In the context of Vietnam emerging as an attractive destination for foreign direct investment (FDI), the demand for leasing factories and office spaces for business operations is rapidly increasing. Understanding the relevant legal framework not only ensures that FDI enterprises operate in compliance with the law but also helps lessors maximize their benefits and minimize legal risks. Thus, what are the current FDI enterprise factory and office lease regulations in Vietnam? Viet An Law will provide a detailed analysis in this article.

Table of contents

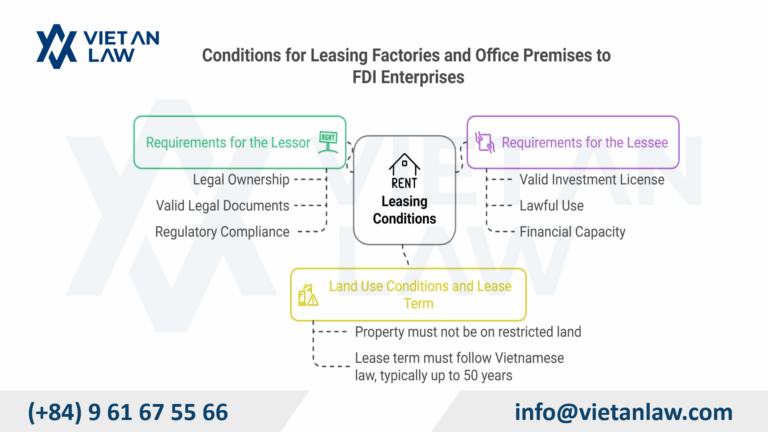

The lessor must be the lawful owner of the factory or office premises, with full rights to use and lease the property. This requires the lessor to possess valid documentation proving ownership or legal use rights, such as a land use rights certificate, a house ownership certificate, or a long-term land lease agreement.

The leased factory or office must comply with regulations on construction planning, environmental protection, and occupational safety standards. The lessor must provide relevant certificates confirming the legal status of the property, including the construction permit and the building quality inspection certificate.

Depending on the business sector and intended use of the FDI enterprise, the lessor must ensure that the leased property meets environmental protection requirements and does not negatively impact the surrounding community.

The FDI enterprise must hold a valid investment license issued by the competent authorities in Vietnam. This license must clearly state the business sectors and purposes of operation, particularly the leasing of factories or office premises to serve production and business activities.

The FDI enterprise must demonstrate that its intended use of the leased property is lawful and does not violate regulations on business lines. Sectors such as manufacturing, processing, and high technology must be duly licensed in accordance with Vietnamese law.

The FDI enterprise must possess sufficient financial capacity to enter into a lease agreement and fulfill its financial obligations under the contract. This includes the ability to pay rent for the factory or office space on time, along with other related expenses.

FDI enterprises are not permitted to lease factories or office premises located on land that is restricted or does not meet the legal conditions under Vietnam’s land laws. The lease arrangement must ensure that the lessor holds legal land use rights.

The lease term for factory and office premises by FDI enterprises must comply with the statutory regulations on land use duration. Typically, lease contracts may last up to 50 years, depending on the specific project and local legal provisions.

According to Article 41 of the 2024 Land Law, FDI enterprises are not permitted to own land in Vietnam. Instead, they may only use land through leasing arrangements with domestic organizations or individuals. The leasing of land for FDI enterprise factory and office lease purposes must ensure that the lessor is the lawful owner of the property and holds valid land use rights.

FDI enterprises may lease land for the construction of factories and office premises for long-term use, typically ranging from 20 to 50 years, depending on the agreement. The lease term may be extended upon mutual consent and in accordance with the applicable laws.

FDI enterprises may lease factory and office premises for purposes such as manufacturing, processing, business operations, or research and development. However, the lease purpose must strictly comply with the business lines specified in the enterprise’s Investment Registration Certificate. The leased property must not be used for unlawful or unlicensed activities.

FDI enterprises must operate in business sectors that are permitted for foreign investment in Vietnam, as stated in the Investment Registration Certificate. Enterprises involved in unlicensed or restricted sectors are not allowed to lease factory or office premises for business operations.

FDI enterprises are required to fulfill their rental payment obligations for factory and office premises in accordance with the terms of the lease agreement. Payments may be made on a monthly, quarterly, or otherwise agreed basis between the parties.

In addition to rent, FDI enterprises must also bear all costs related to the use of the leased property, including maintenance and repair fees, property taxes (if applicable), and other expenses associated with the use of the premises.

The lessor must ensure that they are the lawful owner of the leased property and have the legal right to lease it. This includes having a valid land use rights certificate and documents proving ownership of the factory or office premises.

It is essential to verify whether the property is involved in any legal disputes, subject to zoning violations, or has any outstanding legal obligations (such as unpaid taxes or administrative penalties). These issues must be resolved before entering into a lease agreement.

The lease agreement must clearly specify the lease duration, rental price, payment method, related costs, and the rights and obligations of both parties. These provisions should be explicitly agreed upon to avoid future disputes.

The agreement should clearly define the lessee’s responsibility for maintaining and repairing the leased property, especially in cases of damage or deterioration. This helps protect the asset and ensures the lessor is not burdened with unnecessary expenses.

The lease must include clear provisions regarding conditions under which the agreement may be terminated early, such as payment defaults, unlawful business operations, or force majeure events.

Before entering into a lease agreement, the lessor should require the FDI enterprise to provide copies of its valid Investment Registration Certificate and Business Registration Certificate to ensure that the enterprise is legally operating in Vietnam.

The lessor should assess the financial capacity of the FDI enterprise through financial statements and supporting documents to confirm that the enterprise is capable of making rental payments on time.

The lease agreement must clearly specify whether the FDI enterprise is permitted to assign its lease rights or sublease the property. Typically, the lessor will require prior written consent before the FDI enterprise may assign the lease to a third party.

If the FDI enterprise intends to sublease any part of the leased property, the lessor must ensure that such subleasing does not alter the intended use of the property or violate the original lease agreement.

It is important to determine whether any taxes or fees related to the leased property are the responsibility of the lessor. This helps the lessor avoid bearing unexpected financial burdens.

The lessor should also monitor the lessee’s payment schedule to prevent arrears. To mitigate financial risk, the lessor may require a payment security commitment, such as a deposit or a bank guarantee.

The above content outlines the FDI enterprise factory and office lease regulations in Vietnam, as provided by Viet An Law. Should you require legal consultation or further assistance, please contact Viet An Law for the most professional support.