Foreign investors have rights to contribute capital, buy shares or capital contribution in business organizations in Vietnam.

To help our clients who need relevant information, Viet An Law Firm collect and provide some regulations as follows:

Methods for foreign investors to contribute capital, buy shares or capital contribution:

When foreign investors contribute capitals, buy shares, buy capital contributions in Vietnam, there might be two cases:

Case 1: If foreign investors contribute capitals, buy shares or buy capital contributions that lead to the proportion of foreign ownership is less than 51% in the enterprise, which run no conditional business line, they need to adjust the Certificate of Business Registration.

Dossier includes:

Procedures:

The enterprise submits dossier at the Business Registry Office.

Within 03 working days after the day on which a valid and full dossier is received, the Business Registry Office shall issue the new certificate for the enterprise.

Case 2: If foreign investors contribute capitals, buy shares or buy capital contributions in enterprise which run conditional business lines or the transaction leads to the proportion of foreign ownership is less than 51% in the enterprise, they need to follow these steps:

Step 1: Register to contribute capitals, buy shares or buy capital contributions at the Investment Registry Office;

Step 2: Adjust the Certificate of Business Registration.

Procedures to contribute capitals, buy shares or buy capital contributions in enterprises in Vietnam:

Dossier includes:

Procedures:

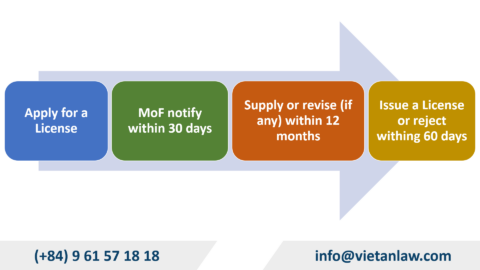

Investors submit dossiers at the Investment Registry Office.

Within 15 days from the day on which a valid and full dossier is received, the Investment Registry Office shall issue a notification on conditions satisfaction, so that investor could proceed the process.

If any foreign investors are interested in investment in Vietnam and have any concern or question about capital contribution, share or capital contributions purchase, please feel free to contact Viet An Law Firm to be supported and to get some legal advice!

Hanoi Head-office

#3rd Floor, 125 Hoang Ngan, Hoang Ngan Plaza, Trung Hoa, Cau Giay, Hanoi, Vietnam

Ho Chi Minh city office

Room 04.68 vs 04.70, 4th Floor, River Gate Residence, 151 – 155 Ben Van Don Street, District 4, HCM, Viet Nam

SPEAK TO OUR LAWYER

English speaking: (+84) 9 61 57 18 18 - Lawyer Dong Van Thuc ( Alex) (Zalo, Viber, Whatsapp)

Vietnamese speaking: (+84) 9 61 37 18 18 - Dr. Lawyer Do Thi Thu Ha (Zalo, Viber, Whatsapp)