For foreign-invested companies, after being granted investment certificates, foreign investors must open foreign direct investment accounts (capital transfer accounts) at the bank and and proceed to contribute capital through that account within the time limit stated in the Investment Certificate. The capital contribution on time is considered extremely important because if overdue under the term of capital contribution stipulated in the Investment Certificate, the bank will not allow to receive investment capital and the company will not be able to receive capital. invest to conduct activities. However, the ability to contribute capital on time depends on many factors and does not always happen in time. At this time, foreign investors are forced to carry out procedures for extension of the time limit for investment capital contribution (the contents are recorded on the Investment Certificate) or the procedure for adjusting the Investment Registration Certificate. This article Viet An Law would like to provide the contents related to the procedure for extension of capital contribution of foreign invested companies.

According to the Enterprise Law 2020, the time limit for capital contribution to limited liability companies and joint stock companies is 90 days. In case, the capital contribution is not on time, the enterprise shall contact the Inspection Department to ask for a decision to sanction the failure to contribute enough capital.

After receiving the decision, the enterprise shall pay a fine and make a full contribution of capital according to the time limit stated in the decision of the Inspection Department or adjust the Investment Certificate in the capital reduction if it is not possible or does not want to contribute capital according to the time limit stated in the decision of the Inspection Department.

Profile: The enterprise submits a written explanation of the violation to the Inspection Department and some other documents depending on the requirements of each Inspection Department.

Processing time limit: Persons competent to sanction administrative violations must issue decisions to sanction administrative violations within 7 days from the date of making the written records of administrative violations.

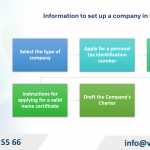

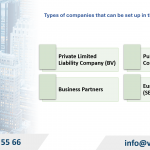

Documents to prepare:

Note: For projects subject to investment policy decisions, when adjusting investment projects related to investment objectives, locations, main technologies, increase or decrease investment capital by more than 10% of the total capital investment, duration of implementation, change of investors or change of conditions for investors (if any), investment registration agencies shall carry out procedures for deciding investment policies before adjusting their Investment Registration Certificate.

However, in case of adjusting the time limit for capital contribution (not the project implementation period), investors do not have to carry out procedures to decide investment policies but only have to implement procedures to adjust Investment Registration Certificates.

Place of submission: Investment Registration Agency shall comply with Investment Law 2020.

Processing time: Within 10 working days from the date of receipt of a complete and valid file, the investment registration agency shall amend the Investment Registration Certificate.

State fee: No.

Table of contents