In case the enterprise no longer meets the minimum number of members as prescribed by law, it is forced to convert another type of enterprise if they do not want to be forced to dissolve.However, how much is the conversion fee is a question that many customers still wonder. And to answer your questions, Viet An Law Firm offers an article on business conversion fees below.

Business type conversion is a form of reorganization and restructuring of an enterprise without having to completely terminate operations. In other words, that company will operate as a different type of business. Enterprises are not allowed to convert arbitrarily, but must fully meet all conditions prescribed by the law on business set up to have the right to convert the type of enterprise. But still inherit all legal rights and interests, be responsible for debts, including tax debts, employment contract and other obligations of the converted company.

Each type of business will have its own characteristics. When registering for business establishment, the owner selects the type of business that suits the size and orientation of that business. However, enterprises will carry out the conversion of the type of enterprise in the following cases:

Note: If in case the number, structure of members and shareholders is not enough in accordance with the law on enterprises, the company must carry out dissolution procedures (according to Point c, Clause 1, Article 207 of the Enterprise Law 2020)

Converting the type of enterprise is one of the cases of issuance of a new Certificate of Business Registration. Pursuant to Circular 47/2019/TT-BTC:

| Conversion cases | Conversion methods |

| Conversion of a 2-member limited liability company into a joint stock company | Do not mobilize other organizations or individuals to contribute capital, do not sell contributed capital to other organizations or individuals;

Mobilize other organizations and individuals to contribute capital; Sell all or part of the contributed capital to one or several other organizations or individuals; Combine the above methods. |

| Conversion of a joint stock company into a 1-member limited liability company | One shareholder receives the transfer of all corresponding shares of all remaining shareholders;

An organization or individual that is not a shareholder receives the transfer of all shares of all shareholders of the company; The company only has 01 shareholder left. |

| Converting a joint stock company into a limited liability company with 2 or more members | Do not mobilize more or transfer shares to other organizations or individuals;

At the same time, mobilize other organizations and individuals to contribute capital; Converting into a limited liability company with two or more members at the same time transferring all or part of the shares to other organizations or individuals contributing capital; The company only has 02 shareholders left; Combine the methods specified at Points a, b and c of this Clause and other methods. |

| Conversion of a private enterprise into a limited company, joint stock company, partnership | A sole proprietorship can be converted into a limited liability company, joint stock company or partnership at the discretion of the owner of the private enterprise. |

Note:

Step 1: Enterprises choose 1 of 6 types to be converted;

Step 2: Enterprises prepare and draft dossiers of conversion of business type suitable to each conversion case;

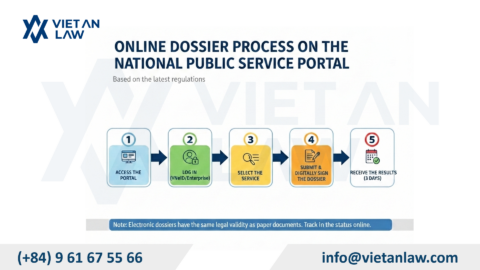

Step 3: Submit the prepared application in 1 of the following 2 ways:

Submit online at the National Business Registration Portal through electronic digital signatures or business registration accounts;

Submit directly at the Business Registration Office under the Department of Planning and Investment of the province / city, where the enterprise is headquartered.

Step 4: Businesses wait to receive results

Within 3-5 working days from the date of receipt of the dossier, the Business Registration Office will check the dossier, then:

Issuance of a new enterprise registration certificate (if the application is valid);

Send a notice of request to amend and supplement the dossier of enterprise type conversion (if the dossier is incomplete and valid).

In fact, the conversion of business type will affect information about the business such as business name, salary accounting, seal, other related documents … Therefore, to ensure future operations, when making the transition, businesses should pay attention to the following issues:

If you need advice on the business type conversion fee, please contact Viet An Company for the best support.