Client’s requirement:

Could I also enquire about setting up a full company, rather than representative office?

Our company currently operates from Singapore and are interested in expanding operations to Vietnam. We are seeking to establish a subsidiary, (or sister company related through holding structure). We supply online marketing services and are in particular focused on expanding our digital signage offering. We are export oriented and do not anticipate local sales (particularly in the first 12 months). Could I please request an estimate of setup costs and timeframe involved.

Is a temporary residence permit all that is required for directors to participate in local operations, or is a work permit also required?

Consultancy:

Dear Sir/Madam,

First of all, Viet An Law would like to thank your trust for legal consultancy services of Viet An Law Firm. For your questions, we would like to answer as follows:

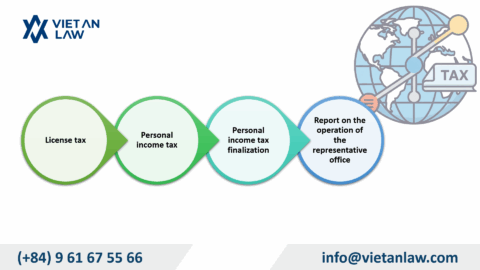

The difference between company and representative offices is:

Based on that, if your purpose is only to develop trade promotion in Vietnam for the parent company in Singapore, we advise you to establish a representative office; If your purpose is trade and make business profit in Vietnam, you must to set up a company.

In addition to a temporary residence permit, if directors are not investors but employees, they must have to labor permit issued by the competent authority of Vietnam.

Furthermore:

Above is our advice content. If you have any questions, please contact Viet An Law and provide more information for specific advice.

Yours sincerely,