “Sign in”.

This case applies to businesses that have not yet registered their license tax declaration.

Select “Tax declaration“/ Select “Register declaration“/ Select “Register additional declaration ” as shown below:

After you have selected “register for additional declarations”, the screen continues to display all declarations that you have not yet registered. Here, you move to the License Tax section and select the declaration “01/LPMB – License Tax Fee Declaration (TT80/2021)” then select “Continue” as follows:

After choosing to continue, you need to confirm again.

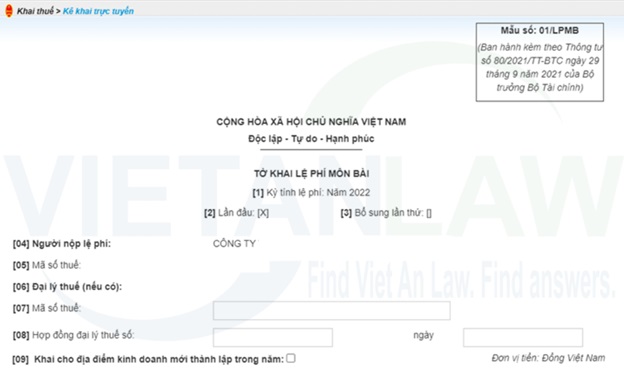

After you have registered the declaration, your next job is to select the license tax declaration to perform the lookup. To do this step, please select ” Tax declaration ” / Select “Online tax declaration” Select tax declaration “01/ LPMB – License tax fee declaration (TT80/2021)” . Details as photo below.

After selecting, please select “Declaration type” / Select “Tax declaration period” and select “Continue“.

The screen displays the license tax fee declaration form. Please fill in the information of the unit that needs to be declared. The information includes:

“Declaring official or additional license fees”: This section you just need to check.

If you use the tax agent service, you must fill in all the information of the tax agent including name, tax code, address, district, province/city.

Fill in the company’s charter capital on the business registration. When you fill in, the license tax rate will automatically jump accordingly.

In case your company has a dependent accounting unit in the same locality, you must declare additionally. If you have more than one dependent accounting unit in the same locality, you can choose to add a line and make an additional declaration.

After completing the declaration, please check the declaration again and then click “Complete declaration“.

Note: all step of this procedure is completed in Vietnamese. English is not available.

Above are instructions for declaring license tax online in Vietnam. Viet An Tax Agent is pleased to support your business with procedures for full tax declaration services and a number of services related to tax accounting services, please contact us for detailed instructions.