In addition to domestic advertising, cross-border advertising services are becoming more popular in Vietnam. These services play a vital role in market access strategies and help boost the competitiveness of businesses. To ensure compliance with Vietnamese law and to support transparent and effective business operations, foreign organizations and individuals providing cross-border advertising services are required to notify the competent authorities of their activities. In the article below, Viet An Law will provide the guidance on the notification procedures for cross-border advertising services in Vietnam.

Table of contents

According to Clause 1, Article 13 of Decree No. 181/2013/ND-CP, amended and supplemented by Decree No. 54/2017/ND-CP, Decree No. 123/2018/ND-CP, Decree No. 11/2019/ND-CP, Decree No. 70/2021/ND-CP (hereinafter referred to as Decree No. 181/2013/ND-CP, amended and supplemented), cross-border advertising service provision activities in Vietnam are the Activities conducted by foreign organizations and individuals who use websites or electronic platforms to provide advertising services from servers located outside Vietnam to users within Vietnam, generating revenue in Vietnam

Key definitions:

According to Clause 4, Article 13 of Decree No. 181/2013/ND-CP, as amended and supplemented, foreign organizations and individuals doing cross-border advertising business in Vietnam must carry out notification procedures with the Ministry of Information and Communications.

Note: Previously, the Department of Radio, Television, and Electronic Information under the Ministry of Information and Communications was responsible for this. However, after a government restructuring, this Department has been transferred to the Ministry of Culture, Sports and Tourism, which is now the competent authority for receiving cross-border advertising notifications..

Thus, currently, the Ministry of Culture, Sports and Tourism is the competent authority to receive notifications on cross-border advertising service business.

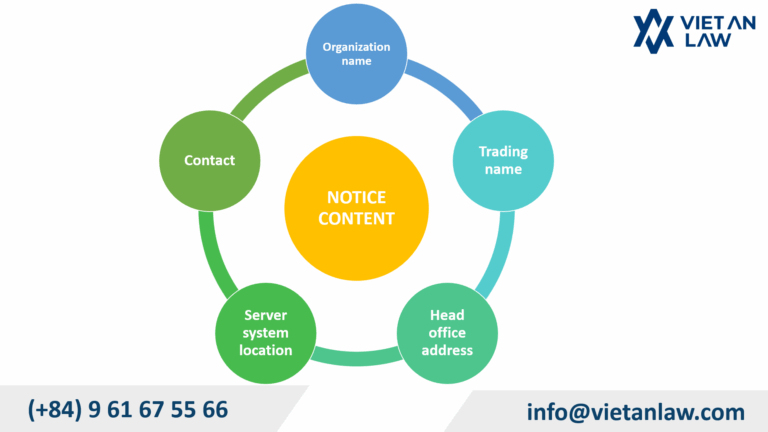

When doing cross-border advertising business, the following information must be notified:

Content of cross-border advertising service business announcement

Procedures for notifying cross-border advertising service businesses in Vietnam

Contact information of the Department of Radio, Television, and Electronic Information:

Upon receipt of the notice, the receiving agency shall be responsible for sending a written or electronic confirmation to the organization or enterprise within 07 working days from the date of receipt of the notice.

According to Article 15 of Decree No. 181/2013/ND-CP, as amended and supplemented, domestic advertising service providers who cooperate with foreign organizations and individuals to conduct cross-border advertising service business in Vietnam must report as follows:

Report to the Department of Radio, Television, and Electronic Information) According to Form No. 01 of Decree No. 181/2013/ND-CP.

According to Clause 2, Article 13 of the 2012 Law on Advertising, Clause 4, Article 13 of Decree No. 181/2013/ND-CP, as amended and supplemented, foreign organizations and individuals doing cross-border advertising business in Vietnam must comply with the following obligations:

Pursuant to Point a, Clause 1, Article 38 of Decree 38/2021/ND-CP, amended by Point a, Clause 13, Article 4 of Decree 129/2021/ND-CP, for the act of not notifying the contents as prescribed by foreign individuals doing cross-border advertising services business in Vietnam, they will be fined from VND 5,000,000 to VND 10,000,000.

Note, the above fine is for individuals; the fine will be doubled for organizations according to the provisions of Clause 3, Article 5 of Decree 38/2021/ND-CP.

If you have any questions or require legal assistance related to advertising regulations in Vietnam, Viet An Law is here to support you with the most up-to-date and reliable legal advice.