Circular No. 43/2024/TT-BTC stipulates a 50% reduction in state fees for domestic travel licensing from July 1, 2024, to the end of 2024. This amendment promotes the development of the domestic tourism industry and improves the quality of tourism services recovering after the pandemic. The fee reduction mechanism during key seasons of national tourism benefits companies and helps attract domestic and foreign tourists, promoting Vietnam’s tourism industry to develop more sustainably in the future. Viet An Law will summarize the important contents of the new Circular issued on June 28, 2024, on reducing Domestic Travel Service License Fees in Vietnam 2024 in the article below.

Table of contents

According to Circular 33/2018/TT-BTC, current state fees in travel service licensing are as follows:

Appraisal fee for granting international travel service business license and domestic travel service business license:

From July 1 to December 31, 2024, according to the provisions of Circular No. 43/2024/TT-BTC issued on June 28, 2024, the Ministry of Finance will reduce 50% of the following important fee items:

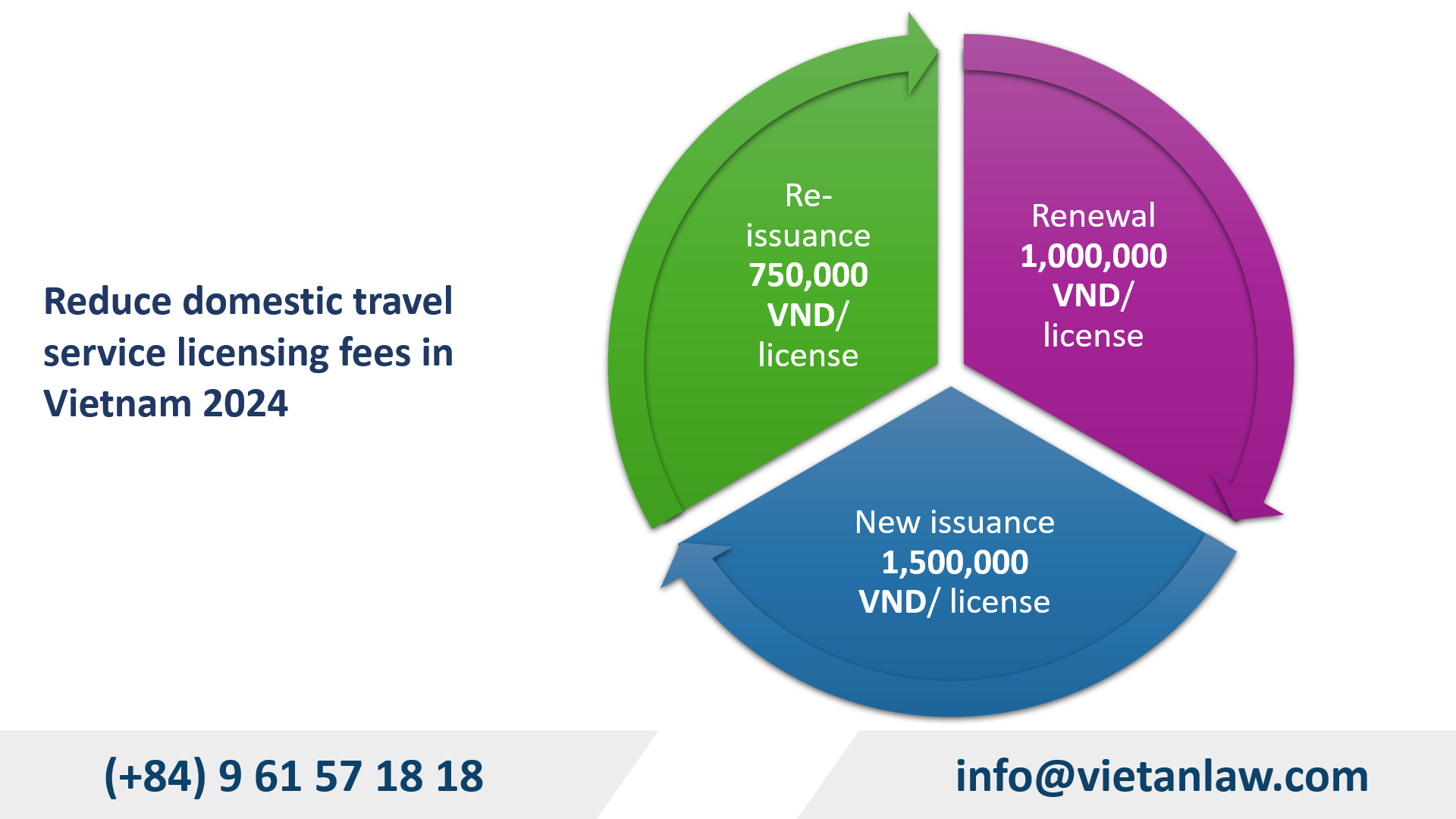

Accordingly, the domestic travel licensing fee applied in the second half of 2024 is specified as follows:

Regulations on reducing licensing fees only apply to appraisal fees for new issuance, re-issuance, and renewal of travel business licenses. This amendment does not apply to the current domestic travel business deposit level.

Accordingly, the deposit level in 2024 is still 100,000,000 VND as prescribed in Decree 168/2017/ND-CP guiding the Law on Tourism 2017. This is a mandatory condition to complete the application for a Business License for travel service in general and a Domestic Travel Service License in particular.

Unlike the regulations on VAT reduction, the regulations on reducing licensing fees are implemented directly, and deducted directly from the fee paid when the agency receives the licensing application. Individuals and businesses applying do not need to make any notes or annotations in their application. During the effective period of the Circular, state agencies are responsible for guiding citizens in collecting and paying state fees according to regulations. In case the applicant is not given instructions, or is incorrectly charged the prescribed fees or charges, the applicant has the right to make a complaint to the head of the application receiving agency (Department of Tourism).

The travel service business applying for a license is responsible for paying the travel licensing fee at the same time as submitting the license application to the Department of Tourism.

The place to receive documents is the specialized provincial tourism agency where the enterprise is headquartered (Article 32 of the 2017 Law on Tourism). For example, the travel company headquarters in Hanoi will submit documents and appraisal fees for domestic travel licensing at the Hanoi Department of Culture, Sports, and Tourism, information:

According to Circular 33/2018/TT-BTC, currently, 90% of the fees collected for domestic travel licensing are deducted to serve the appraisal process of domestic travel business licensing. The remaining 10% of the total fee is paid into the state budget.

Other expenses related to work performance, services, and fee collection, including expenses for setting up management software, setting up network systems, renting servers, and maintaining network systems to serve grant travel service business license; Training on travel service business.

According to the provisions of the Law on Tourism 2017, guided by Decree 168/2017/ND-CP, after being established, businesses must be eligible to apply for a license for the general travel business, and domestic travel businesses in particular must deposit at the Bank. According to current regulations in 2024, the domestic travel business deposit level is 100,000,000 VND.

Businesses need to monitor updated regulations applied from time to time for specific socio-economic purposes. For example, during the period from October 28, 2021, to December 31, 2023, according to the provisions of Decree 94/2021/ND-CP, the deposit level for domestic travel services business is reduced by 80% down to 20,000,000 (twenty million) VND/1 set of licensing documents to stimulate demand for recovery of the tourism industry after the pandemic.

Businesses that conduct travel services without a travel service business license will be fined from 90,000,000 VND to 100,000,000 VND and forced to return the profits earned during the unlicensed business process.

With the travel business, businesses need to meet many complex conditions when establishing and operating. Therefore, using the legal services of a lawyer with expertise and experience is necessary to save costs and time. Viet An Law provides a full package of services to establish a travel business in Vietnam, including:

Above are the latest updated regulations on reducing Domestic Travel Service License Fees in Vietnam 2024. If you need advice and support during the travel business process in Vietnam, please contact Viet An Law for the most effective advice and support. Best regards!